The USD/CAD pair continues to build on its recent rebound from the psychological level of 1.3500, reaching highs not seen in more than a week. Prices are holding just below the 1.3650 level as the pair attempts to break above the 20-day SMA. At the same time, bulls are showing caution ahead of fresh Canadian consumer inflation data. Canada's core Consumer Price Index (CPI) is expected to exceed the Bank of Canada's target and reach 2.4% year-over-year in January.

These key indicators will significantly influence expectations regarding the central bank's monetary policy, which in turn will play a decisive role in shaping the Canadian dollar's direction and providing momentum for USD/CAD. The Bank of Canada's neutral rhetoric is largely offset by rising oil prices, which support the currency, as the Canadian dollar is considered a commodity-linked currency.

The U.S. dollar is consolidating the previous day's moderate gains, supporting USD/CAD's upward momentum. However, bullish enthusiasm for the dollar is restrained by prospects of monetary easing by the Federal Reserve. Market participants have increased expectations of a Fed rate cut in June following weak U.S. consumer inflation data released last Friday. Market pricing currently implies at least two 25-basis-point Fed rate cuts in 2026.

These prospects, combined with concerns about the Fed's independence, are limiting the dollar's rally. Broader market optimism is also restraining the U.S. dollar's safe-haven appeal ahead of Wednesday's FOMC meeting minutes.

Additionally, Friday's U.S. Personal Consumption Expenditures (PCE) index will clarify the Fed's rate-cut plans and influence the dollar, which calls for caution among USD/CAD bulls.

From a technical standpoint, if the pair manages to break above the 20-day SMA, bulls may gain an opportunity for further growth. The nearest resistance level is 1.3650; a break above it would open the way toward the psychological 1.3700 level. If the pair fails to hold above the 9-day EMA, it may decline back toward the 1.3600 psychological level, followed by February's low.

With daily chart oscillators remaining in negative territory, it is difficult for bulls to regain control.

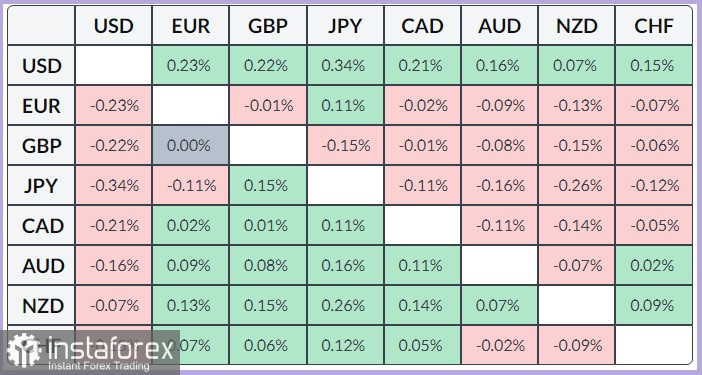

The table below shows the percentage change of the U.S. dollar against a basket of major currencies. Today, the U.S. dollar has shown the