At the time of writing on Thursday, the EUR/JPY pair has fallen below the round 183.00 level. Domestic factors are strengthening the Japanese yen, neutralizing positive economic signals from the eurozone.

The yen is supported by speculation about the likelihood of intervention by Japanese authorities to curb its further weakening. This factor is compounded by the Bank of Japan's hawkish rhetoric. The minutes from the December meeting, published on Wednesday, indicated that several board members believe that real interest rates will remain deeply negative, even if the policy rate is raised to 0.75%.

Overall, officials agree that the Bank of Japan will continue to tighten monetary policy if economic and inflation forecasts are confirmed, avoiding a predetermined schedule and assessing the situation at each meeting individually. Rabobank, through its RaboResearch division, emphasizes that the Japanese yen is supported by the risk of official government intervention amid inflationary pressures and a widening trade deficit.

Additionally, the bank highlights the fragility of the Japanese economy and the risks to the US Treasury bond market, noting that Tokyo may ultimately need external assistance to resolve financial difficulties.

In Europe, the euro is gaining momentum from January surveys that exceeded expectations: the economic sentiment index rose to 99.4 from 97.2 in December, and indicators for the manufacturing and services sectors improved. Consumer confidence remains stable at -12.4, in line with expectations. However, the euro's upside potential is limited by cautious signals from the European Central Bank. Governing Council member Martin Kocher warned that excessive strengthening of the euro could trigger new rate cuts.

Following these comments, markets slightly increased expectations of monetary policy easing in the summer. It is expected that the ECB, which has kept interest rates unchanged since June 2025 with inflation around 2%, will likely maintain the status quo at the next meeting.

To better identify trading opportunities, it is worth paying attention to upcoming inflation data from Japan, specifically the Tokyo consumer price index, expected to be published on Friday. Following a drop to 2% year-on-year in December from 2.7% earlier, a new slowdown in January could ease pressure on the Japanese yen and temporarily boost EUR/JPY.

From a technical perspective, the pair is attempting to find support at the 182.00 round level. If prices do not hold this level, the pair could accelerate its decline to the next round level at 181.00, with a likely stop at 181.50.

Conversely, resistance may now be at 182.70 before the round level of 183.00. Oscillators on the daily chart are mixed, but it is worth noting that the Relative Strength Index has moved into negative territory, which favors bears.

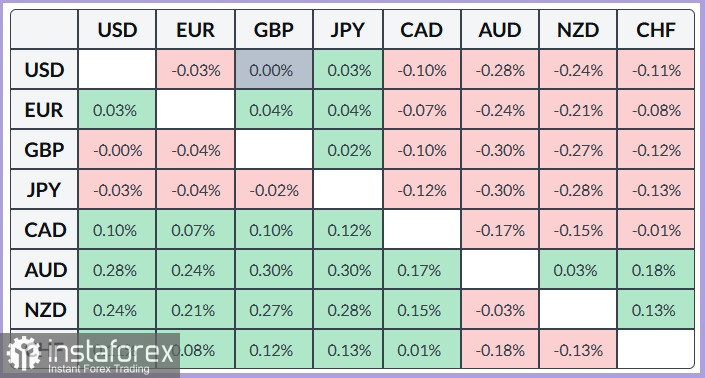

Below is a table showing the percentage changes of the euro against key currencies for the day. The euro achieved the largest increase against the yen.