Overview:

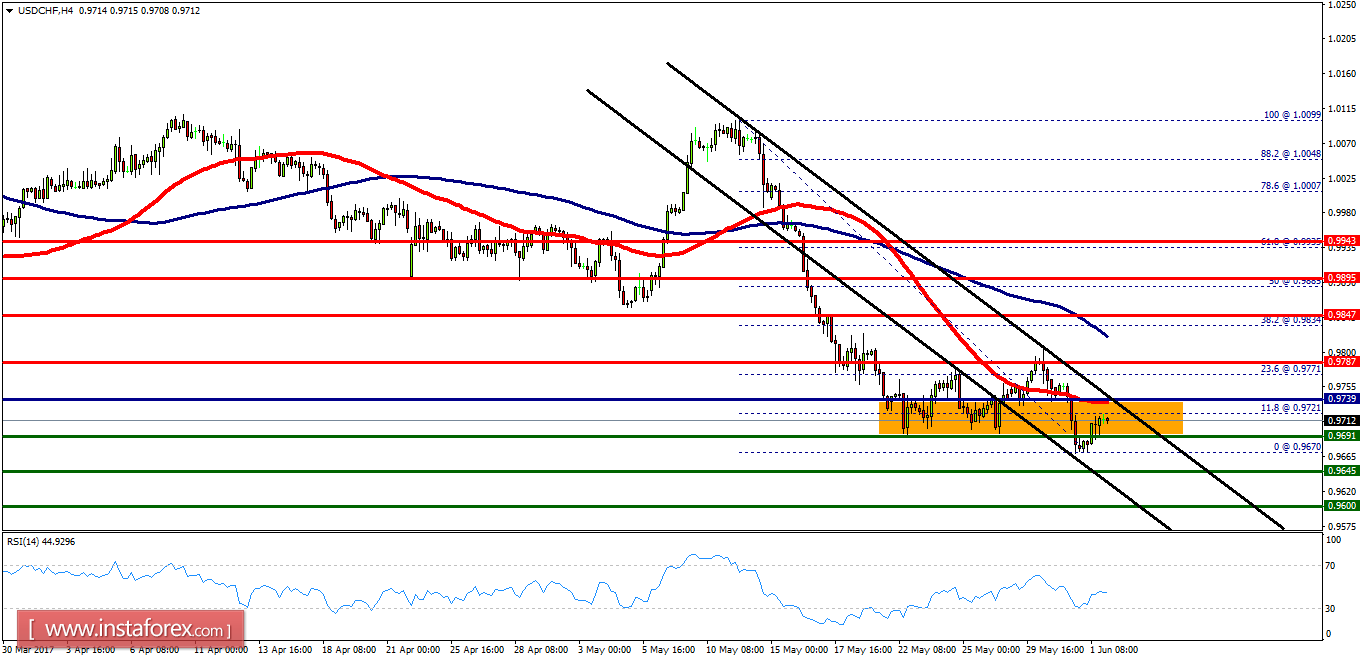

- The USD/CHF pair is still indicating a strong bearish market from the spot of 0.9739. The bias remains bearish in the nearest term testing 0.9691 or 0.9645.

- The first resistance level is seen at 0.9787 followed by 0.9739, while daily support 1 is seen at 0.9691.

- The USD/CHF pair broke support which turned into strong resistance at 0.9787. The market is still set to trade around the daily pivot point of 0.9739.

- It continued to move downwards from the level of 0.9787 to the bottom around 0.9739. The pair is trading below this level. It is likely to trade in a lower range as long as it remains below the resistance of 0.9787 which is expected to act as major resistance.

- According to the previous events, the USD/CHF pair is still moving between the levels of 0.9787 and 0.9645.

- Consequently, the major resistance can be found at 0.9787 providing a clear signal to sell with a target seen at 0.9691. If the trend breaks the minor support at 0.9691, the pair will move downwards continuing the bearish trend development to the level of 0.9645 and 0.9600.

- The bearish scenario which suggests that the pair will stay below the spot of 0.9787. Hence, the stop loss should be placed at the price of 0.9820.