Trump's political ratings have dropped to the lowest levels since his return to the White House. Only 38% of surveyed Americans support Trump's overall policies. The main reasons for Americans' dissatisfaction include his strict immigration policy, rising prices on imported goods, a sharp decline in America's international reputation, unfounded repressions, Trump's interference in the operations of independent agencies, and controversial foreign policy. In reality, political ratings have little influence; they only indirectly reflect the likelihood that the incumbent government will win the next elections. The next elections (midterms) are set for November, when the Republican Party may lose one of the two chambers.

If this happens, it will become much more difficult for Trump to make controversial, contradictory decisions. In my view, this presents an opportunity for America to withstand the autocratic regime that many economists and political scientists believe Trump is implementing. I remind you that the dollar's exchange rate has sunk to four-year lows this week, but Trump sees this as a victory. After all, if the national currency is weak, it is easier for exporters to sell their goods abroad. It doesn't matter that import prices are also rising sharply, as they already have due to the ongoing full-scale trade war that has been underway for nearly a year. Americans should be happy about the high rates of economic growth, even if it doesn't reflect in their wallets.

Based on all of the above, I believe the dollar will have a chance not earlier than next fall, when exit polls will allow speculation about the new composition of the House and Senate. If there is even the slightest chance that Trump will lose one of the chambers, the market will begin to anticipate a more prudent and balanced policy from the US government, aimed not only at GDP growth and the enrichment of millionaires.

However, until next fall, Trump may impose a huge number of new sanctions and tariffs and tighten control over the Fed, which would be a death knell for the American currency. Trump himself stated no later than yesterday that he can manage the dollar's exchange rate like a yo-yo. It is fortunate that this has not yet come to pass. But if the Fed complies with Trump's orders without question, the president will gain a tool for managing the currency's exchange rate. In my opinion, despite today's strengthening of the dollar, the prospects remain extremely bleak.

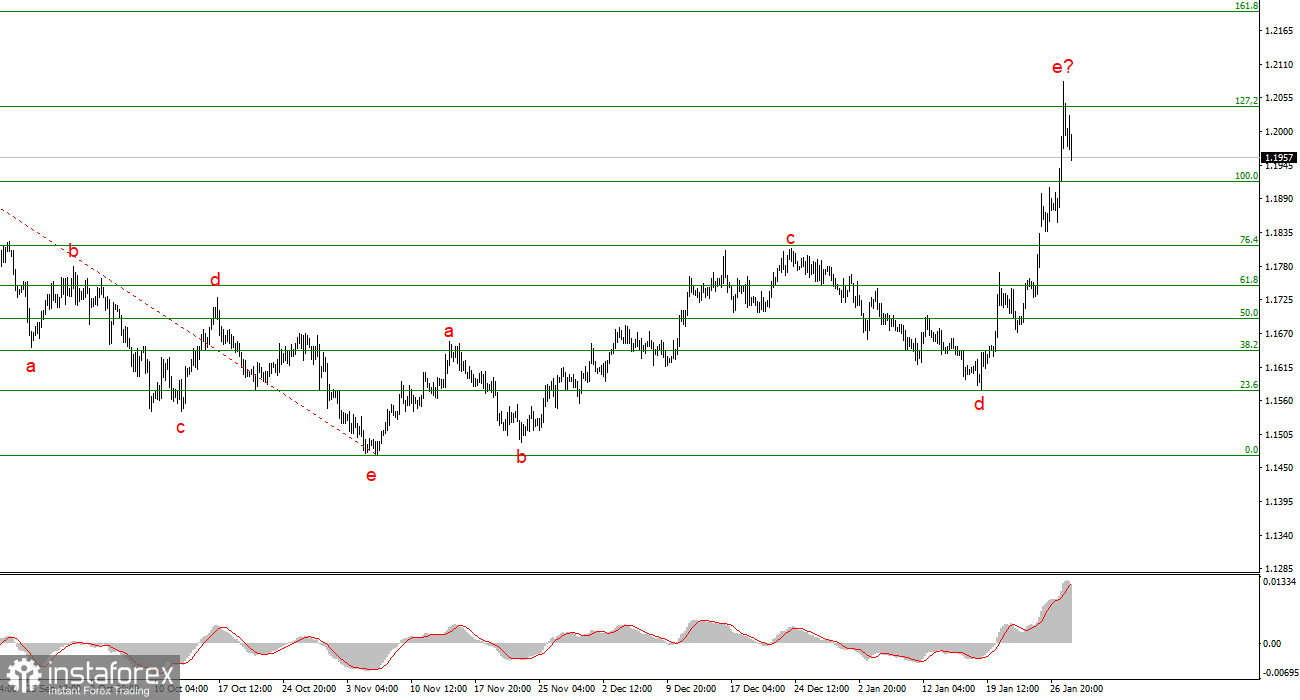

Wave Picture for EUR/USD:

Based on my analysis of EUR/USD, I conclude that the instrument is continuing to build an upward trend segment. Trump's policies and the Fed's monetary policy remain significant factors in the long-term decline of the American currency. The targets for the current trend segment may reach up to the 25-figure mark. At this moment, I believe that corrective wave 4 has completed its formation, so I expect further increases in quotations. However, I also anticipate a corrective wave forming in the near future.

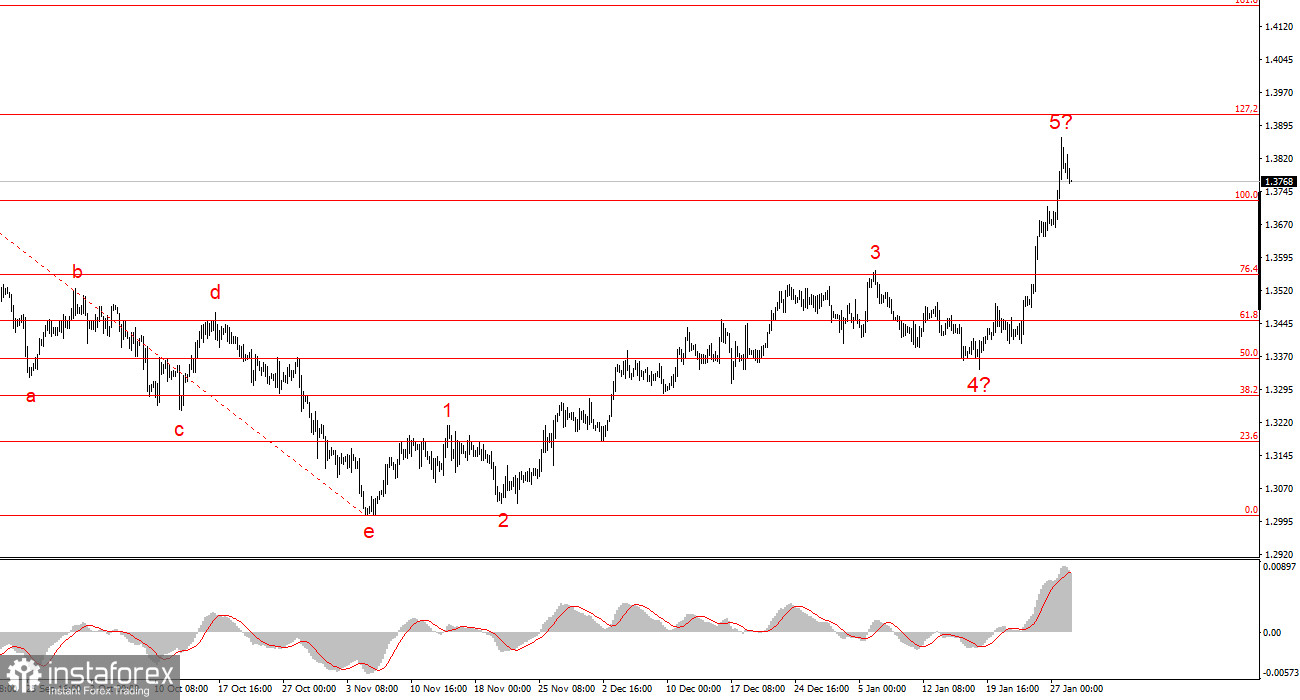

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has become clearer. Currently, the presumed wave 5 is still forming within wave 5, but the internal wave structure of global wave 5 may take a much more extended form. I believe that the current bullish wave set is nearing completion or has already completed. Therefore, a corrective wave or wave set may begin soon, after which the main trend is likely to resume with targets positioned above the 39-figure.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are hard to play back and often carry changes.

- If there is no confidence in what is happening in the market, it is better not to enter.

- There can never be 100% certainty in the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.