EUR/JPY shown a good amount of impulsive bullish pressure after breaking above the corrective structure resistance of 125.80. After hawkish Draghi's speech, EUR has eventually got a boost to break above the corrective structure and proceed further upwards. Last week, a good amount of volatility struck the market and an upward trend seems to have started after the break. Today, Germany posted the Consumer Climate report with a slight better result at 10.6 which was expected to be unchanged at 10.4. Spanish Flash CPI report showed a decline to 1.5% which was expected to decrease deeper to 1.6% from the previous value of 1.9%. Besides, German Prelim CPI report is yet to be published which is expected to show a slight growth to 0.0% from the previous negative figure of -0.2%. On the JPY side today, Japan's Retail Sales report was published with a slowdown to 2.0%, worse than the forecast for a decrease to 2.6% from the previous value of 3.2%. The negative report from Japan provided EUR with support, so EUR gain more ground despite the mixed economic reports from the eurozone today. As of the current economic situation, EUR is expected to dominate JPY further in the coming days.

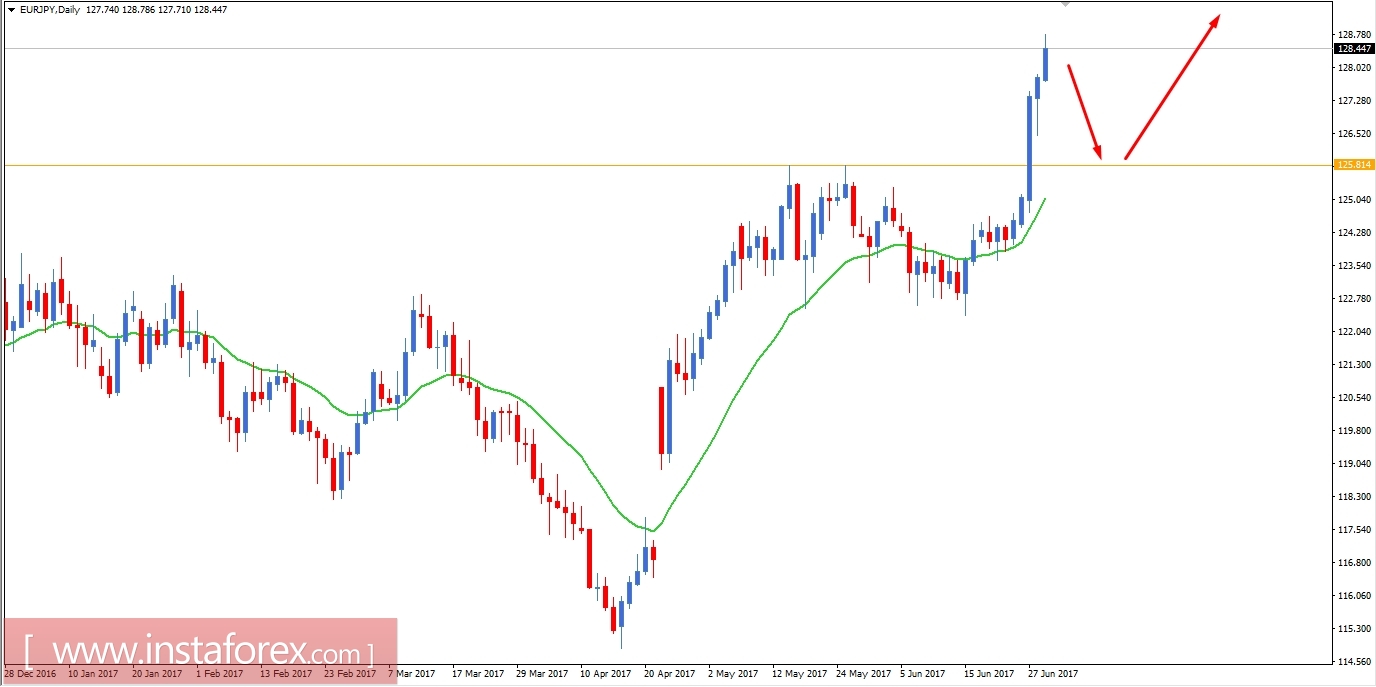

Now let us look at the technical chart. Recently, the price has moved above the resistance of 125.80 with an impulsive price action. Currently, we are anticipating the price moving down towards the 125.80 to respect it as a support before proceeding further upward with a target towards 132.00 resistance area. As the price remains above 125.80 the bullish bias is expected to continue further.