The US dollar continued to strengthen against the euro, the pound, and other risk assets, driven by objective factors.

Yesterday, the euro continued its decline against the dollar, a consequence of positive US labor market data, particularly the unemployment claims report. A similar narrative unfolded for the British pound. This report, released amid the broader recovery of the US economy, indicated employment resilience and a low number of initial unemployment claims, which typically signals a positive outlook for the US dollar.

However, upcoming macroeconomic indicators from both the US and the Eurozone will play a more significant role, as they may either confirm or adjust current trends. In the first half of the day, key indicators reflecting business activity in the region are expected to be published: the manufacturing purchasing managers' index (PMI), the services PMI, and the composite PMI for the Eurozone for February. These figures serve as a barometer of economic activity and business sentiment, significantly shaping currency pair dynamics and market expectations.

As for the British pound, volatility is likely to surge as traders monitor any signs of a slowdown in the British economy. Weak data on retail sales or production could signal further selling pressure. However, the most critical indicator will be the UK services PMI. If the PMI Services index shows unexpectedly strong growth, it could serve as a lifeline for the pound. Strong performance in services, which includes finance, tourism, and other vital sectors, would indicate economic resilience despite potential weaknesses in other areas. In that case, the pound might not only stabilize but also show a slight rebound, easing traders' concerns.

If the data aligns with economists' expectations, it would be better to act based on the Mean Reversion strategy. If the data is significantly higher or lower than economists' expectations, the Momentum strategy would be most appropriate.

Momentum Strategy (Breakout):

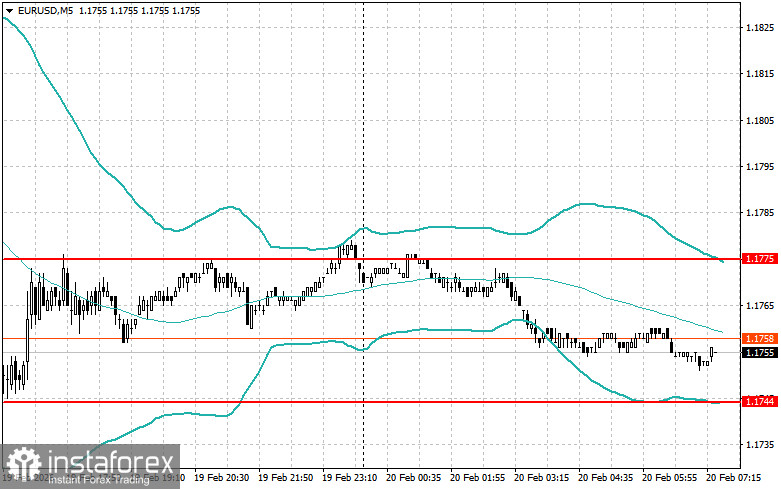

For the EUR/USD Pair

- Buy on a breakout of 1.1767, which could lead to a rise in the euro to around 1.1790 and 1.1810;

- Sell on a breakout of 1.1745, which could lead to a decrease in the euro to around 1.1719 and 1.1697;

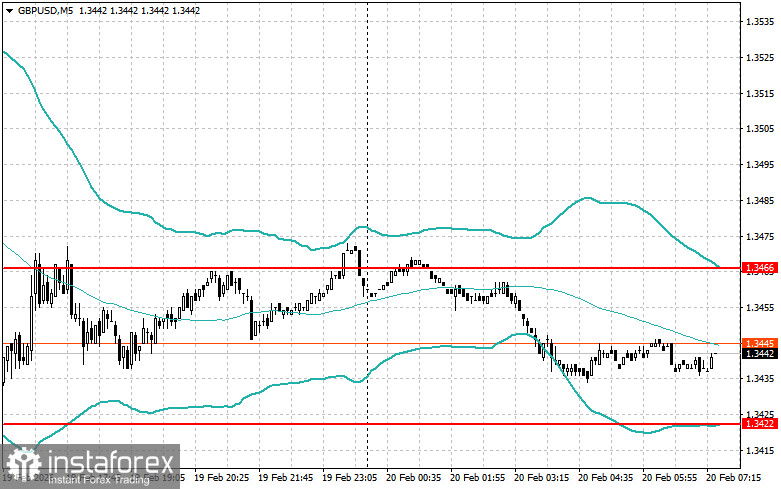

For the GBP/USD Pair

- Buy on a breakout of 1.3460, which could lead to a rise in the pound to around 1.3489 and 1.3515;

- Sell on a breakout of 1.3432, which could lead to a decrease in the pound to around 1.3409 and 1.3384;

For the USD/JPY Pair

- Buy on a breakout of 155.35, which could lead to a rise in the dollar to around 155.67 and 156.07;

- Sell on a breakout of 154.95, which could lead to a decline in the dollar to around 154.65 and 154.35;

Mean Reversion Strategy (Retracement):

For the EUR/USD Pair

- Look for short positions after a failed breakout above 1.1775 on a retracement below this level;

- Look for long positions after a failed breakout below 1.1744 on a retracement back to this level;

For the GBP/USD Pair

- Look for shorts after a failed breakout above 1.3466 on a retracement below this level;

- Look for longs after a failed breakout below 1.3422 on a retracement back to this level;

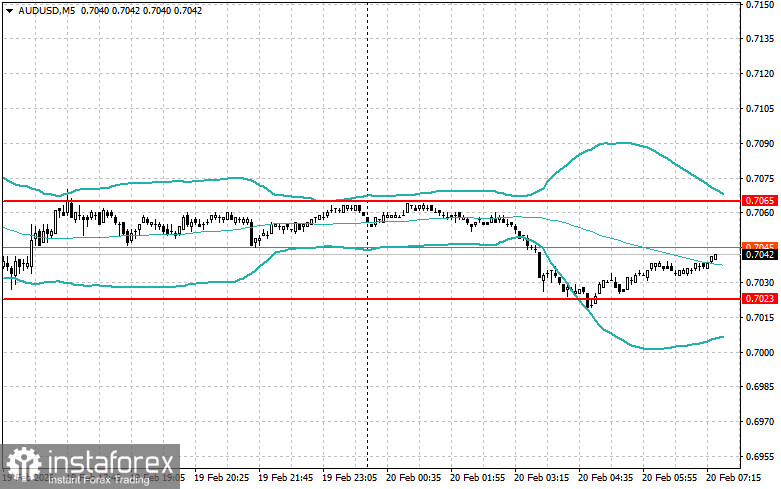

For the AUD/USD Pair

- Look for shorts after a failed breakout above 0.7065 on a retracement below this level;

- Look for longs after a failed breakout below 0.7023 on a retracement back to this level;

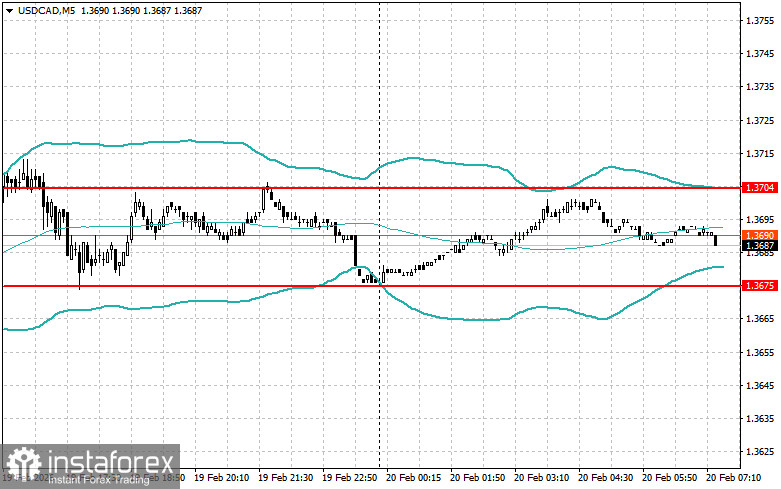

For the USD/CAD Pair

- Look for shorts after a failed breakout above 1.3704 on a retracement below this level;

- Look for longs after a failed breakout below 1.3675 on a retracement back to this level;