Bitcoin has remained firmly within the $65,000–$72,000 sideways channel over the past week. If last year we frequently observed a flat at the maximum values or near them, we are currently witnessing a flat at the minimum values. What does this technical phenomenon signify? It indicates that after another significant crash in the cryptocurrency market and "digital gold," there have been no new buyers at "favorable prices" for two weeks. Crypto news feeds are filled with headlines claiming Bitcoin will eventually be worth $1 million, while institutional investors continue to buy up all available coins. But the fact remains: Bitcoin is unable to recover and shows no signs of starting an upward trend.

Meanwhile, Donald Trump's son, Eric Trump, has once again confirmed that Bitcoin will grow over time and will eventually reach $1 million. Trump Jr. expressed deep optimism regarding "digital gold." He pointed out that over the last 10 years, Bitcoin has averaged 70% annual growth, urging skeptics to name an asset with higher returns. However, Mr. Trump did not mention that, year after year, Bitcoin's percentage growth has been decreasing, and last year ended with a decline.

Trump Jr. also noted that two years ago, Bitcoin was priced at $16,000 and is now at $70,000, to which one could respond by reminding the US president's son that six months ago, Bitcoin was valued at $126,000 and is now half that. Last year, Eric Trump predicted that Bitcoin would reach $175,000 by the end of the year, similar to the other army of crypto experts who have significant investments in Bitcoin and are therefore compelled to urge everyone to buy BTC, predicting great heights.

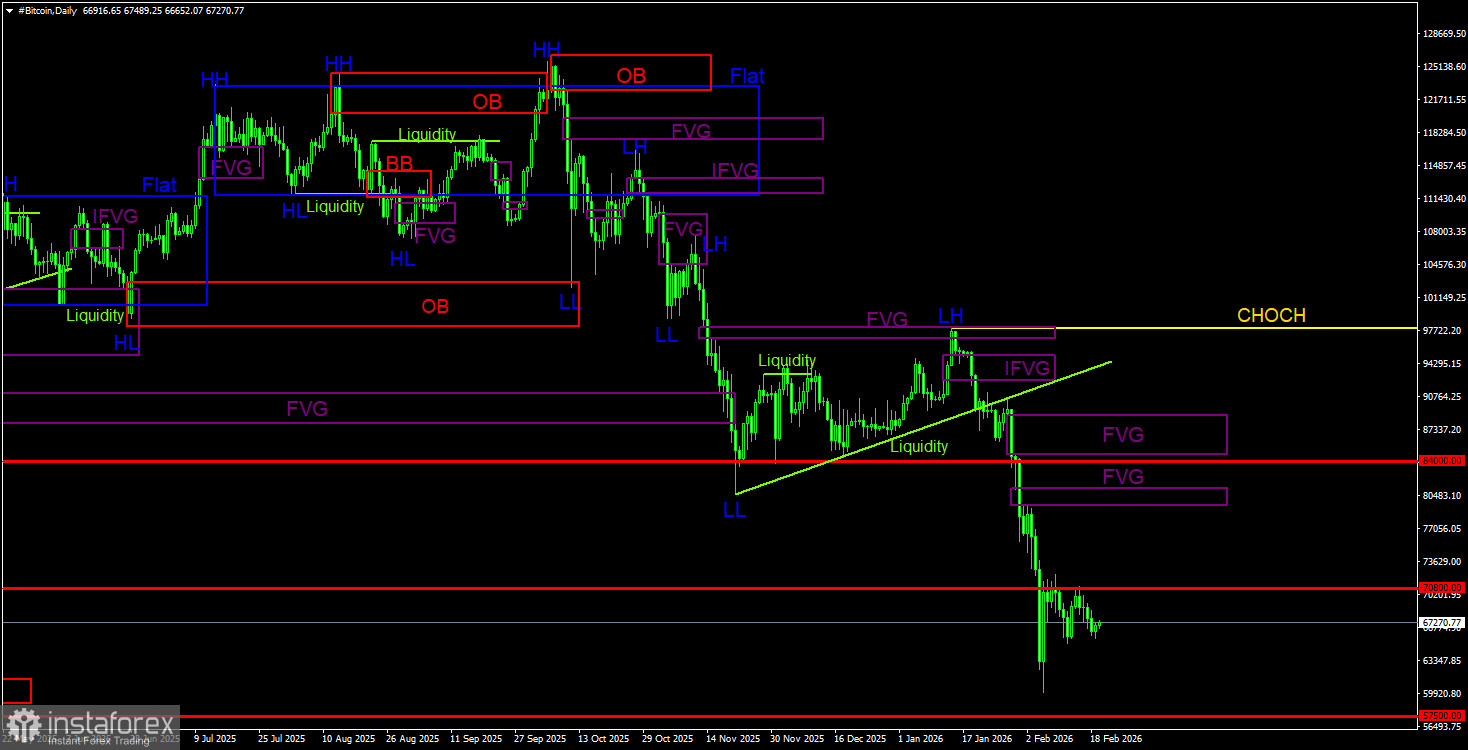

Overall Picture of BTC/USD on the Daily Timeframe

On the daily timeframe, Bitcoin continues to form a downward trend. The trend structure is bearish, with the CHOCH line currently at $97,900. Only above this level will it be considered that the downward trend has ended. Recall that a sell signal was generated within the "bearish" FVG ($96,900 – $98,000) and confirmed on a lower timeframe. As a result, traders had an excellent opportunity to capture almost the entire recent downward movement. The current target remains the level of $57,500 – the 61.8% Fibonacci. Given the lack of signs of a reversal, we believe the decline will continue. On the daily timeframe, the nearest area of POI for new sales is $79,500–$81,100, but Bitcoin still has to reach that level.

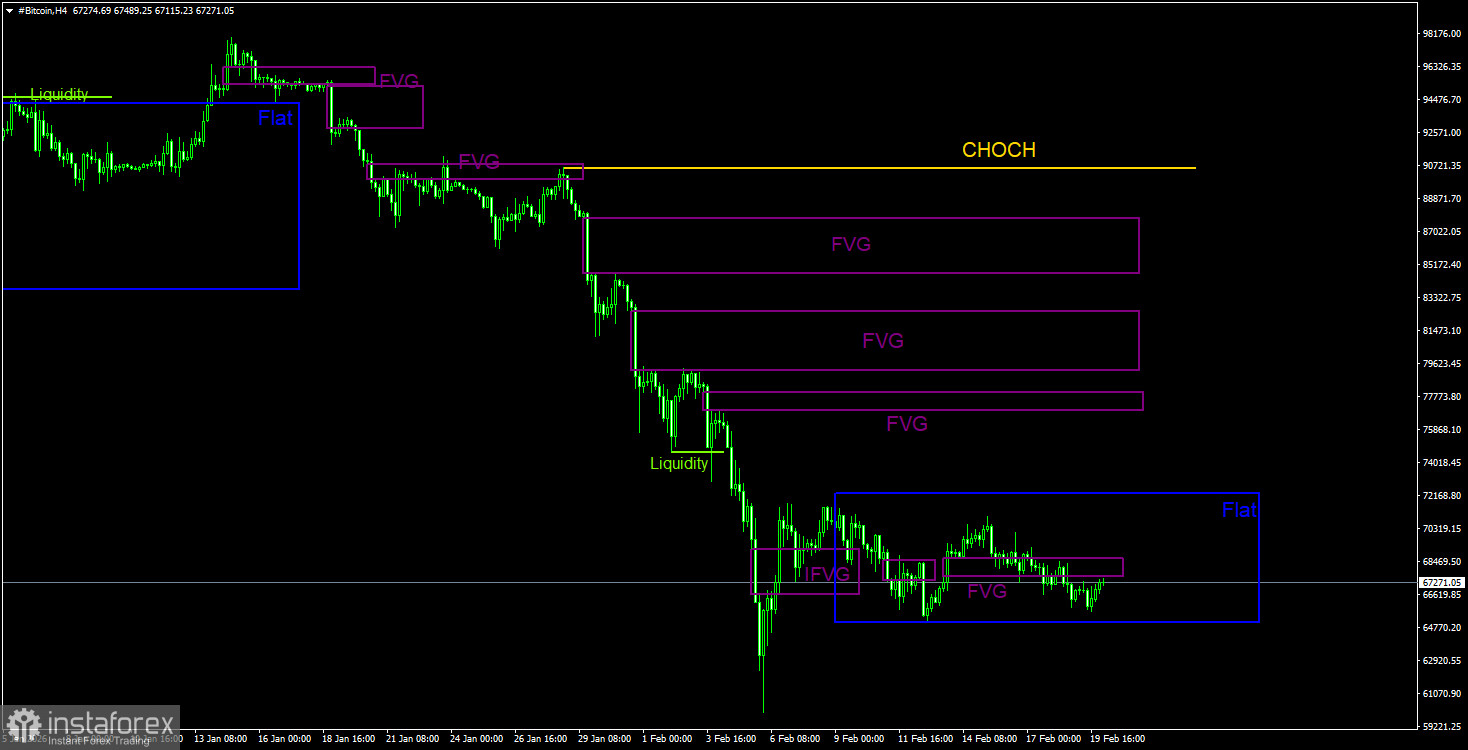

Overall Picture of BTC/USD on the 4H Timeframe

On the 4-hour timeframe, the price continues to form a downward structure. The CHOCH line is at $90,560—only above that level can we talk about a trend shift to the upside. However, there are currently no signs that Bitcoin's decline will end in the near future. All recent FVG patterns have not shown any significant reaction. We believe that a flat has formed at this time on the 4-hour timeframe. Therefore, trading positions can only be considered if deviations form.

Trading Recommendations for BTC/USD

Bitcoin continues to establish a full downward trend. We continue to expect a decline, targeting $57,500 (the 61.8% Fibonacci level of the three-year upward trend), and there are currently no signs of a trend reversal. Even the $57,500 level no longer seems like a terminal stop. Within the POI areas for selling on the daily timeframe, the last "bearish" FVG can be noted, which is still quite far for Bitcoin. On the 4-hour timeframe, there are three unaddressed bearish FVGs; however, these patterns belong to previous movement and are located much higher than the current price. They are unlikely to provoke a resumption of the trend.

Explanations for Illustrations:

- CHOCH: Change of character in trend structure.

- Liquidity: Stop-loss orders from traders that market makers use to build their positions.

- FVG: Fair Value Gap - an area of price inefficiency. The price moves through these areas very quickly, indicating a complete absence of one side in the market. Subsequently, the price tends to return and react to these areas.

- IFVG: Inverted Fair Value Gap - after returning to this area, the price does not react to it and breaks through impulsively, then tests it from the other side.

- OB: Order Block - the candle on which the market maker opened a position to gather liquidity for forming their position in the opposite direction.