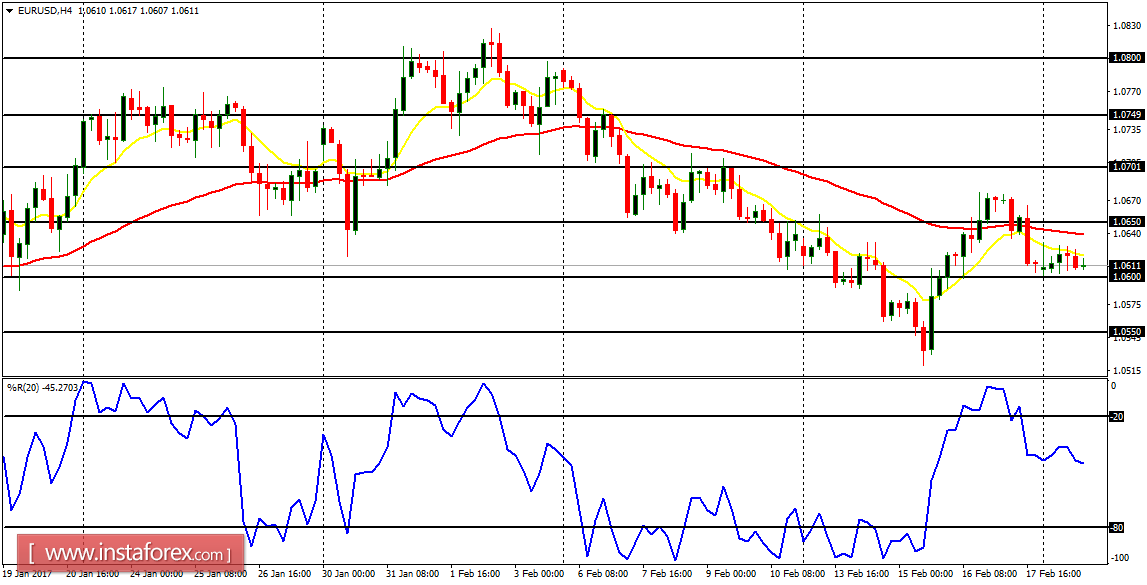

EUR/USD: This pair did nothing significant on Monday: It only moved sideways in the context of a bearish outlook. Some considerable movement might occur this week, but it may not be as significant as what we would see next week. Further bearish movement is expected in the market, as price targets the support lines at 1.0600, 1.0550 and 1.0500.

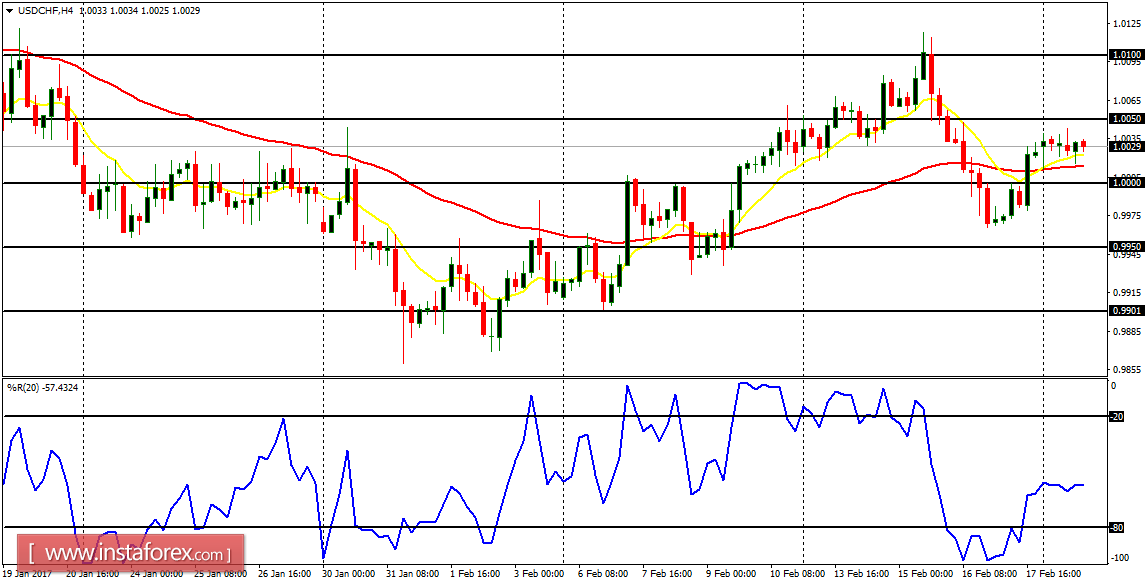

USD/CHF: Here, it can be seen that the psychological level at 1.0000 has become insignificant because price just goes above and below it at will, while the level offers little resistance to that play. Price went below the level at 1.0000 on Thursday and then went above it on Friday. One would need to wait to see what price would do today.

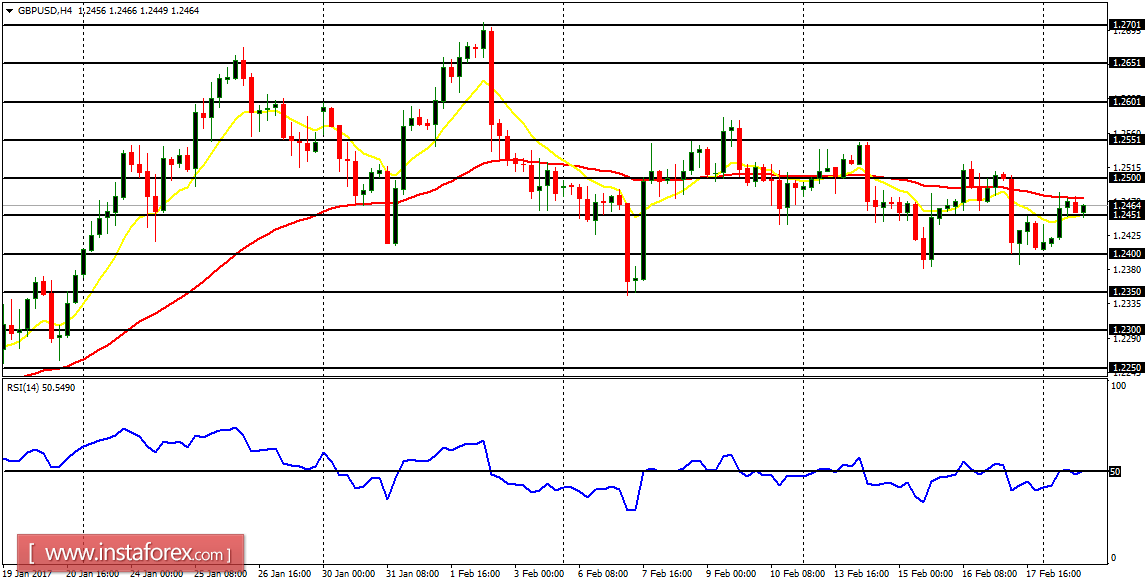

GBP/USD: The GBP/USD moved sideways throughout last week (plus Monday). However, there would soon be a serious breakout in the market, which would most probably push it to the downside, as the outlook on GBP pairs remains bearish for February. Bullish attempts should be approached with caution here.

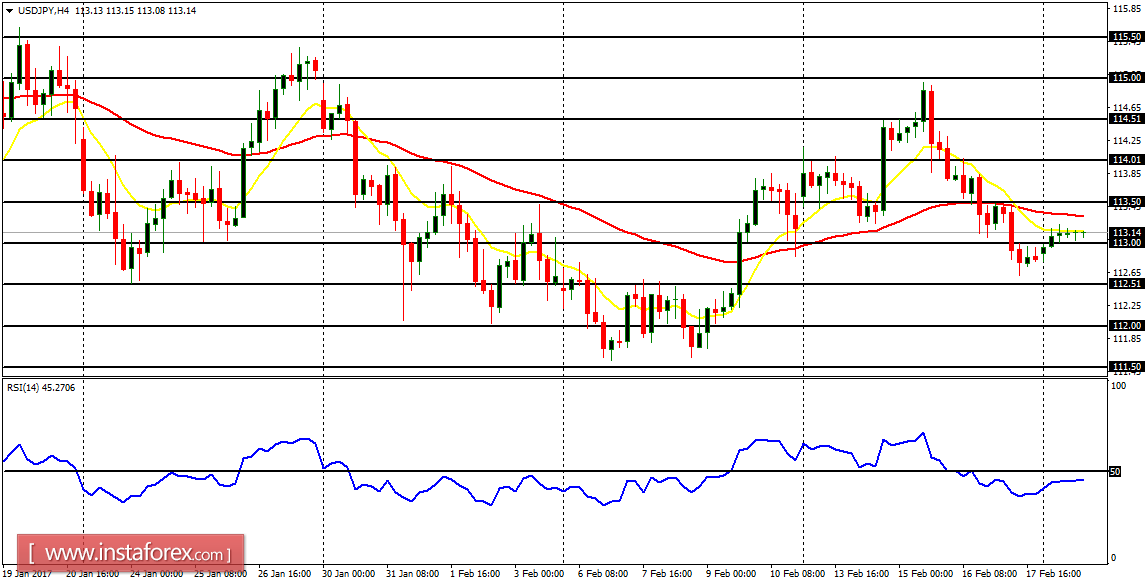

USD/JPY: This currency trading instrument simply went flat yesterday, and the position of the market is currently dicey. The bias is not very bullish or very bearish (at least in the short-term). It is OK to wait for price to assume a protracted directional movement, which would most probably be in favor of bulls in the long run.

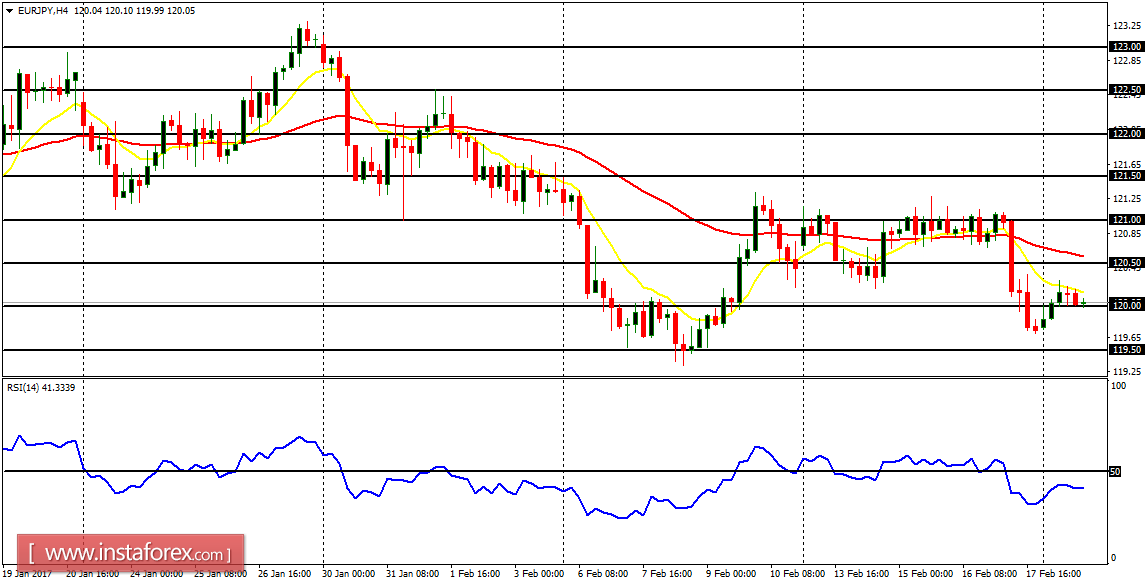

EUR/JPY: This cross pair also did nothing significant on February 20, 2017. The near-term bias is bearish, and there is likelihood that price could go further downwards today or tomorrow, reaching the demand zones at 119.50 and 119.00. As it has often been mentioned, this does not rule out the possibility of a strong pullback that may occur very soon.