Trading plan for 08/02/2017:

Wednesday's a slow day for economic releases, but there still are two important news releases that will catch the attention of the global investors: the Crude Oil Inventories data and The Reserve Bank of New Zealand interest rate decision.

03:30 pm GMT - Crude Oil Inventories

The actual inventories of crude oil, gasoline, and distillate, such as jet fuel, as reported on a weekly basis will be watched closely by energy and commodity traders. The market participants expect a decrease from 6,466k barrels from last week to 2,700k barrels for this week. In January 2017, the OPEC and non-OPEC countries have agreed to cut the oil supply, so the stockpiles might be increasing slowly. The good example is the latest weekly American Petroleum Institute (API) inventory report for the week ending February 3rd. The API reported 142,300k barrel build in inventories and the second largest build on record. This followed a build 5,800k barrels last week and was substantially higher than consensus forecasts of a build near 2,500k barrels for the week.

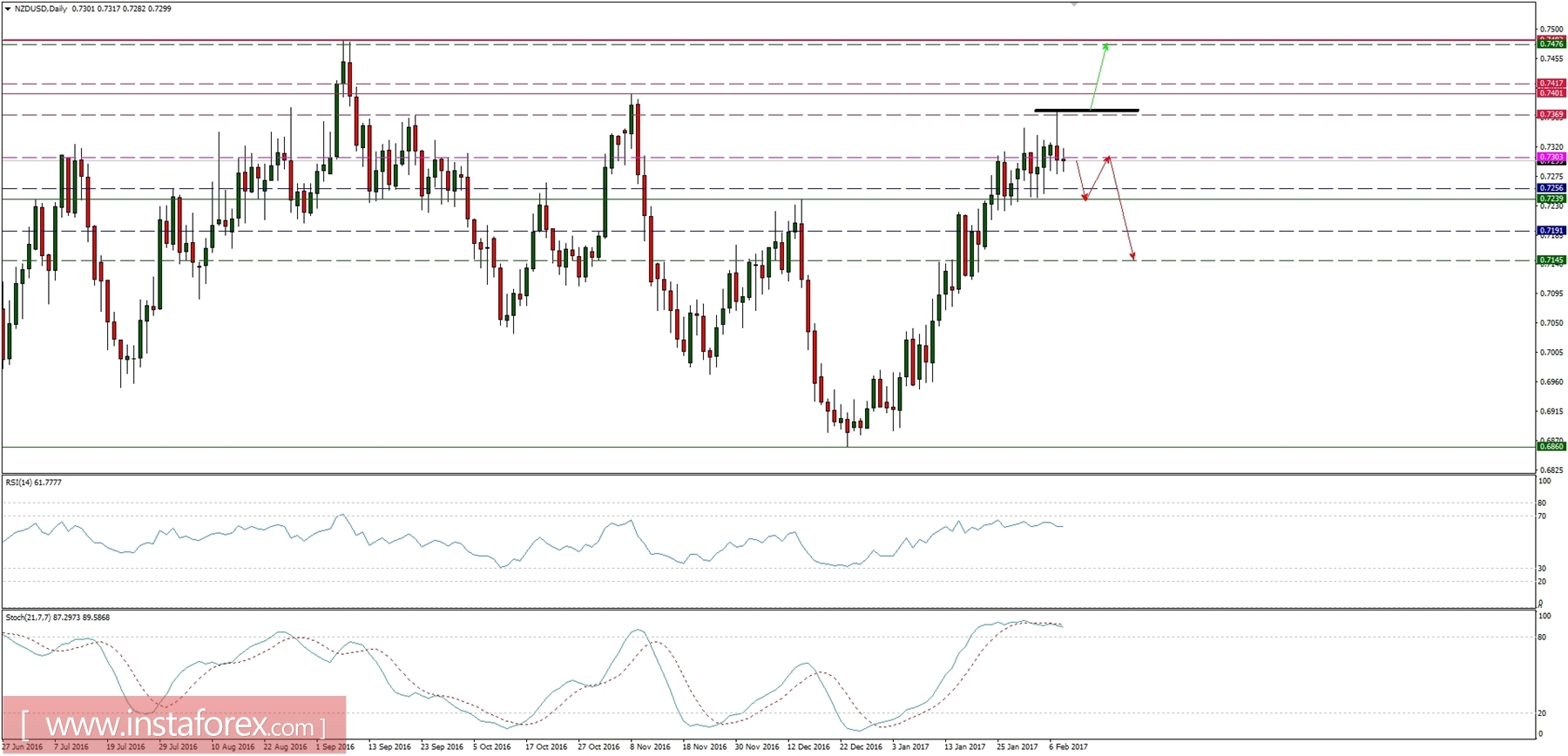

Let's take a look at the Crude Oil technical picture at H1 time frame to plan how to trade this news event. The market is clearly oversold as the stochastic oscillator is just bouncing from the 20-30 area. If the inventories data will be lower than expected 2,700k barrels, then bulls might take control of this market and push the price higher toward the next intraday resistance at the level of 52.29 and 52.90 (green arrows scenario). However, if the inventory data will be bigger than expected 2,700k barrels, then the price might fall again toward the technical support at the level of 50.99 (red arrows scenario)

08:00 pm GMT - New Zealand Official Cash Rate, and Press Conference

09:00 pm GMT - The Reserve Bank of New Zealand (RBNZ) Statement

10:00 pm GMT - The Reserve Bank of New Zealand (RBNZ) Press Conference

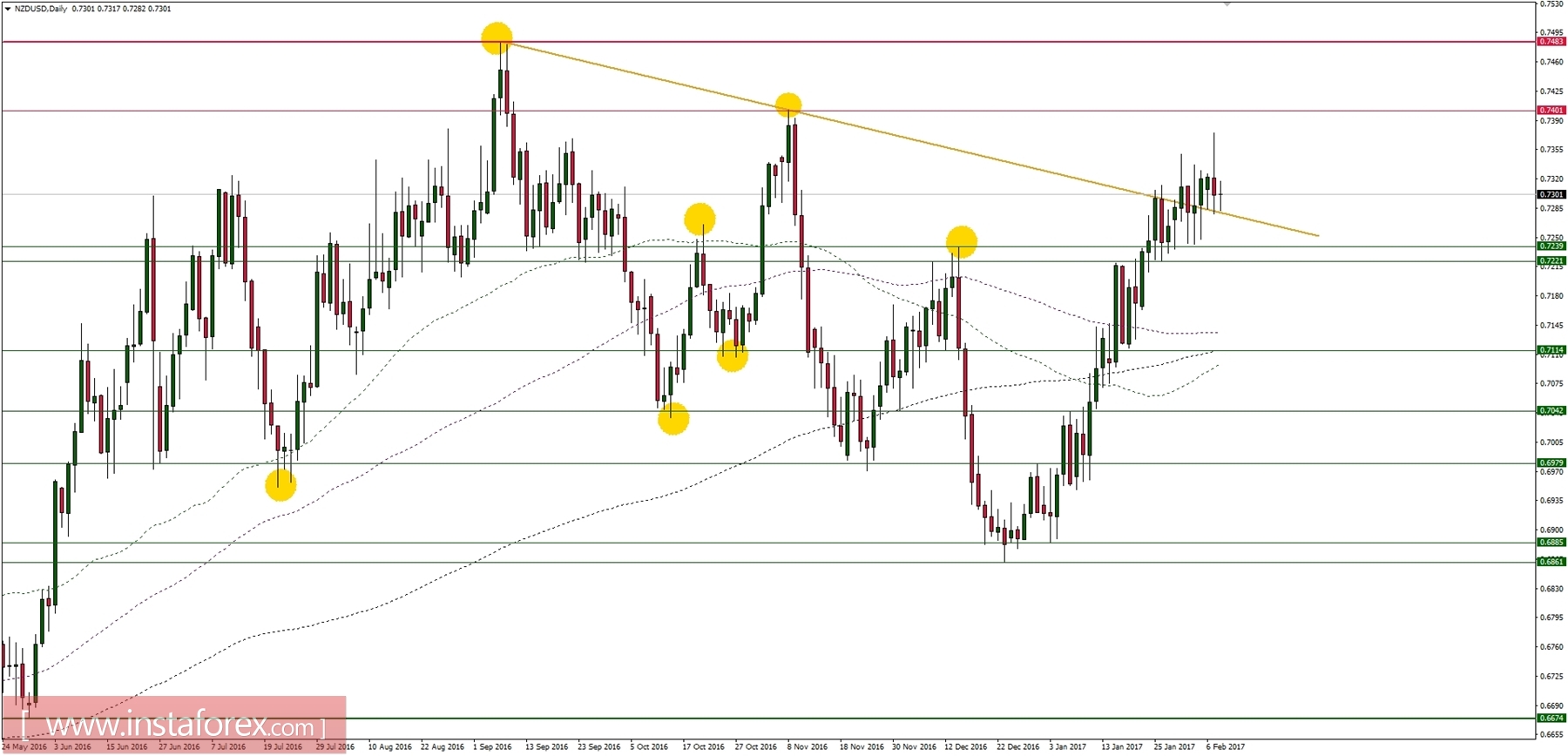

An important event to keep an eye on from New Zealand as the Reserve Bank of New Zealand is releasing his decision regarding the interest rate. The market participants expect the interest rate to be left unchanged at the level of 1.75%, but the next very important thing is the RBNZ statement and press conference. The global investors will be looking for a hints regarding a possible further interest rate hike/cut and inflation expectations. The robust New Zealand economy could trigger a rate hike in the future, but on the other hand, they do not want a stronger exchange rate to dampen the economy too quickly. Any hint about future moves this year will heavily impact the NZD.

There are two scenarios that we could take into consideration to plan the trade ahead of the news event. In a case of leaving the interest rate unchanged, the market will react with a sell-off from the current levels around the weekly pivot. The intraday support at the level of 0.7239 might be immediately tested and will likely be violated (red arrows scenario). This scenario is being supported by the overbought conditions in this market indicated by a slow stochastic oscillator and multiple bearish divergences indicated by the diminishing RSI momentum. The second scenario includes a possibility of a rate hike or cut, but the reaction here is more difficult to anticipate. Generally, if the interest rate is cut, the market should decrease, just as in the previous scenario. So, the only risk to the upside is when the RBNZ will hike the interest rate (which will be a huge surprise for the market) and then the price should spike higher toward the next resistance at the level of 0.7401 and even 0.7477 (green arrows scenario).