Analysis of Trades and Trading Tips for the British Pound

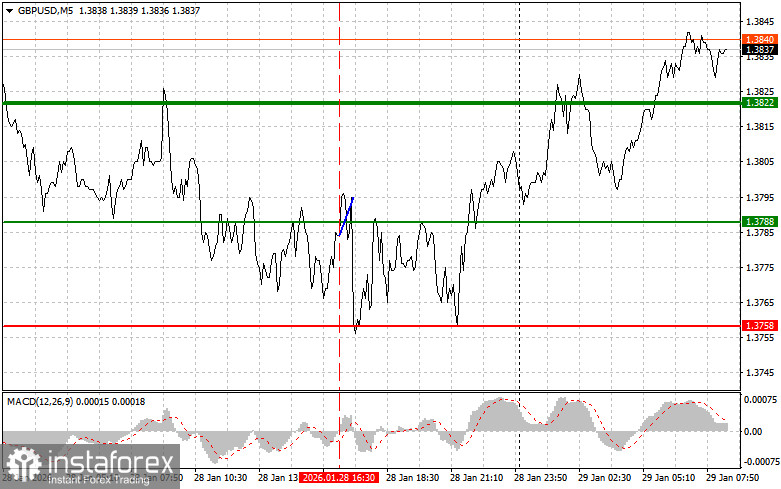

The test of the price at 1.3788 coincided with the moment when the MACD indicator was just beginning to move upward from the zero mark, confirming the correct entry point for buying the pound. However, the pair did not demonstrate significant growth, resulting in the fixation of losses.

As it became known yesterday, the Federal Reserve left interest rates unchanged at 3.75%, which restored pressure on the dollar and boosted the pound. During the press conference, Fed Chairman Jerome Powell stated that the unemployment rate has begun to stabilize, but this does not mean that the situation is under control. Investors interpreted the Fed chairman's comments as a signal that the central bank intends to wait for more convincing evidence of sustainable economic growth before changing its policy.

Today, the GBP/USD pair is expected to continue its upward trend. Due to the absence of significant economic reports from the United Kingdom, the pound sterling could reach new highs by midday. However, the current optimism about the British currency is more due to the dollar's weakness than to the pound's strength.

Regarding the intraday strategy, I will rely more on implementing Scenarios #1 and #2.

Buying Scenarios

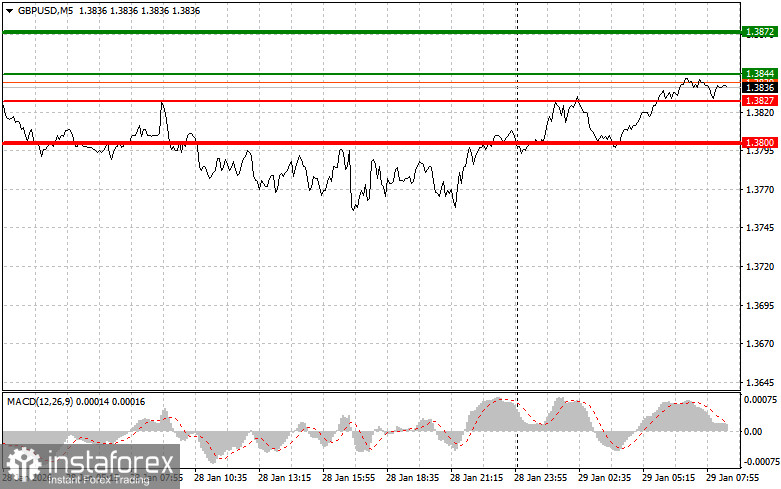

Scenario #1: I plan to buy the pound today upon reaching an entry point around 1.3844 (green line on the chart), with a target for growth to 1.3872 (thicker green line on the chart). Around 1.3872, I intend to exit my long positions and open short positions in the opposite direction (expecting a movement of 30-35 pips back from that level). One can expect continued pound growth today within the trend. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the price at 1.3827 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. One can expect growth towards the opposite levels of 1.3844 and 1.3872.

Selling Scenarios

Scenario #1: I plan to sell the pound today after the 1.3827 level (red line on the chart) is reached, which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3800 level, where I plan to exit my short positions and open long positions immediately in the opposite direction (expecting a move of 20-25 pips back from that level). Pound sellers are unlikely to show significant strength. Important! Before selling, ensure the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario #2: I also intend to sell the pound today if the price tests 1.3844 twice in a row while the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. One can expect a decline to the opposite levels of 1.3827 and 1.3800.

What's on the Chart:

The thin green line represents the entry price at which one can buy the trading instrument;

The thick green line represents the approximate price where one can set Take Profit or secure profits, as further growth above this level is unlikely;

The thin red line represents the entry price at which one can sell the trading instrument;

The thick red line represents the approximate price where one can set Take Profit or secure profits, as further decline below this level is unlikely;

The MACD indicator: when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders in the Forex market should be very careful when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, it is essential to have a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.