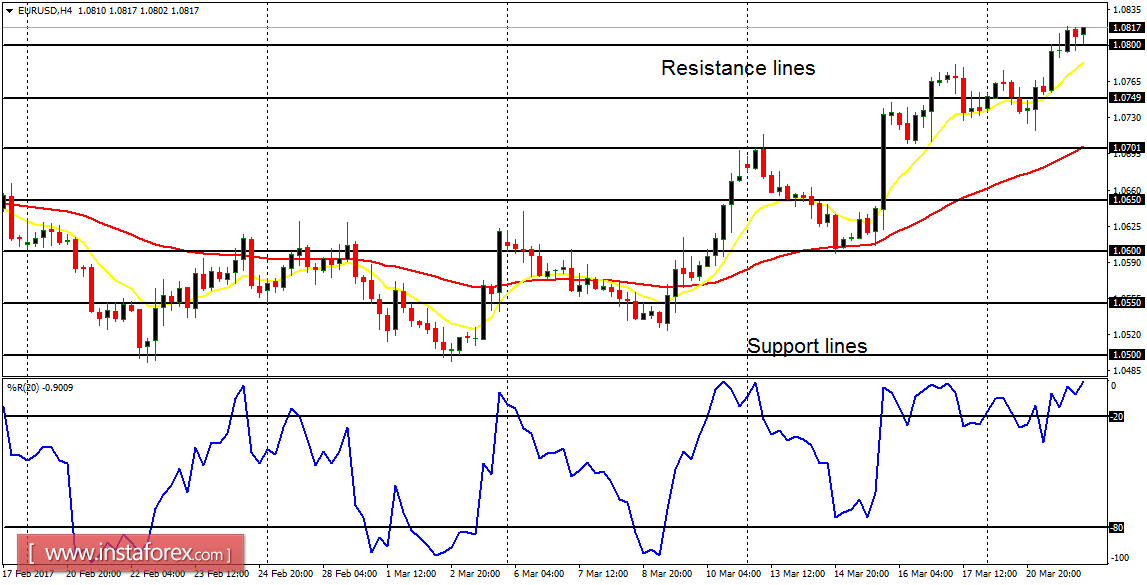

EUR/USD: This currency trading instrument has been going upwards since the beginning of this week; in continuation of the bullishness that began last week. Price is currently above the support line at 1.0800, going towards the resistance lines at 1.0850 and 1.0900. Since the initial targets for this week have already been exceeded, the aforementioned resistance lines are the next targets.

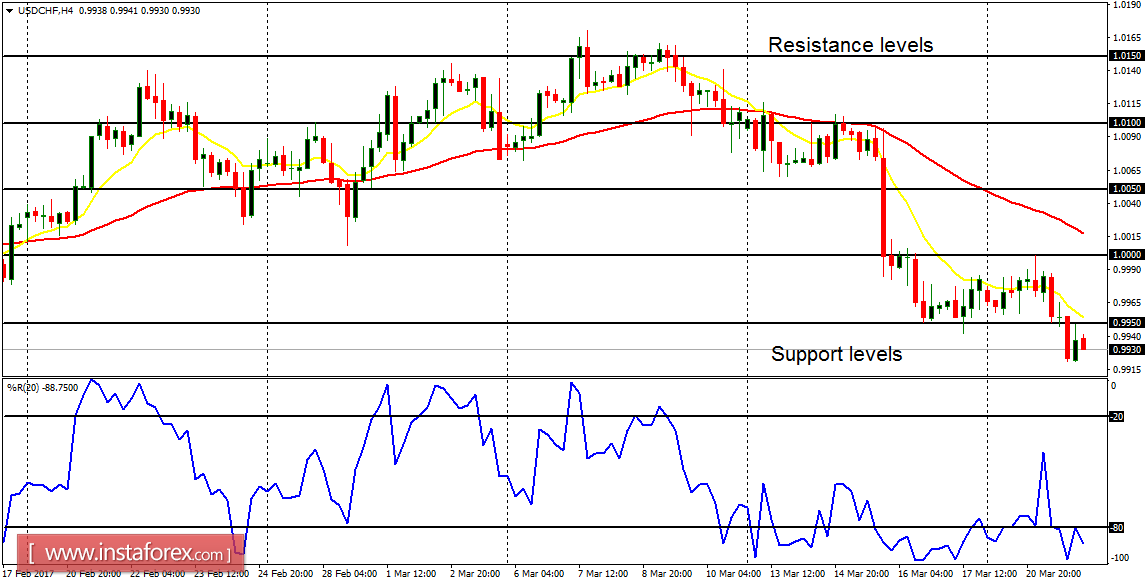

USD/CHF: This pair would be going downwards as long as the EUR/USD is going upwards. The EMA 11 is below the EMA 56, and the Williams' % Range period 20 is in the oversold region. Further bearish movement is thus rational, which would make price reach the support levels at 0.9900 and 0.9850. Price is currently below the resistance level at 0.9950.

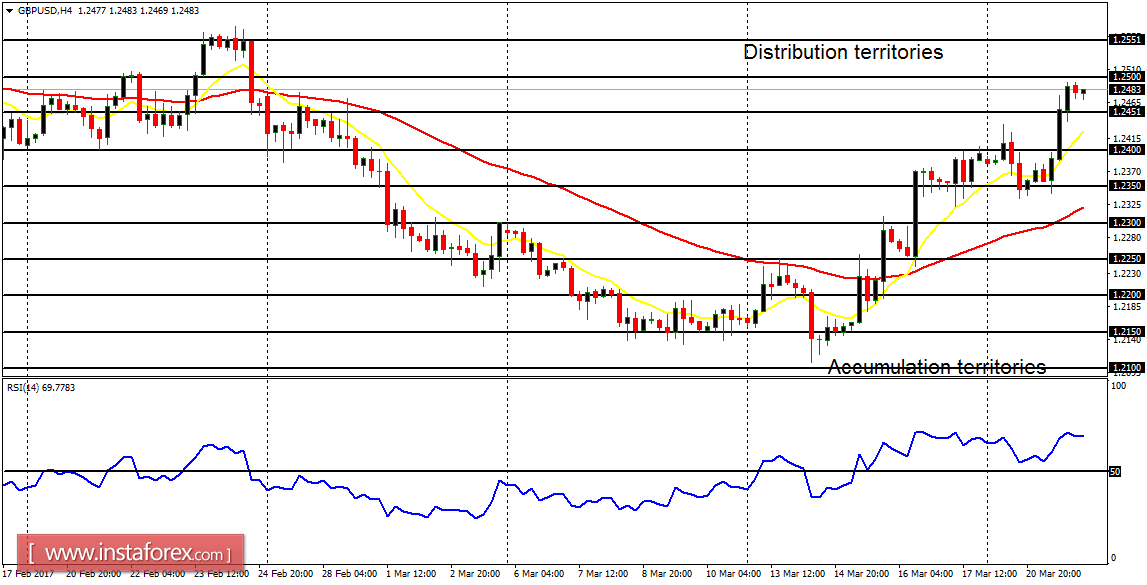

GBP/USD: There is a bullish signal on the GBP/USD, which has been in place since last week. Price may go further upwards to reach the distribution territories at 1.2500, 1.2550 and 1.2600. These are the targets for the remaining of this week.

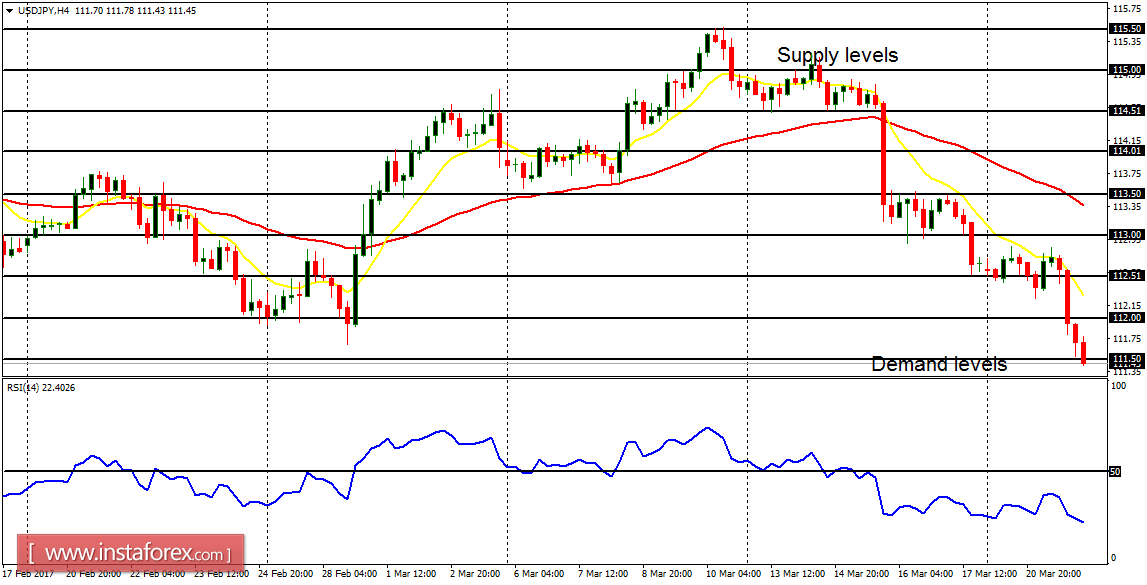

USD/JPY: This pair has come down by 100 pips this week, testing the demand level at 111.50. There is a strong Bearish Confirmation Pattern in the 4-hour chart, and since there is some selling pressure in the market, the price may eventually reach the demand levels at 111.00, 110.50 and 110.00 before the end of this week.

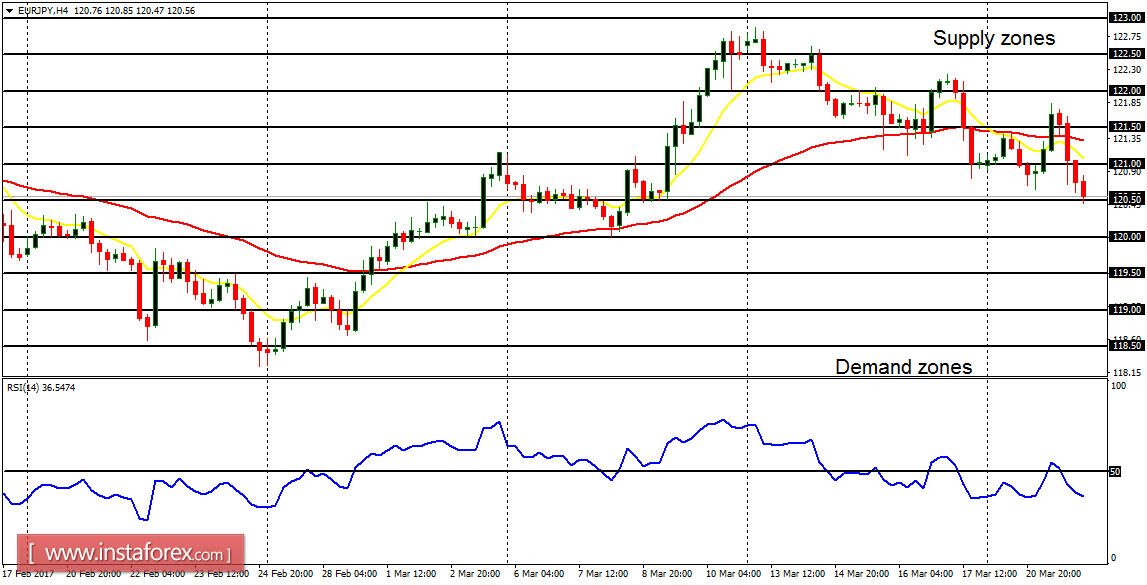

EUR/JPY: There is a short-term bearish signal on the EUR/JPY. Price went down yesterday and it is now under the supply zone at 121.00, going towards the demand zone at 120.50 (even almost reaching it). The EMA 11 is below the EMA 56, and the RSI period 14 is below the level 50 (a bearish outlook). There is a possibility that the demand zones at 120.00 and 119.50 would be tested this week.