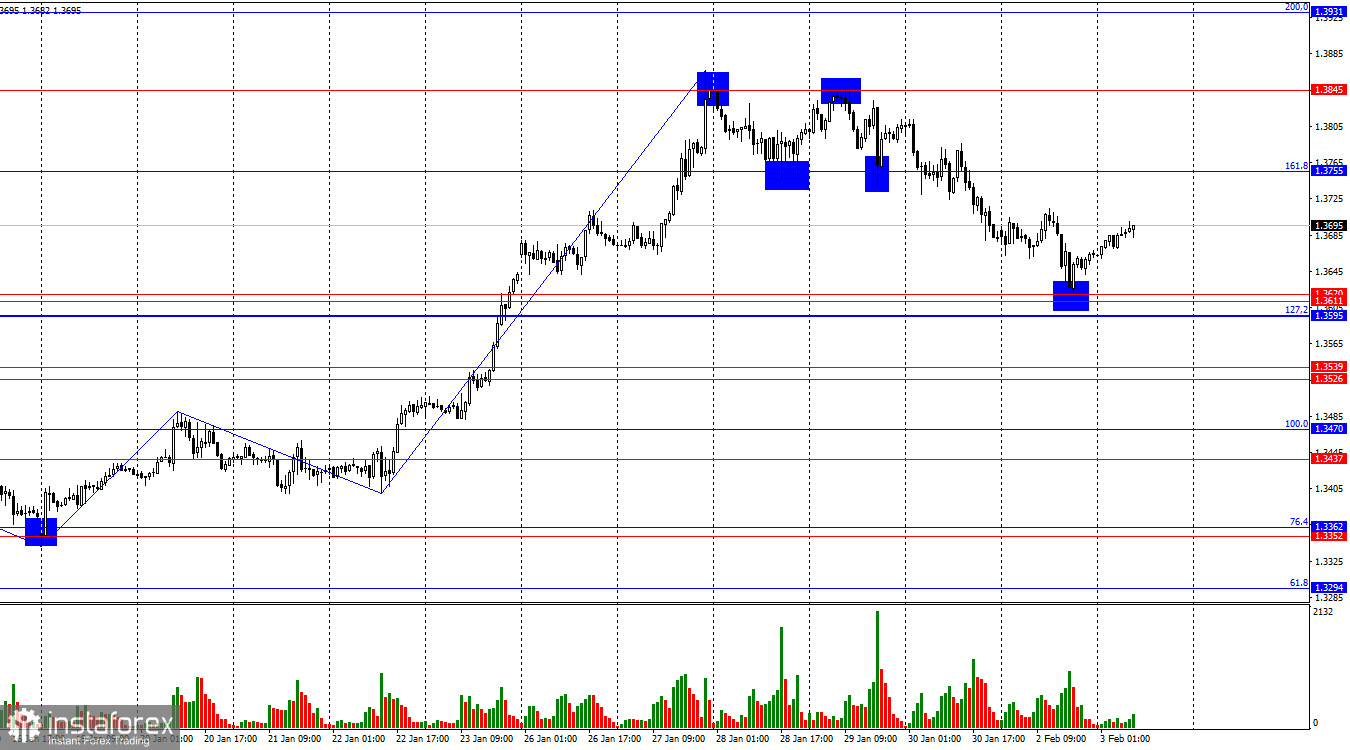

On the hourly chart, the GBP/USD pair continued its decline on Monday and reached the support level of 1.3611–1.3620. A rebound from this zone worked in favor of the British pound and marked the beginning of growth toward the 161.8% corrective level at 1.3755. Consolidation above 1.3755 would increase the likelihood of further growth toward the next levels at 1.3845 and 1.3931.

The wave situation remains "bullish." The most recently completed upward wave broke the previous peak, while the new downward wave has not yet even approached the last low. The news background for the pound has been weak in recent months, but the news background in the United States is even worse. Donald Trump regularly provides support to the bulls, which ensures growth of the British currency. A breakdown of the current trend can only be identified by two consecutive "bearish" waves.

The news background on Monday supported bear traders, but further growth of the dollar would surprise me. Economic statistics in the United States have begun to improve, and even the labor market has started to show signs of recovery. However, events taking place in the United States and related in one way or another to the U.S. do not allow me to assume strong growth of the dollar. I would like to remind you that a new conflict between Iran and America may flare up this week. A whole fleet of U.S. naval forces is located near Iran, ready to strike at any moment. Washington demands negotiations on the nuclear deal, and Tehran agrees with the need for a diplomatic resolution. But at the same time, how many such negotiations has the world already seen? Iran will not abandon nuclear development and uranium enrichment, in my opinion. There is no official information that negotiations will take place in the near future—only rumors about their possible occurrence. In my view, bears can currently count only on moderate attacks—in other words, corrective pullbacks.

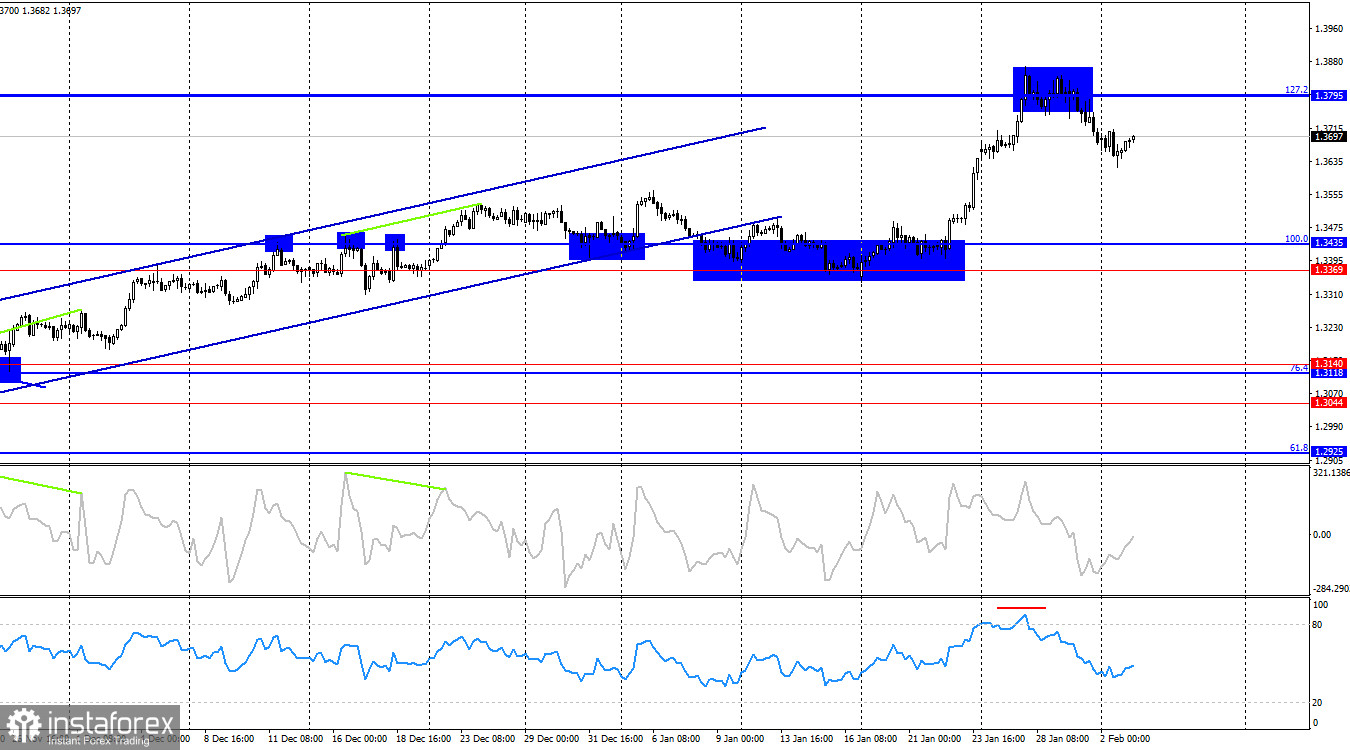

On the 4-hour chart, the pair rose to the Fibonacci 127.2% level at 1.3795 and rebounded from it. As a result, a reversal in favor of the U.S. dollar followed, and a decline began toward the support level of 1.3369–1.3435. Consolidation above 1.3795 would allow expectations of a continuation of the bullish trend toward the 1.4020 level. No emerging divergences are observed today.

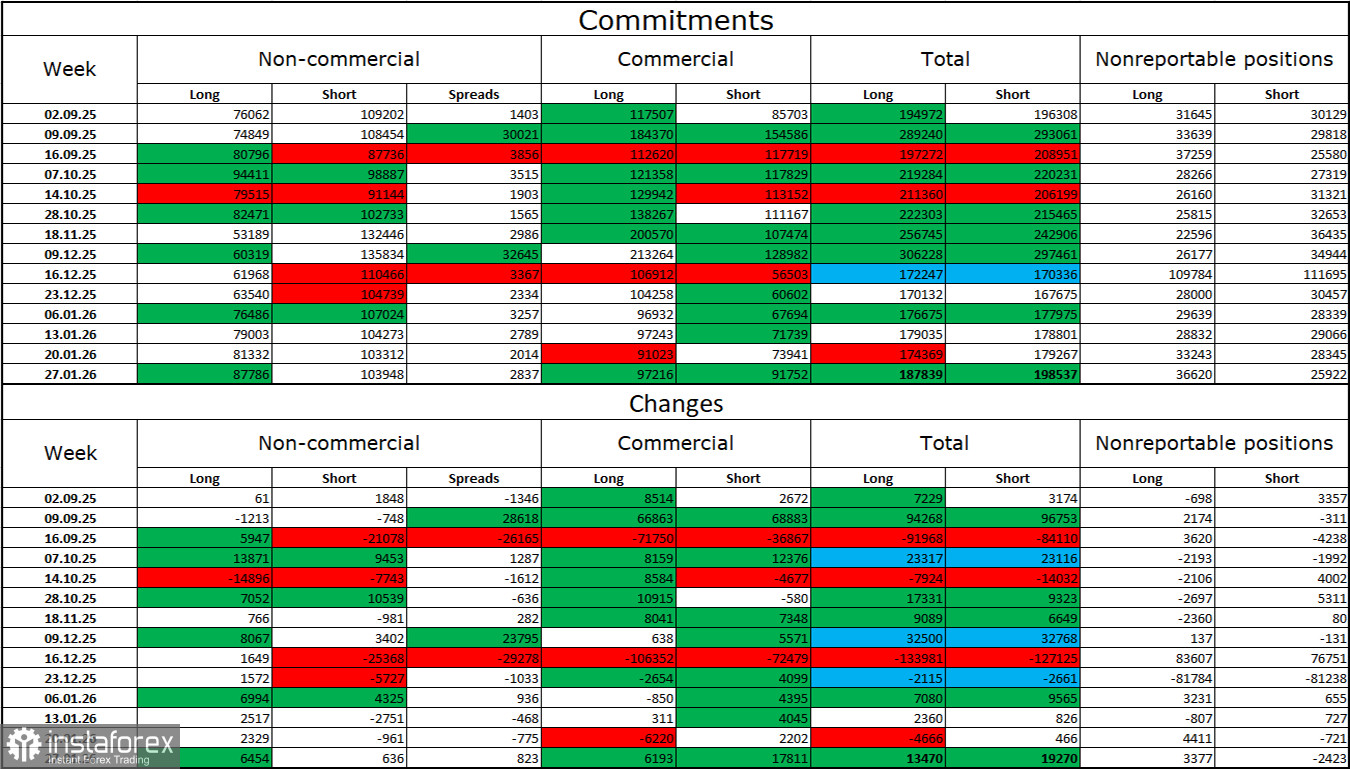

Commitments of Traders (COT) Report:

Sentiment among the "Non-commercial" trader category became more bullish over the last reporting week. The number of long positions held by speculators increased by 6,454, while the number of short positions rose by only 636. The gap between long and short positions is now effectively as follows: 87,000 versus 104,000, and it is shrinking rapidly. Bears have dominated in recent months, but it seems they have exhausted their potential. At the same time, the situation with euro contracts is directly opposite. I still do not believe in a bearish trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency may occasionally enjoy demand in the market—but not in the long term. Donald Trump's policies led to a sharp decline in the labor market, and the Federal Reserve is forced to ease monetary policy to stop rising unemployment and stimulate the creation of new jobs. U.S. military aggression also does not add optimism for dollar bulls.

News Calendar for the U.S. and the U.K.:

United States – JOLTS Job Openings Change (15:00 UTC).

On February 3, the economic calendar contains only one entry, and it is not among the most important. The impact of the news background on market sentiment on Tuesday may be present only in the second half of the day.

GBP/USD Forecast and Trading Advice:

Selling the pair was possible after a rebound from the 1.3845 level on the hourly chart, with targets at 1.3755 and 1.3620. All targets have been reached. I would not rush into new sales positions at the moment. Buy positions could be opened after a rebound from the 1.3611–1.3620 level on the hourly chart, with a target at 1.3755. These trades can be kept open today.

Fibonacci level grids are built from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.