The U.S. dollar has felt much better in recent weeks. Donald Trump has temporarily shelved the idea of seizing Greenland militarily while still not having struck Iran or announced new tariffs against any trading partners. The reason lies in a national-scale scandal surrounding Jeffrey Epstein. Trump is currently busy answering hundreds of questions related to his involvement in this case. As soon as Trump stopped bombarding the media with aggressive rhetoric, the dollar immediately experienced relief.

However, next week, the dollar will not have the luxury of relief. At least three significant indicators will be released, and the market may already be bracing for new sell-offs of the American currency. It is rare for three of the most crucial indicators under current conditions to come out in one week, made possible by the second "shutdown" in the U.S. at the beginning of February. Another rare occurrence is that all three reports could work against the American currency.

To start, the labor market and unemployment data were supposed to be released last Friday. After the ADP and JOLTS reports, currency market participants are skeptical that the U.S. labor market has stopped "cooling." Consequently, no strong Non-Farm Payroll numbers are expected. The unemployment rate will likely remain at 4.4% at best, but it could rise to 4.5%. There is a roughly 70-80% chance that at least one of these reports will come in below market expectations.

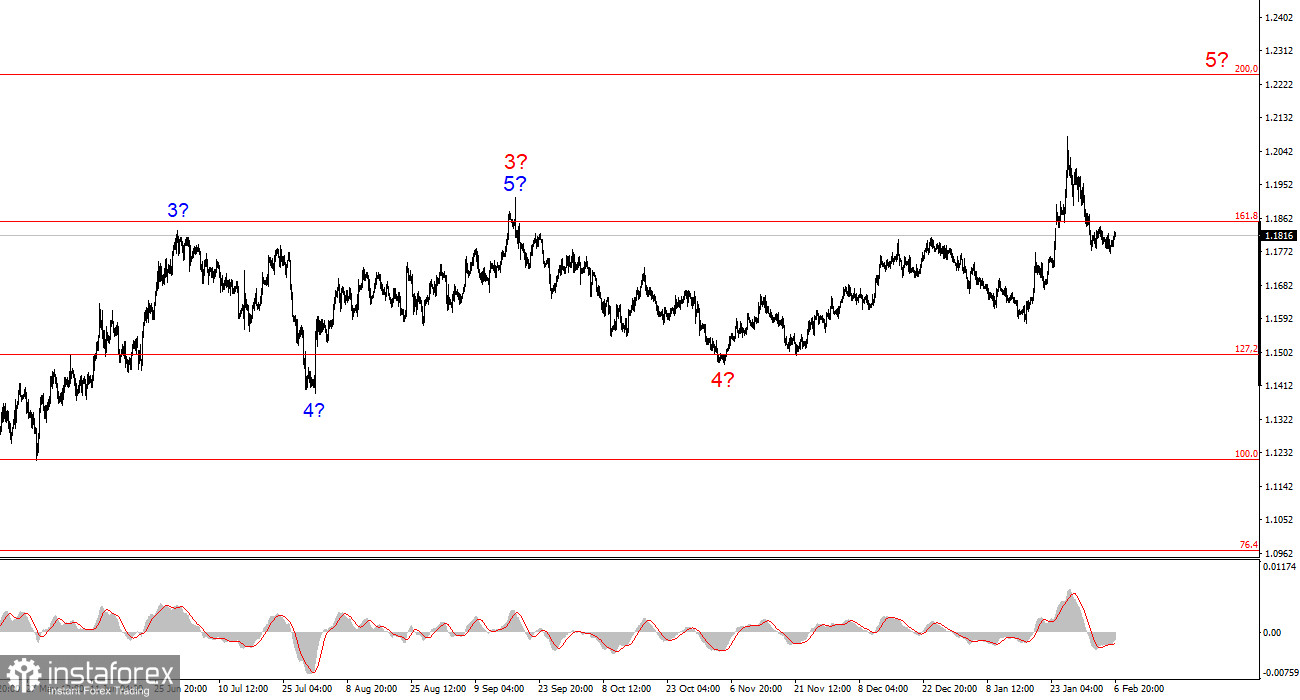

Wave Analysis for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. Donald Trump's policies and the Federal Reserve's monetary policy remain significant factors affecting the long-term decline of the U.S. dollar. The targets for the current trend section could extend to the 25th figure. At this moment, I believe that global wave 5 has begun and is continuing, so I expect prices to rise in the first half of 2026. However, in the near term, I anticipate a downward wave (or series of waves), as the structure a-b-c-d-e appears complete. My readers can soon look for areas and levels for new purchases.

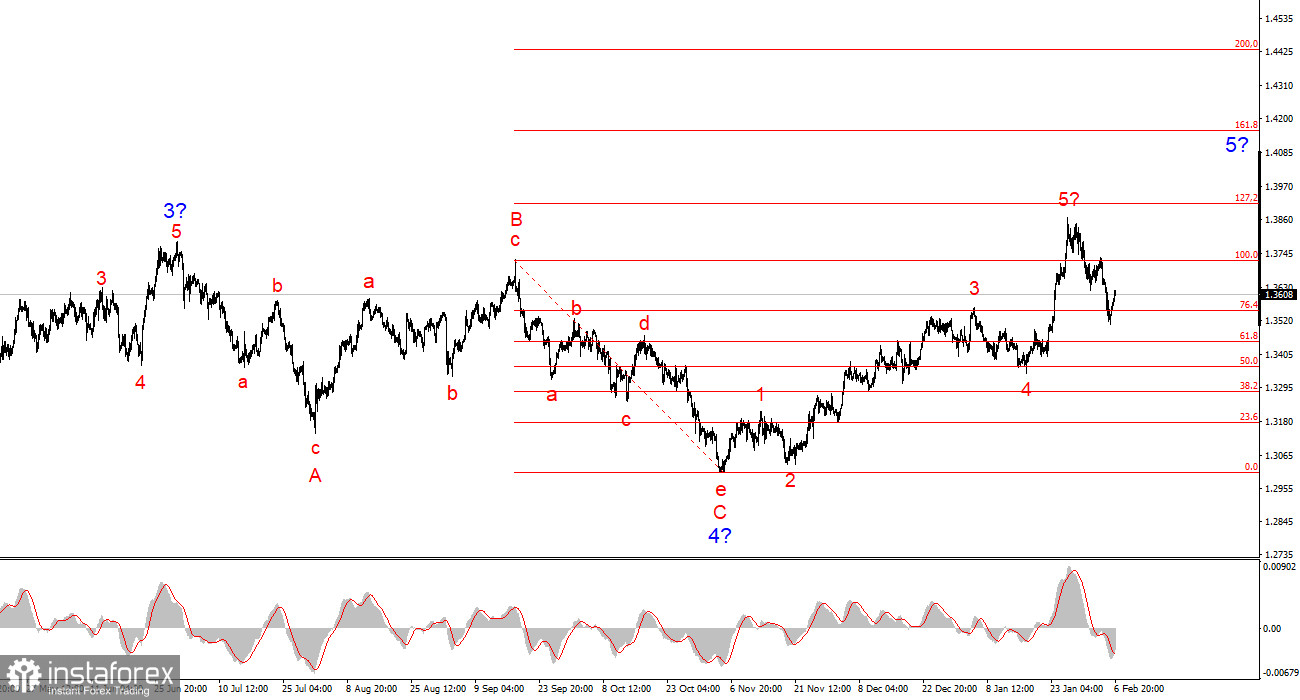

Wave Analysis for GBP/USD:

The wave pattern for GBP/USD appears quite clear. The five-wave upward structure has completed its formation, but global wave 5 may take on a much more extended appearance. I believe that a corrective set of waves may be formed in the near future, after which the upward trend will resume. Therefore, in the coming weeks, I suggest seeking opportunities for new purchases. In my opinion, under Trump, the British pound has a good chance of trading at $1.45-$1.50. Trump himself welcomes the decline in the dollar's exchange rate. All his actions have a dual effect: a weaker dollar and the resolution of internal, external, trade, and geopolitical issues.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to interpret, and they often lead to changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Don't forget to use protective stop-loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.