The GBP/USD currency pair traded relatively calmly in the first half of Wednesday, while in the second half, it showed more activity. We will discuss the unemployment and Non-Farm Payroll reports in detail in our "Trading Recommendations" articles, so we won't dwell on them here. As we mentioned earlier, individual reports can even support the American currency. However, that does not mean the situation is improving.

Investors are fleeing the dollar in favor of safer currencies and assets. They are concerned that the Fed may have to restart the printing press. Investors fear that with Kevin Warsh's arrival, the Fed's key rate might plummet at lightning speed. There's also concern about Trump's geopolitical ambitions and the complete uncertainty surrounding the future of the American economy. Investors are wary of the rapidly increasing US national debt. Recently, the Chinese government banned Chinese banks from investing in American Treasuries. What else is this but a continuation of the war between China and the US? Washington targets the trade sector because it can do so, thanks to a wealthy consumer market. Beijing retaliates in other areas, such as rare-earth metals and investments.

Thus, the main points for traders to remember in the coming years are:

- Trump benefits from a cheap dollar, so no one will save the US currency from falling;

- Trump is alienating half the world's countries against the US, so when the opportunity arises, those nations will respond to him in kind;

- Trump doesn't care about inflation. He would gladly accept a 10% growth in the economy with a 10% inflation rate;

- The national debt will continue to rise under Trump.

The Fed is a separate topic in the context of Trump's goals. If anyone thinks that the Master of the White House and King of the World has given up on his plans to establish control over the central bank, they are very mistaken. Starting in May, pressure on the Fed's officials is set to intensify, as that is part of Warsh's mission. It is unlikely that Trump appointed Warsh as chair to ensure nothing would change at the Fed. However, there are still not enough votes for a rate cut. The majority of the Monetary Policy Committee fully supports Jerome Powell and his position, which is to wait for some time for the effects of the 2025 rate cuts to fully manifest in the American economy.

Thus, any unplanned easing will only be possible if the labor market continues to slow. Or in the case of inflation slowing to levels that do not require maintaining a "restrictive" monetary policy. The next inflation report is due on Friday and may indicate a slowdown to 2.5%. This is unlikely to be sufficient for a new rate cut, but Powell has warned repeatedly that there is no action plan for rates; decisions are made from meeting to meeting based on macroeconomic data.

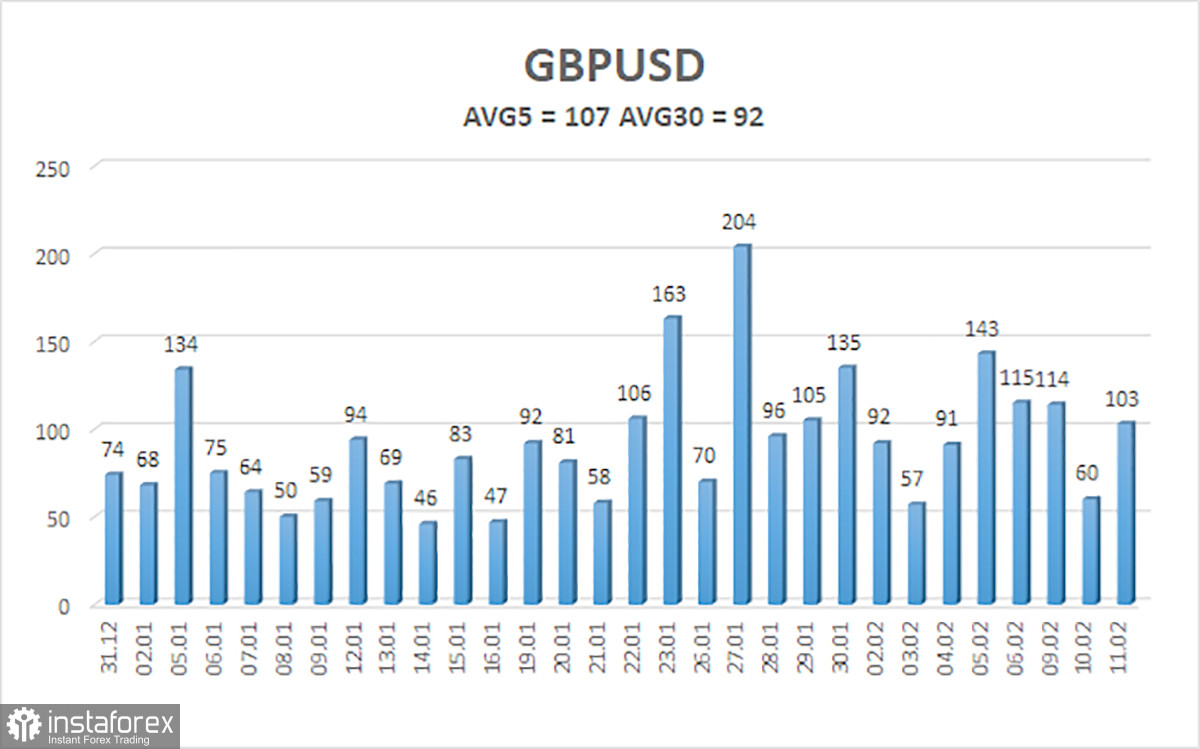

The average volatility of the GBP/USD pair over the last 5 trading days as of February 12 is 102 pips. For the pound/dollar pair, this value is considered "average." On Thursday, February 12, we therefore expect movements within a range bounded by levels 1.3557 and 1.3761. The upper channel of the linear regression is directed upwards, indicating a trend recovery. The CCI indicator has entered the overbought zone six times over the past months. It has formed numerous "bullish" divergences, repeatedly warning traders of an impending resumption of the upward trend.

Nearest Support Levels:

- S1 – 1.3550

- S2 – 1.3428

- S3 – 1.3306

Nearest Resistance Levels:

- R1 – 1.3672

- R2 – 1.3794

- R3 – 1.3916

Trading Recommendations:

The GBP/USD currency pair is on track to continue its 2025 upward trend, and its long-term prospects remain unchanged. Trump's policies will continue to exert pressure on the US economy, so we do not expect the US currency to grow in 2026. Even its status as a "safe haven" no longer holds significant importance for traders. Therefore, long positions with targets of 1.3916 and above remain relevant for the near term as long as the price is above the moving average. If the price is below the moving average line, small shorts can be considered with a target of 1.3550 based purely on technical (correction) factors. From time to time, the American currency shows corrections (on a global scale), but for trend growth, it requires global positive factors.

Explanations of the Illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, it means the trend is strong at the moment.

- The moving average line (settings 20.0, smoothed) defines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the likely price channel in which the pair will move over the next day, based on current volatility readings.

- The CCI indicator's entry into the oversold area (below -250) or overbought area (above +250) indicates a potential trend reversal in the opposite direction.