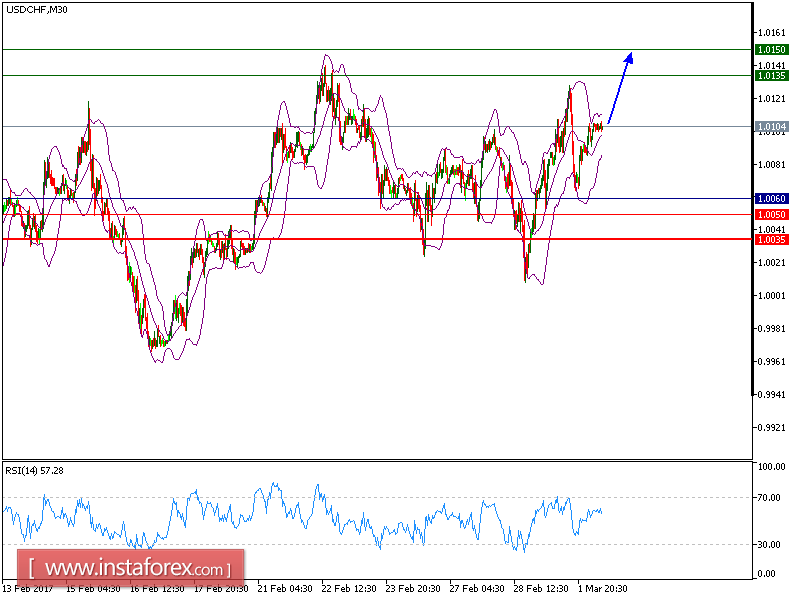

USD/CHF is expected to trade with bullish bias above 1.0060. The pair is trading above the key support level at 1.0060 which should limit the downside potential. The relative strength index is mixed to bullish. Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

On the economic data front, MBA Mortgage applications were up 5.8% in the week ended February 24th, a strong improvement from the decline of 2.0% in the prior week. Separately, personal income improved 0.4% (estimated 0.3%) in January, an increase from 0.3% in December. Personal spending rose 0.2% (estimated 0.3%) in January compared with an improvement of 0.5% in the previous month. PCE core MoM advanced 0.3% in-line with estimates and an improvement from the 0.1% in the prior month. In other news, Markit US Manufacturing PMI slightly decreased to 54.2 in a final estimate in February (estimated 54.5) from 54.3 in a preliminary estimate and 55 in January. ISM Manufacturing rose to 57.7 in February (estimate 56.2) compared with 56.0 in the month prior. Recently, construction spending MoM fell 1.0% in January (estimated +0.6%) in comparison to a rise of 0.1% in December. The Federal Reserve unveiled its Beige Book stating an acceleration of manufacturing activity since the beginning of the year as well as a moderate growth in the economy, lifted by gains in consumer spending.

To conclude, as long as 1.0060 is not broken, expect a further rebound to 1.0050 and even to 1.0035 in extension.

Resistance levels: 1.0135, 1.0150, and 1.0180

Support levels: 1.0050, 1.0035, and 1.000