Trade breakdown and trading advice for the Japanese yen

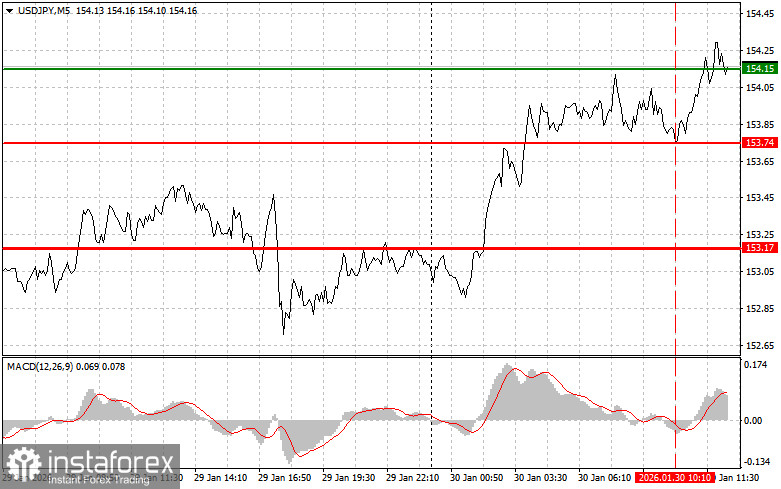

The test of the 153.74 price level occurred when the MACD indicator had already moved well below the zero line, which limited the pair's downward potential. For this reason, I did not sell the dollar.

Next, market participants' attention will be focused on the upcoming statement by Trump, where a candidate for a senior position at the Federal Reserve will be presented. If Kevin Warsh is appointed, the dollar is likely to strengthen. Warsh, who adheres to conservative views on monetary policy, is seen as a potential factor in stabilizing and strengthening confidence in the US currency, which has been going through a difficult period recently.

At the same time, it is important to consider other fundamental factors that could influence the dollar's dynamics. US Producer Price Index (PPI) data and the Chicago PMI index are expected, followed by a speech from FOMC member Alberto Musalem. The market will closely analyze his every word in search of clues about the Federal Reserve's future policy. The risk of hawkish rhetoric appears low, while more cautious comments could weaken the dollar in the short term.

As for the intraday strategy, I will rely primarily on the implementation of scenarios No. 1 and No. 2.

Buy Signal

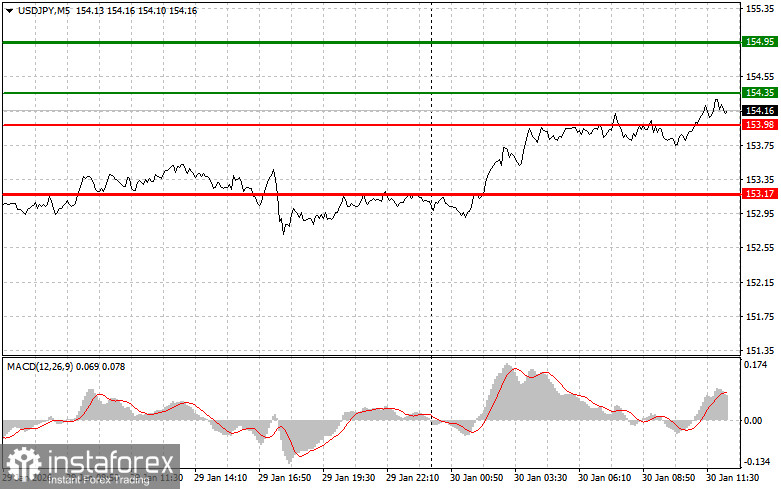

Scenario No. 1: Today, I plan to buy USD/JPY if the entry point is reached around 154.35 (green line on the chart), targeting a rise toward the 154.95 level (the thicker green line on the chart). Around 154.95, I will exit long positions and open sell positions in the opposite direction (expecting a 30–35 point move in the opposite direction from the level). Growth in the pair today can be expected after strong US data.Important: Before buying, make sure that the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the case of two consecutive tests of the 153.98 price level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 154.35 and 154.95 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after a break/update of the 153.98 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 153.17 level, where I will exit sell positions and also immediately open buy positions in the opposite direction (expecting a 20–25 point move in the opposite direction from the level). Pressure on the pair will return in the case of weak data.Important: Before selling, make sure that the MACD indicator is below the zero line and is just starting to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the case of two consecutive tests of the 154.35 price level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 153.98 and 153.17 can be expected.

What's on the chart:

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – estimated price where Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – estimated price where Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders need to be extremely cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.