The European currency concludes the week on a positive note. Despite the fact that the EUR/USD instrument continues to primarily build corrective structures (which significantly complicates trading), the euro has been either rising or trading steadily within a range for most of the time. However, despite the strong increase of the instrument this week, it is not certain that this will continue into next week. I remind you that the main reason for the dollar's decline (as before) is Donald Trump and his foreign, trade, and immigration policies. Consequently, the market has already priced in the latest threats and ultimatums from the U.S. president, and new data will be needed next week. However, according to the current wave analysis, the EUR/USD instrument is expected to continue building an upward trend segment. Therefore, it is possible to anticipate new growth for the euro even without news.

Will the news background support buyers next week? At first glance, there are doubts about the news calendar. In the Eurozone and the U.S., there will be few important reports and events, and participants are not expecting radical changes in monetary policy from the Federal Reserve. Let's consider what to expect and what to be cautious about regarding the euro.

In the Eurozone, reports will primarily focus on Germany. Data will be released on the business climate, consumer confidence, unemployment, fourth-quarter GDP, and inflation. GDP, unemployment, and inflation data can be considered important, but the market values European reports more. Reports on unemployment and GDP for the fourth quarter will be released for the Eurozone. They are somewhat more interesting, but they will affect the instrument's movement only on Friday. And that influence is unlikely to be strong.

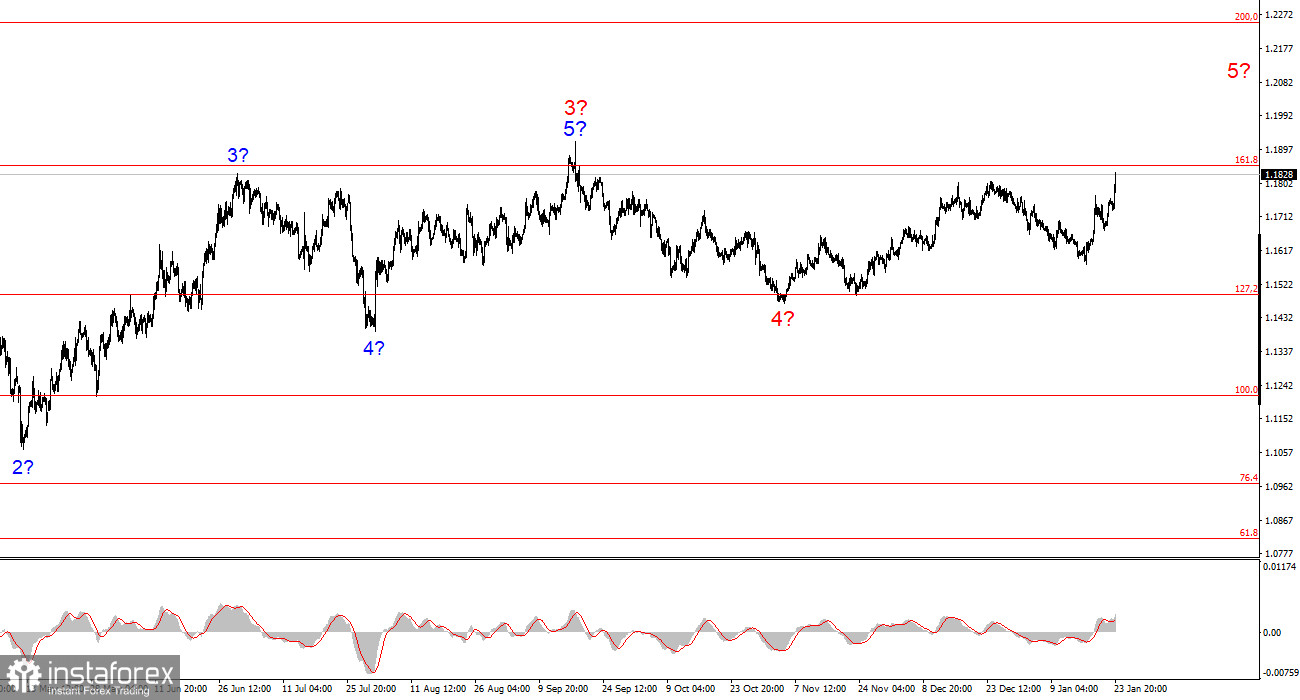

Based on all of the above, price increases might continue on wave and technical grounds. A successful attempt to break above the 1.1851 level, which corresponds to the 161.8% Fibonacci, will indicate the market's readiness to continue buying euros, with targets around 1.2248 (200.0% Fibonacci).

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Trump's policy and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the American currency. The targets of the current trend segment may reach the 25-figure mark. At this moment, I believe corrective wave 4 has completed its formation, so I expect further price increases, with the first target around 1.1918.

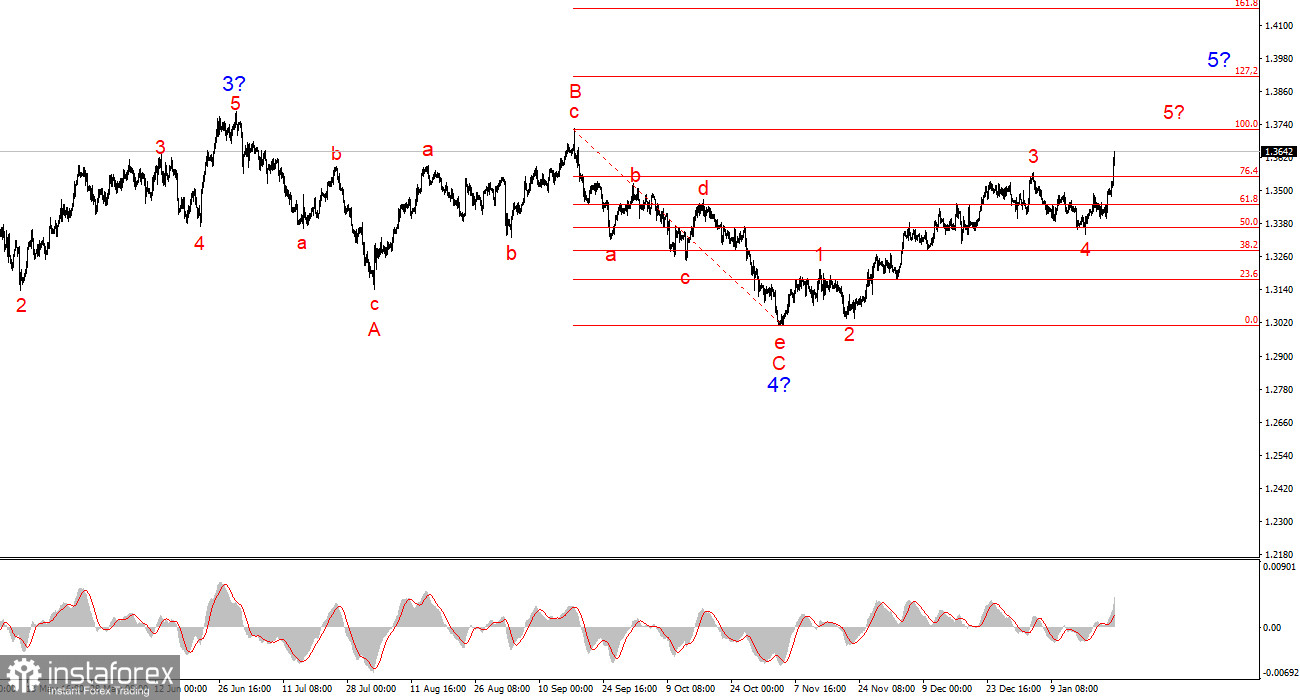

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has become clearer. The presumed wave 5 in 5 is currently being formed, but the internal wave structure of the global wave 5 may take on a much more extended form. I believe price increases will continue soon, with targets around the 1.3721 and 1.3913 levels, corresponding to the 100.0% and 127.2% Fibonacci. After completing the current five-wave pattern, the instrument may form three corrective waves. But for now, the upward segment is not yet complete, and after the correction, I expect a new impulsive wave segment in the direction of the 42 figure.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade, and they often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% confidence in the direction of movement, and there never can be. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.