The American currency continues to bear the consequences of Donald Trump's policies. I think no one doubts the reasons for the U.S. dollar's decline this week. I'll just highlight that the U.S. GDP report for the third quarter could have pleased dollar buyers, but market participants paid no attention to this important and positive report for the dollar. This indicates that the market is currently extremely negative towards the American currency. If this is indeed the case, the dollar's decline will continue next week.

What news should be expected from the United States? At the top of the list is certainly... no, not the Federal Reserve meeting. As I mentioned, Donald Trump started this year at full speed, so I do not rule out new tariffs, claims, accusations, and ultimatums in the near future. In my opinion, each new event of this nature potentially poses a danger to the American currency.

Economic reports next week may well be ignored by the market. Among the important reports, I would highlight durable goods orders and the ADP report on weekly employment changes. And, as the cherry on top, the Federal Reserve meeting. According to the CME FedWatch tool, the probability of a rate cut by the FOMC on January 28 is 4.4%. The probability of a rate cut in March is only 15%. Therefore, the market does not expect a new easing of monetary policy. If Jerome Powell or his colleagues indicate the possibility of a new round of easing in the coming months, this information will further pressure the already weak dollar.

As a result, the likelihood of a continued decline in the American currency is, in my opinion, higher than the probability of strengthening. Positive economic data from the U.S. is being ignored by the market, and the Fed may take either a neutral position or hint at further easing. The market's reaction to any messages from Trump likely no longer needs explanation...

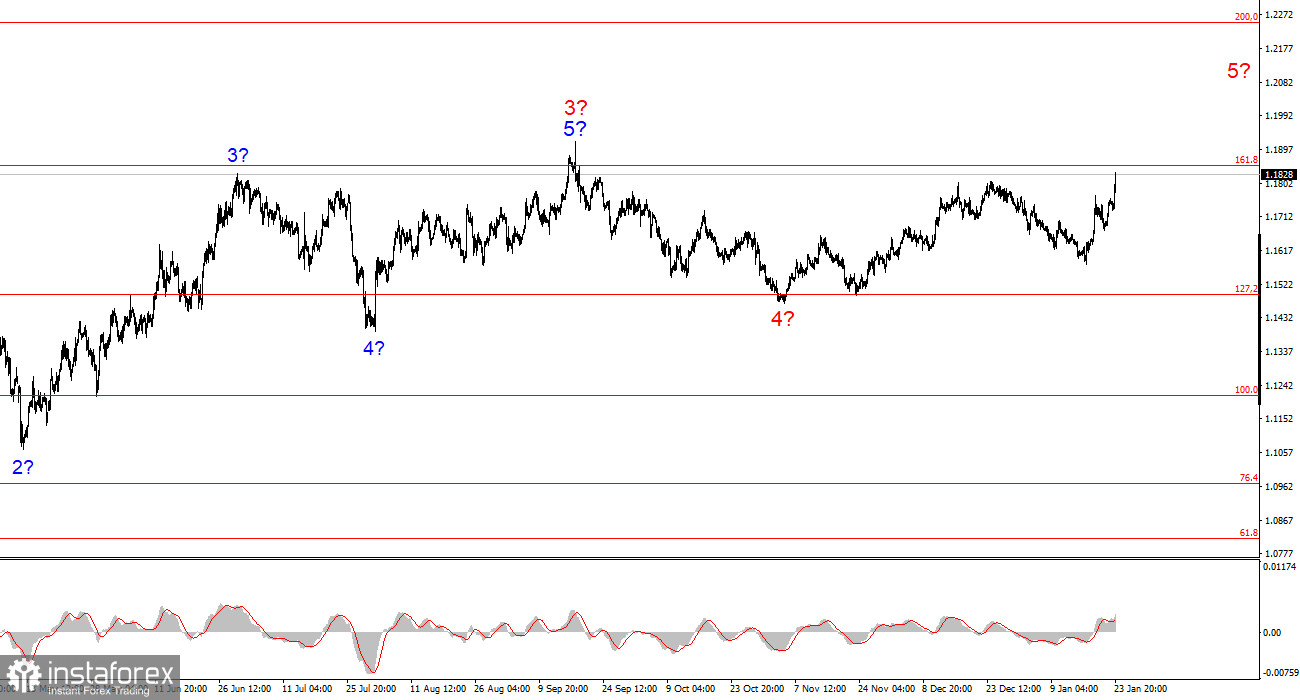

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. Trump's policies and the Fed's monetary policy remain significant factors in the long-term decline of the American currency. The targets for the current trend segment may extend to the 25-figure mark. At this moment, I believe corrective wave 4 has completed its formation, so I expect further price increases, with the first target around 1.1918.

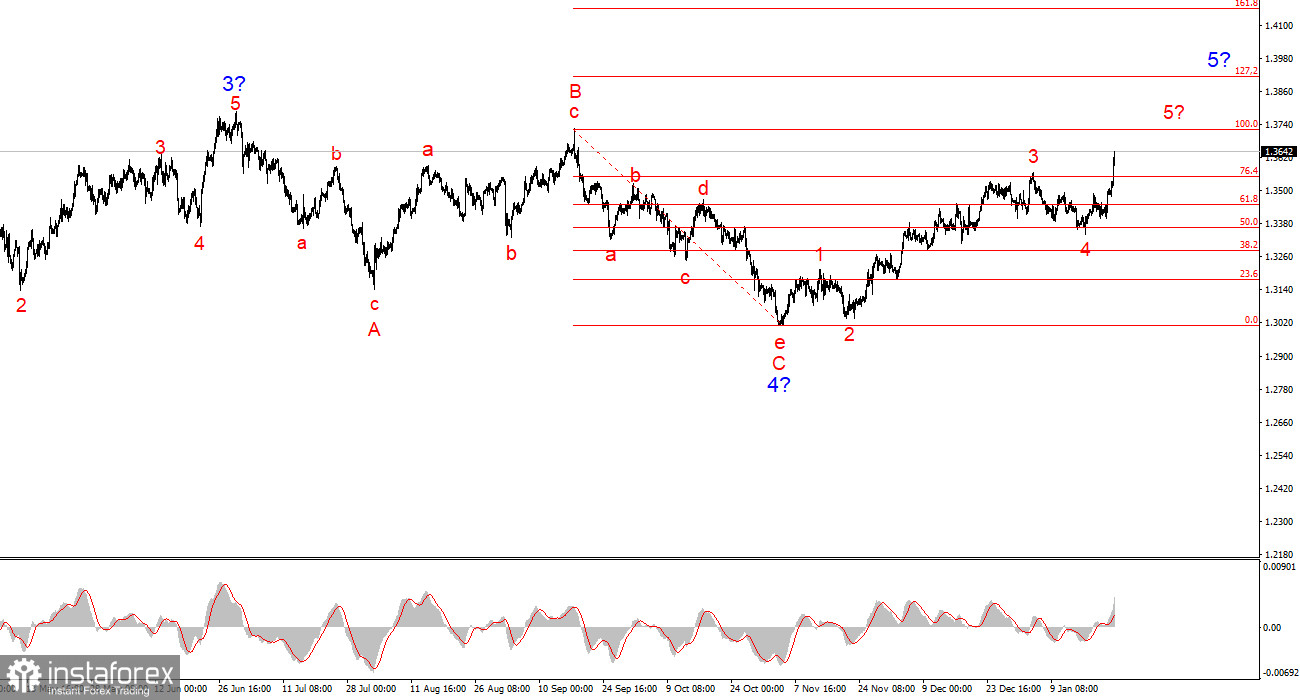

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has become clearer. The presumed wave 5 in 5 is currently being formed; however, the internal wave structure of the global wave 5 may take on a much more extended form. I believe the price rise will continue soon, with targets around 1.3721 and 1.3913, corresponding to the 100.0% and 127.2% Fibonacci. After completing the current five-wave pattern, the instrument may form three corrective waves. But for now, the upward segment is not yet complete, and after the correction, I expect a new impulsive wave segment in the direction of the 42 figure.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade, and they often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% confidence in the direction of movement, and there never can be. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.