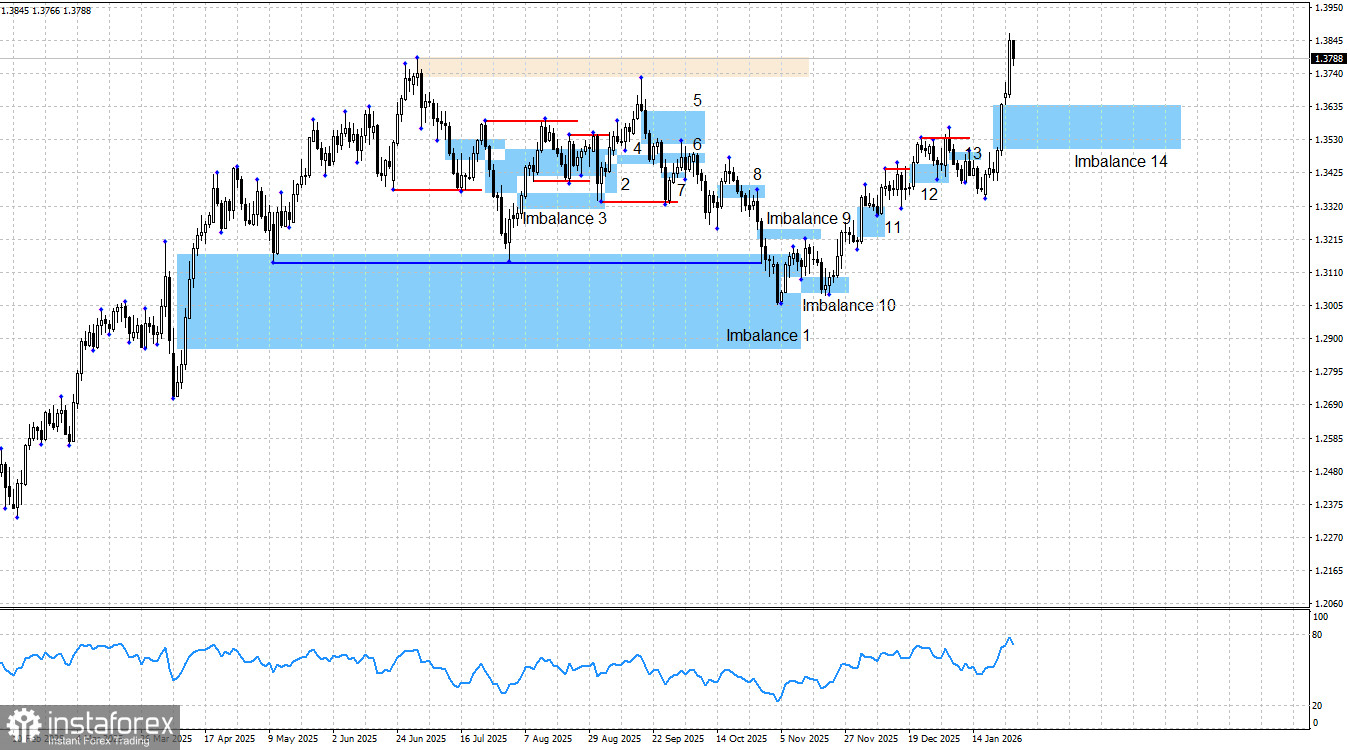

The GBP/USD pair also continues a strong upward move. Unfortunately, unlike EUR/USD, no buy signal was formed before the start of this rally, so traders had no opportunity to open new positions using the "Smart Money" system. However, not all is lost and there is no reason for despair. Monday ended with the formation of a new bullish imbalance (No. 14), which will serve as a zone of interest for bullish traders going forward. Another bullish imbalance may be formed as early as tomorrow if the FOMC meeting triggers further growth in the pair. If, on the other hand, we see a decline, it is likely to be toward imbalance No. 14.

The new week began with fresh attacks by Donald Trump. This time, Canada became the focus due to its trade with China without Washington's approval. Traders did not react to news of a possible 100% tariff increase on Canada, but on Tuesday bulls launched another offensive. This followed Trump's threat to raise tariffs on South Korea due to the prolonged ratification of a trade agreement with the U.S. As early as February 1, a new U.S. government shutdown may begin, as Trump has failed to reach an agreement with Democrats. The Fed is unlikely to support the dollar this week, although the dollar may still see a modest rebound as part of a corrective pullback.

Since the bullish trend in the euro remains intact, in my view, the bullish trend in the pound also remains intact. I cannot imagine a bullish trend in the euro occurring simultaneously with a bearish trend in the pound. This week, a new bullish imbalance (No. 14) was formed, which may allow traders to open new buy positions in the future. In my opinion, the technical picture remains unambiguous, as does traders' strategy.

The information background for the dollar should no longer be viewed on a day-by-day basis. The U.S. currency is in an almost free fall due to factors that have no expiration date. In other words, bulls can attack today and tomorrow alike, as Donald Trump provides them with such opportunities on a daily basis. Yesterday, the U.S. president stated that a cheap dollar is a very good thing, as it makes American products more competitive in global markets. There is no one to throw the dollar a lifeline.

In the U.S., the overall news background remains such that nothing but further dollar depreciation can be expected in the long term. The situation in the country remains quite difficult. The government shutdown lasted a month and a half, and Democrats and Republicans have only agreed on funding through the end of January, which ends on Saturday. U.S. labor market data continue to disappoint or are simply ignored by the market. The last three FOMC meetings ended with dovish decisions, and recent data suggest that the pause in monetary easing will be short-lived. Trump's military aggression, threats toward Denmark, Mexico, Cuba, Colombia, EU countries, Canada, and South Korea, the criminal case against Jerome Powell, and the threat of a new shutdown all perfectly complement the current picture of an "American crisis." In my view, bulls have everything they need to continue their offensive throughout 2026 (albeit with pauses).

A bearish trend would require a strong and stable positive news background for the dollar, which is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not want a strong dollar, as the trade balance would remain in deficit in that case. Therefore, I still do not believe in a bearish trend for the pound, despite the fairly sharp decline seen in September and October. Too many risk factors continue to weigh heavily on the dollar. What would bears use to push the pound lower? If new bearish patterns appear, a potential decline in sterling can be reconsidered, but at the moment there are none.

News Calendar for the U.S. and the U.K.:

United States – Change in Initial Jobless Claims (13:30 UTC).

On January 29, the economic calendar contains only one event of no particular interest. The impact of the news background on market sentiment on Thursday will be negligible.

GBP/USD Forecast and Trading Advice:

The picture for the pound remains clear; what is missing are new buy signals. Bulls have launched a new offensive, which threatens to become both lengthy and significant.

Since the bullish trend is undeniable, traders are left to trade to the upside using clear patterns and well-defined signals. In the near future, traders may expect a return of prices into imbalance No. 14 and the formation of a new bullish signal. I previously considered the 1.3725 level as a potential upward target; this level has been reached, but the pound may rise much higher in 2026—especially given the events of the first month of the year. If bearish patterns form, short trades may also be considered, but within a bullish trend, I remain a proponent of buying rather than selling.