The UK labor market report released this morning turned out to be unexpectedly weak. The unemployment rate rose from 5.1% to 5.2%, and in January there was a sharp increase in unemployment benefit claims from 2.7 thousand to 28.6 thousand. The pound reacted with a noticeable decline.

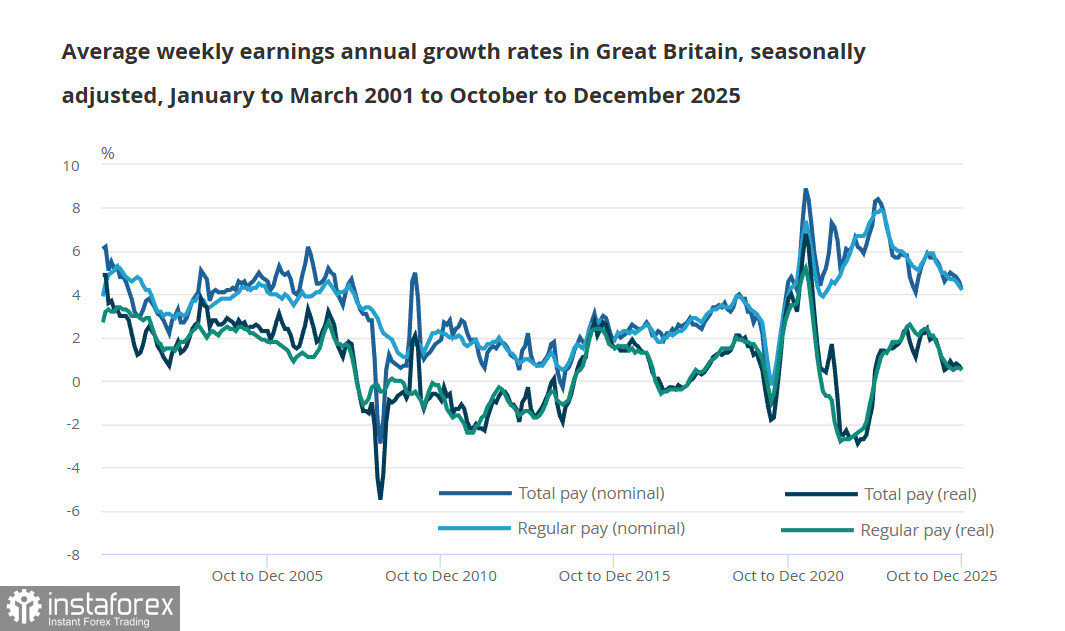

The pace of average wage growth slowed. While the decrease in wages excluding bonuses had been expected and matched forecasts (a decline from 4.4% year-over-year to 4.2%), the second indicator unexpectedly fell from 4.6% to 4.2%. This suggests that inflation in the UK may slow faster than previously anticipated.

The report reinforced the negative outlook for the overall state of the UK economy. Recall that data published last week showed a slowdown in GDP growth in the fourth quarter from 1.2% to 1.0%, as well as a decline in industrial production in December, whereas no change had been expected.

On Wednesday, the January inflation report will be released. Headline inflation is expected to slow from 3.4% year-over-year to 3.0%. If the data generally meet expectations — or especially if they come in lower — the conclusion that inflation may slow faster will receive further confirmation. This would force the Bank of England to adopt a more dovish stance. It is worth noting that at its last meeting, when the Bank of England left the rate unchanged at 3.75%, its forecasts for the labor market and GDP were downgraded. The market barely reacted at the time, as PMI indices were near three-year highs and traders needed additional signals. Now those signals have arrived, and the pound's bullish prospects have deteriorated noticeably.

It is still too early to expect key data from the United States, though the current week will be fairly eventful, with particular attention focused on Friday's release of the Personal Consumption Expenditures (PCE) price index. Both the UK and the US are showing similar trends — slowing inflation, weakening GDP growth, and soft labor market dynamics.

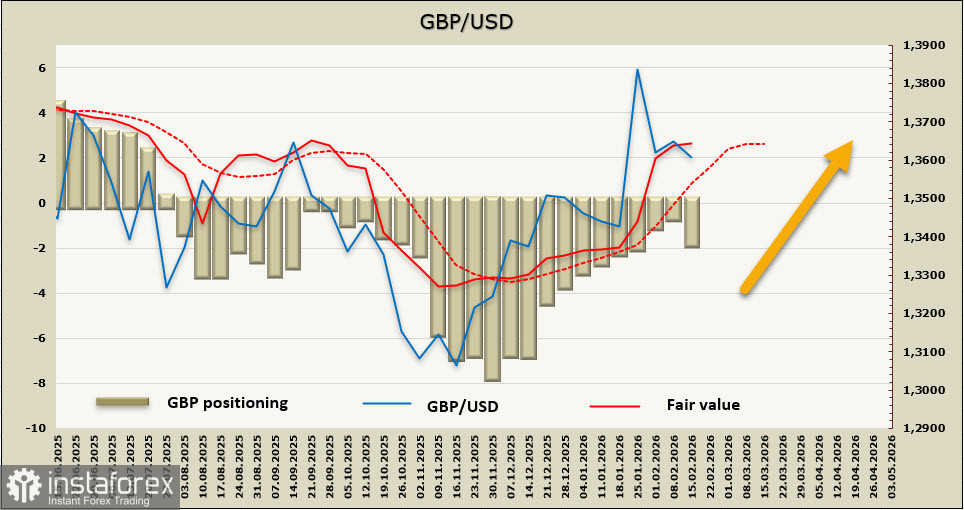

The net short position in GBP increased by 1 billion over the reporting week to -2.2 billion. Speculative positioning remains moderately bearish. The estimated price is above its long-term average, which provides grounds to expect continued growth, but momentum has weakened.

A week earlier, we expected that after completing consolidation the pound would resume its upward movement. However, weak labor market data have at least postponed this scenario. Support at 1.3540/65 has so far held. Taken together — weak labor market data and a dovish Bank of England stance — the pound now has fewer reasons to resume growth, though the dollar's prospects are not particularly strong either. We expect further consolidation and range trading. If there is another successful attempt to move below 1.3540/65, the technical picture will become more bearish, with the next target at support 1.3338. For bullish prospects to strengthen, the pound needs to return to the 1.3710/20 range, but for now there are no solid grounds for growth.