The dollar is under pressure again, and demand for riskier assets has returned.

The upwardly revised data on the U.S. economy's third-quarter growth rate could not strengthen the dollar's position, as data on the labor market and inflation indicated the need for further interest rate cuts.

The report indicated that U.S. GDP grew by 4.4% in the third quarter, which is higher than initial estimates. However, the optimism these figures sparked proved short-lived. Currently, many market participants are focused on signs of weakening consumer spending, business investments, and a troubled labor market, which may indicate a slowdown in economic momentum. Furthermore, expectations regarding the future trajectory of the Federal Reserve's monetary policy continue to exert pressure on the U.S. currency. Speculation is growing that the Fed may begin to cut interest rates in the first quarter of 2026 to support the economy.

Today, the release of the PMI index data for the manufacturing sector of the Eurozone, the services PMI index, and the composite PMI index is expected in the first half of the day. There will also be a speech by ECB President Christine Lagarde. These events will undoubtedly have a significant impact on traders' sentiment and, consequently, on the dynamics of the European currency. If the figures come in above expectations, it could signal sustained growth and, therefore, support the euro. However, if the numbers disappoint, pressure on the single currency may increase. Lagarde's speech is unlikely to be the day's central event. Everything we could have heard this week has already been addressed. It is unlikely that Lagarde will say anything new today.

Regarding the pound, traders' attention will also be focused on the release of data on changes in UK retail sales, the manufacturing and services PMI indices, and the composite PMI index in the first half of the day. Changes in retail sales reflect consumer sentiment and the dynamics of domestic demand. Positive data indicating an increase in retail sales may be seen as a sign of a healthy economy and, therefore, support the pound. The PMI indices for the manufacturing sector and the services sector provide valuable information about business activity in these key sectors of the economy. The composite PMI index, which combines data from both sectors, is an important indicator of the UK's overall economic health. Surpassing expectations on the PMI indices may signal sustained growth and positively impact the pound.

If the data aligns with economists' expectations, it is better to act on a Mean Reversion strategy. If the data is significantly above or below economists' expectations, it is best to use a Momentum strategy.

Momentum Strategy (Breakout):

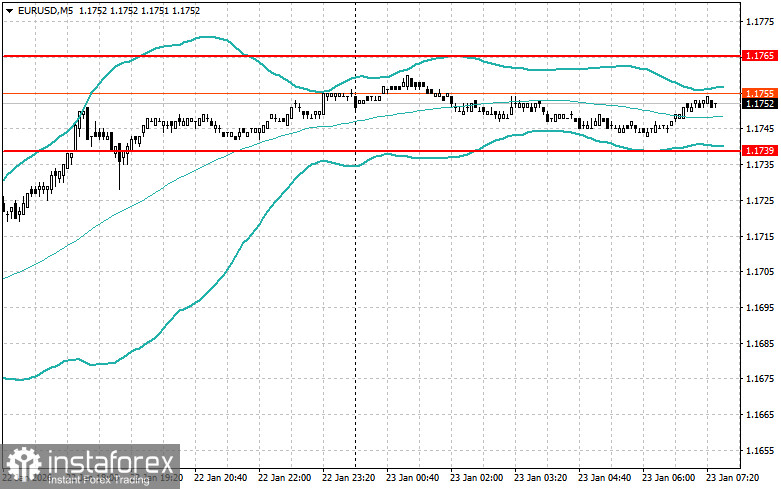

For the EUR/USD Pair

- Long positions on the breakout of the level 1.1766 may lead to an increase of the euro to the area of 1.1785 and 1.1807;

- Short positions on the breakout of the level 1.1736 may lead to a decrease of the euro to the area of 1.1705 and 1.1672;

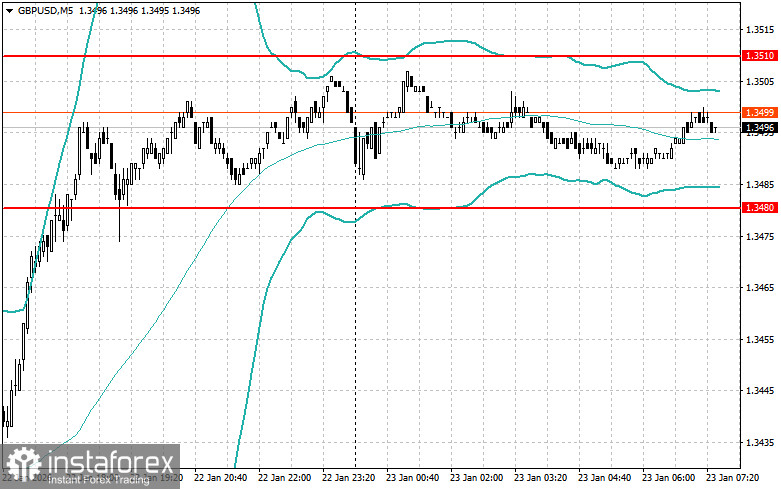

For the GBP/USD Pair

- Longs on the breakout of the level 1.3514 may lead to an increase of the pound to the area of 1.3539 and 1.3564;

- Shorts on the breakout of the level 1.3489 may lead to a decrease of the pound to the area of 1.3464 and 1.3438;

For the USD/JPY Pair

- Longs on the breakout of the level 158.80 may lead to an increase of the dollar to the area of 159.15 and 159.45;

- Shorts on the breakout of the level 158.60 may lead to a sell-off of the dollar to the area of 158.30 and 157.90;

Mean Reversion Strategy (Pullback):

For the EUR/USD Pair

- I will look for shorts after a failed breakout above 1.1765 on a return below this level;

- I will look for longs after a failed breakout below 1.1739 on a return to this level;

For the GBP/USD Pair

- I will look for shorts after a failed breakout above 1.3510 on a return below this level;

- I will look for longs after a failed breakout below 1.3480 on a return to this level;

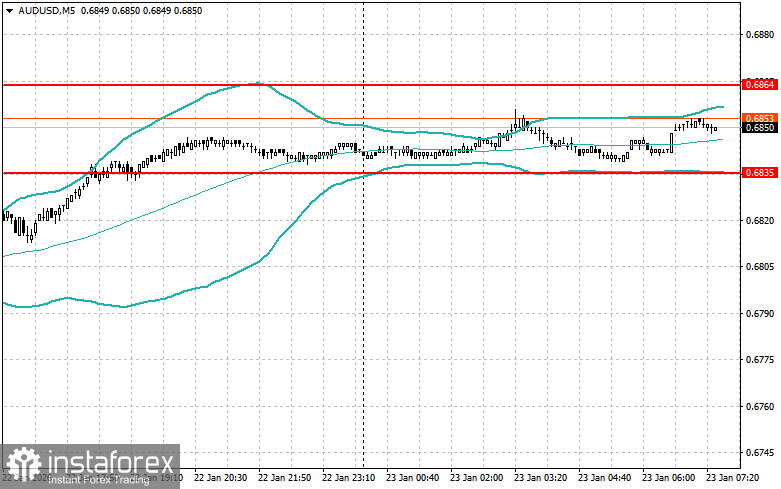

For the AUD/USD Pair

- I will look for shorts after a failed breakout above 0.6864 on a return below this level;

- I will look for longs after a failed breakout below 0.6835 on a return to this level;

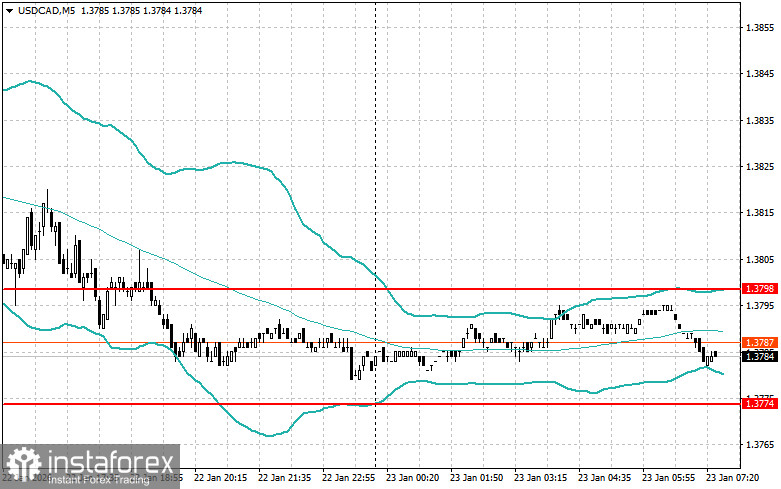

For the USD/CAD Pair

- I will look for shorts after a failed breakout above 1.3798 on a return below this level;

- I will look for longs after a failed breakout below 1.3774 on a return to this level;