Overview:

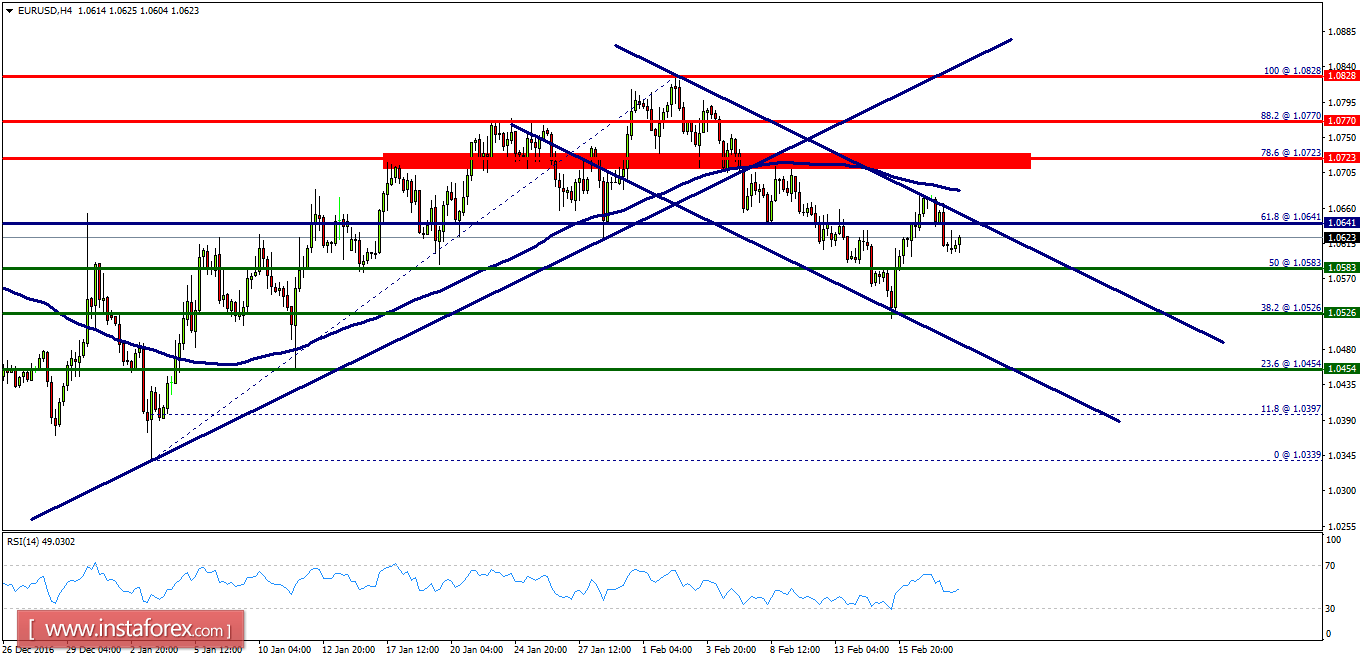

- The EUR/USD pair continues to move downwards from the level of 1.0723.

- The pair dropped from the level of 1.0723 (this level of 1.0723 coincides with the ratio of 78.6% Fibonacci retracement) to the bottom around 1.0641.

- This week, the first resistance level is seen at 1.0723 followed by 1.0828 (the double top), while daily support 1 is found at 1.0583.

- Also, the level of 1.0641 represents a weekly pivot point for that it is acting as a major level this week. Amid the previous events, the pair is still in a downtrend, because the EUR/USD pair is trading in a bearish trend from the new resistance line of 1.0723 towards the first key level at 1.0641 in order to test it.

- If the pair succeeds to pass through the level of 1.0641, the market will indicate a bearish opportunity below the level of 1.0641 with the targets of 1.0583 and 1.0526.

- On the other hand, if a breakout happens at the resistance level of 1.0723, then this scenario may be invalidated.