Events have turned the market upside down several times. Speaking of the movements of the two main instruments, both started rising on Monday and ended on Friday. This tells me that market participants reacted negatively to all events this week. Negatively for the dollar. I remind you that the U.S. GDP report came in stronger than expected in the third quarter and could have theoretically supported the American currency. The news of the de-escalation of the new trade conflict with Trump could also be seen as positive for the U.S. dollar. But the market is currently interpreting almost all news as bearish for the dollar.

There are good reasons for this. As probably all economists have noted, Trump's policy is unpredictable and unforecastable. Who could have predicted a military intervention in Venezuela and Trump's sudden desire to acquire Greenland at the end of 2025? The U.S. president continuously shakes the world order. Almost every day, Trump makes decisions of a global nature, and it is simply astonishing how he manages to keep up with it all.

After the geopolitical tension surrounding Greenland has subsided somewhat, economists are left with a question. Was Europe ready to deploy its "trade bazooka" in response to Trump's threats? I remind you that Brussels almost immediately pulled out from the archives a project for retaliatory tariffs that were planned to be introduced last year in response to U.S. trade aggression. However, they did not implement them, as at the Davos forum, Donald Trump reached an agreement with NATO Secretary General Mark Rutte and announced that he had decided to pardon the EU countries. Therefore, the ratification process of the trade agreement with the USA in the European Parliament has resumed, while whether retaliatory tariffs would have been introduced remains unknown.

Why is this important? In less than a year of his presidency, Trump has already created significant pressure on the European Union twice. First, there was the trade war, and now Greenland. I stated last year that the trade war would not end there, and Trump could impose tariffs at his discretion. He does not need the approval of Congress or the Senate; he makes all decisions himself. Therefore, today the U.S. president might announce the imposition of tariffs, and tomorrow he could retract them. All of this destabilizes the markets, and the European Union is verbally prepared to respond, but in practice, it increasingly looks for reasons not to clash with the conflict-prone U.S. leader.

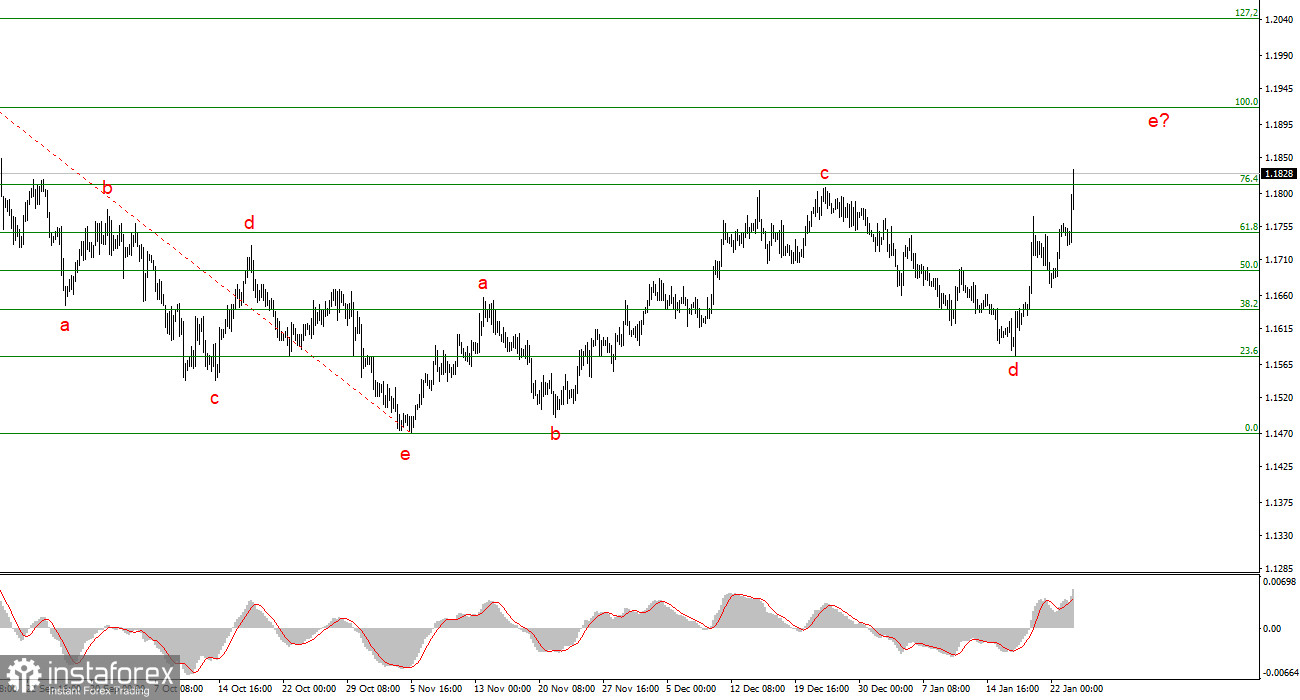

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Trump's policy and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the American currency. The targets of the current trend segment may reach the 25-figure mark. At this moment, I believe corrective wave 4 has completed its formation, and I expect further price increases, with the first target around 1.1918.

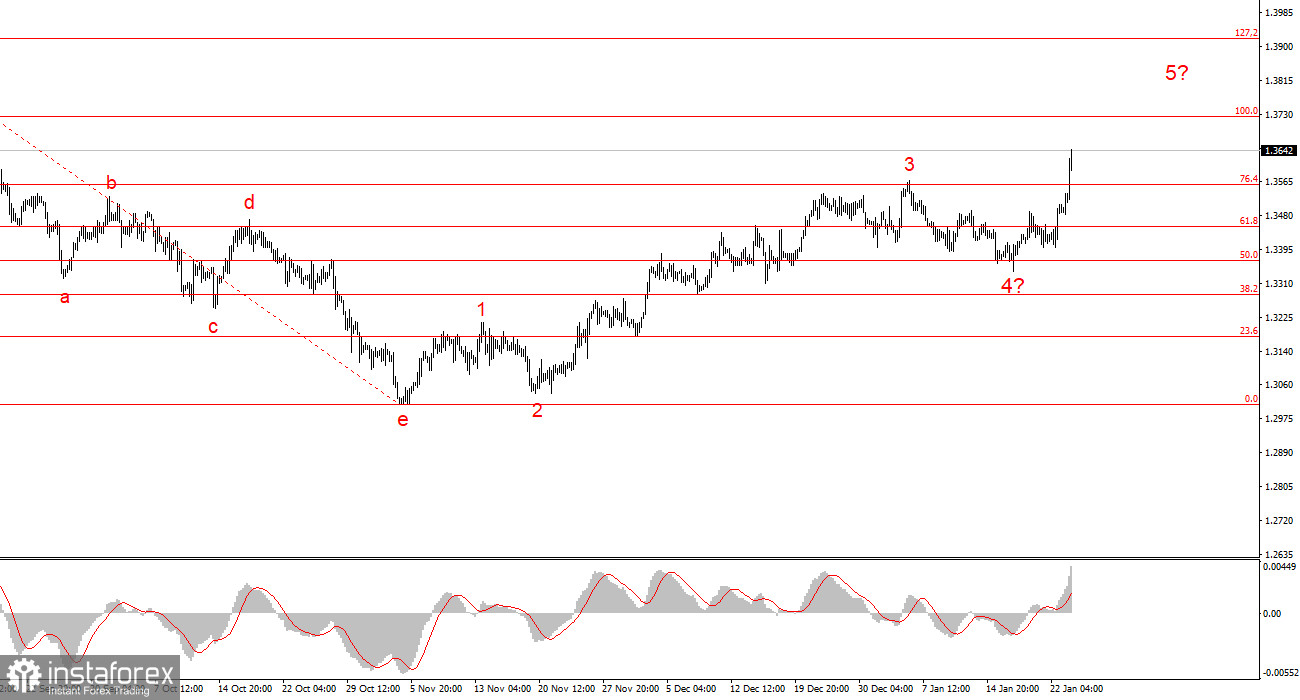

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has become clearer. The presumed wave 5 in 5 is currently forming, but the internal wave structure of the global wave 5 may take on a much more extended form. I believe that price increases will continue soon, with targets around the 1.3721 and 1.3913 levels, corresponding to the 100.0% and 127.2% Fibonacci levels. After completing the current five-wave pattern, the instrument may form three corrective waves. But for now, the upward segment is not yet complete, and after the correction, I expect a new impulsive wave segment in the direction of the 42 figure.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade, and they often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% confidence in the direction of movement, and there never can be. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.