Global macro overview for 23/03/2017:

The Reserve Bank of New Zealand maintained its Official Cash Rate (OCR) at the level of 1.75% as expected. Interest rates were last reduced from 2.00% to 1.75% at the November 2016 meeting. In the policy statement released after the decision, the RBNZ said that monetary policy will remain accommodative for a considerable period. Moreover, RBNZ added that numerous uncertainties remain, particularly in respect of the international outlook and policy may need to adjust accordingly. The 2016 Q4 growth was weaker than expected, but the RBNZ attributed it to temporary factors and the overall growth outlook remains positive. The inflation target is still in the range between the levels of 1-3% and it might vary during the year, mainly due to one-off effects from food and import price movements. In conclusion, the RBNZ is more comfortable with the inflation which gives the bank the possibility to maintain a neutral policy for now and await both domestic and global developments.

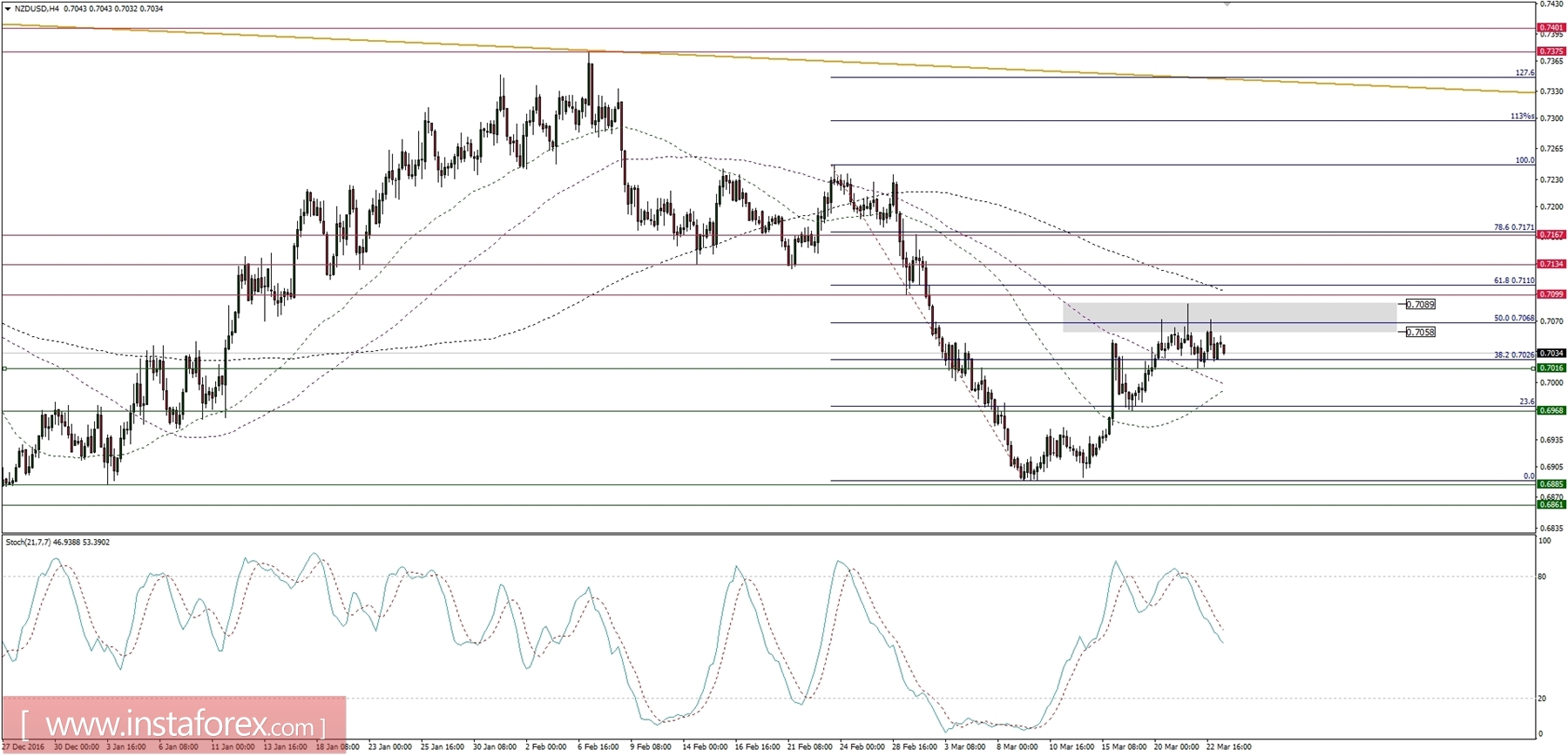

Let's now take a look at the NZD/USD technical picture at the H4 time frame. The market response to the news was muted and the price is still trading below the 50%Fibo at the level of 0.7068. The gray rectangle zone is the supply zone that is needed to be violated in order for a market to rally. Nevertheless, the lack of an initial response to the data and clear bearish divergence indicate that the price might fall towards the next technical support at the level of 0.7016 before it will be able to make any new highs.