EURGBP had been in a dilemma since the start of the week before the BoE official rate was announced today. Some rumors did not came true, the Bank of England did not change its official bank rate and it is the same as previous at 0.25%. Along with the official bank rate, GBP Asset Purchase Facility report was also published unchanged at 435B. Though EUR had Final CPI reports published today, which was also unchanged at 2.0%, the events favored GBP as the most important bank rate was unchanged or had no negative impact on the currency after the Fed's funds rate was increased from 0.75% to 1% at last night FOMC Meeting. So GBP is said to gain ground against EUR in the coming days.

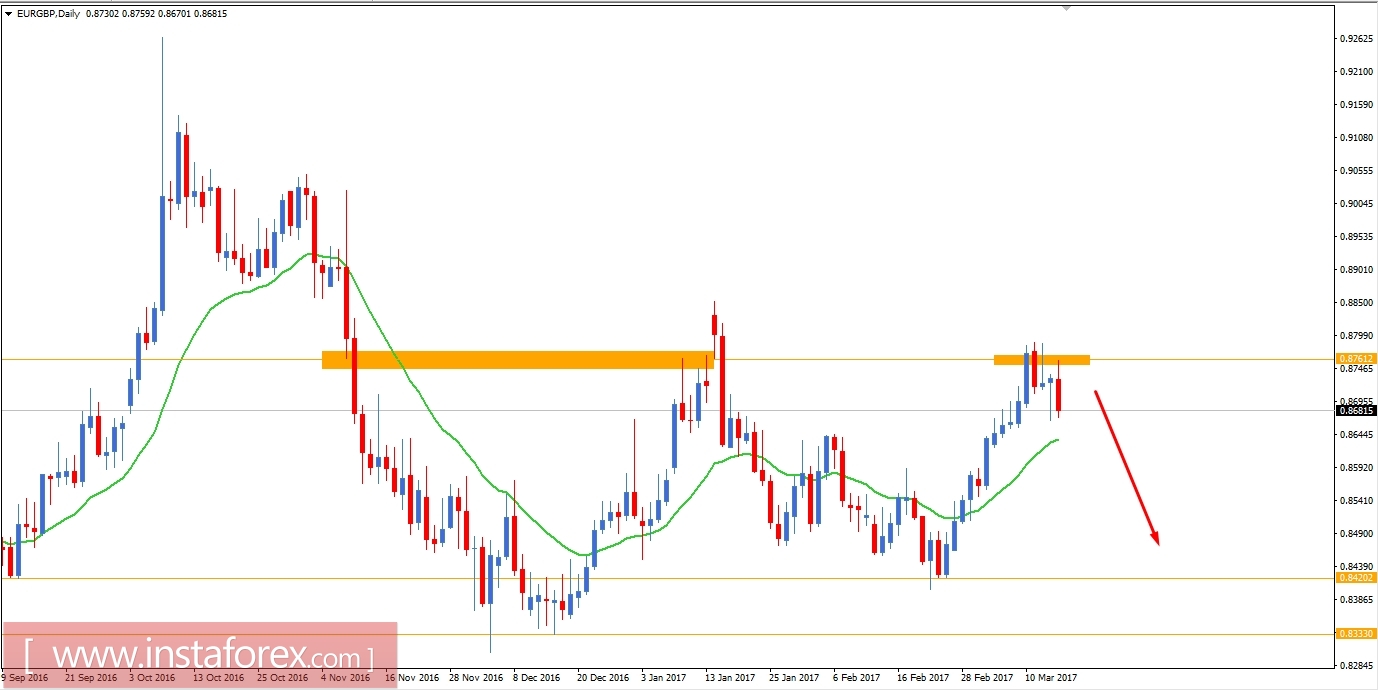

Now let us look at the technical view. The price has bounced off from the most important event level of 0.8761 today. The bearish engulfing pressure today did engulf the last 2 days of price action, and it is expected that the price is going to move lower towards the next support at 0.8420 in the coming days. As the market is inside a large corrective structure, a good amount of volatility is expected before the price moves down to the upcoming support.