Bitcoin declined yesterday to around $66,600 but has already returned to approximately $67,000 today. Ethereum remains below $2,000, which only increases short-term pressure on it.

As there hasn't been anything interesting happening in the cryptocurrency market, an intriguing interview with David Solomon, the CEO of Goldman Sachs, caught my eye, where he admitted for the first time that he owns Bitcoin. The head of the second-largest investment bank in the world surprised many with this statement. "I'm still trying to understand how Bitcoin works," Solomon said. "I have a very small amount of Bitcoin, very little, but I do have it."

His admission of not fully understanding the principles of such a significant digital asset as Bitcoin—from someone in such a high position—highlights the deep divide between the traditional financial system and the emerging crypto economy. At the same time, the mere fact that he holds Bitcoin, even in minimal amounts, indicates that even conservative financiers are cautiously exploring this new asset class, unwilling to remain on the sidelines of potential opportunities.

Solomon's statement, made against the backdrop of increasing interest in digital currencies and their gradual integration into the global financial system, reflects a broader trend. For many years, Solomon has supported blockchain technology but was less enthusiastic about cryptocurrencies. "I've always said that I consider this a speculative investment," he told CNBC in July 2024. At that time, he did not see practical applications for Bitcoin, but noted that it could possibly be used as a store of value. In January 2025, Solomon confirmed that Goldman Sachs could not hold Bitcoin or other crypto assets, be a primary investor in them, or participate in their management. However, yesterday, he indicated that the situation is beginning to change.

As for the intraday strategy in the cryptocurrency market, I will continue to act on any significant pullbacks in Bitcoin and Ethereum, anticipating the continued development of a long-term bullish market, which has not gone away.

For short-term trading, the strategy and conditions are described below.

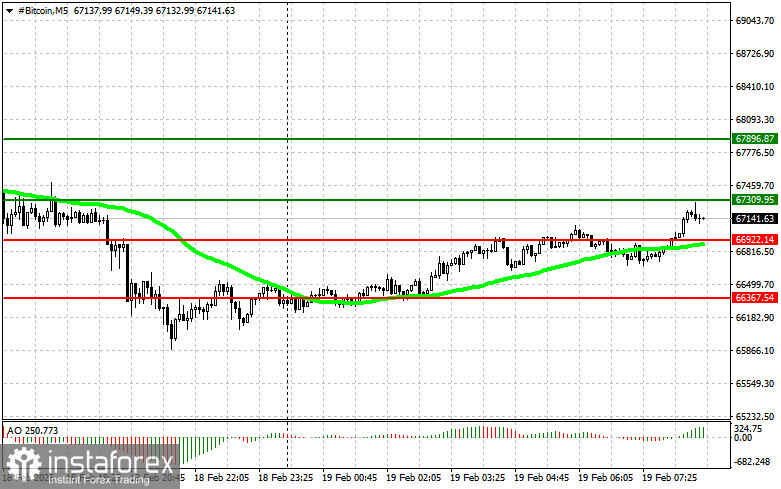

Bitcoin

Buy Scenario:

- Scenario 1: I will buy Bitcoin today upon reaching an entry point around $67,300, targeting a rise to $67,900. Near $67,900, I will exit the buy positions and sell immediately on a rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome indicator is above zero.

- Scenario 2: I can buy Bitcoin at the lower boundary of $66,900 if there is no market reaction to its breakout back to $67,300 and $67,900.

Sell Scenario:

- Scenario 1: I will sell Bitcoin today upon reaching an entry point around $66,900, targeting a decline to $66,300. Near $66,300, I will exit the sell positions and buy immediately on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome indicator is below zero.

- Scenario 2: I can sell Bitcoin at the upper boundary of $67,300 if there is no market reaction to its breakout back to $66,900 and $66,300.

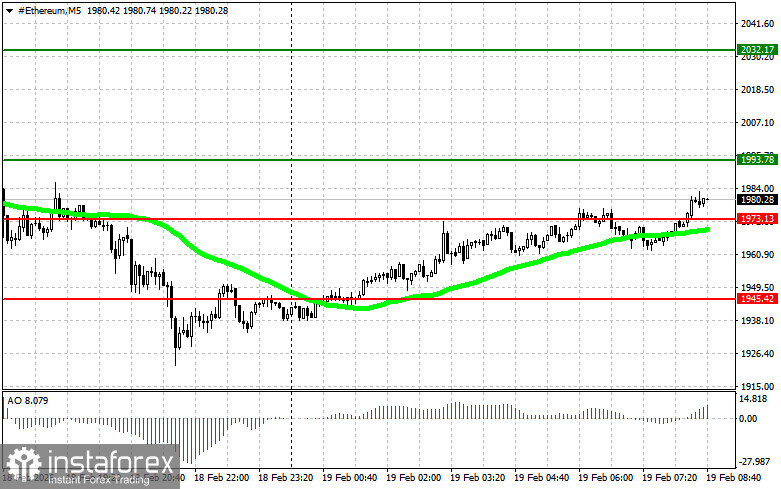

Ethereum

Buy Scenario:

- Scenario 1: I will buy Ethereum today upon reaching an entry point around $1,993, targeting a rise to $2,032. Near $2,032, I will exit the buy positions and sell immediately on a rebound. Before buying on a breakout, ensure that the 50-day moving average is below the current price, and the Awesome indicator is above zero.

- Scenario 2: I can buy Ethereum at the lower boundary of $1,973 if there is no market reaction to its breakout back to $1,993 and $2,032.

Sell Scenario:

- Scenario 1: I will sell Ethereum today upon reaching an entry point around $1,973, targeting a decline to $1,945. Near $1,945, I will exit the sell positions and buy immediately on a rebound. Before selling on a breakout, ensure that the 50-day moving average is above the current price, and the Awesome indicator is below zero.

- Scenario 2: I can sell Ethereum at the upper boundary of $1,993 if there is no market reaction to its breakout back to $1,973 and $1,945.