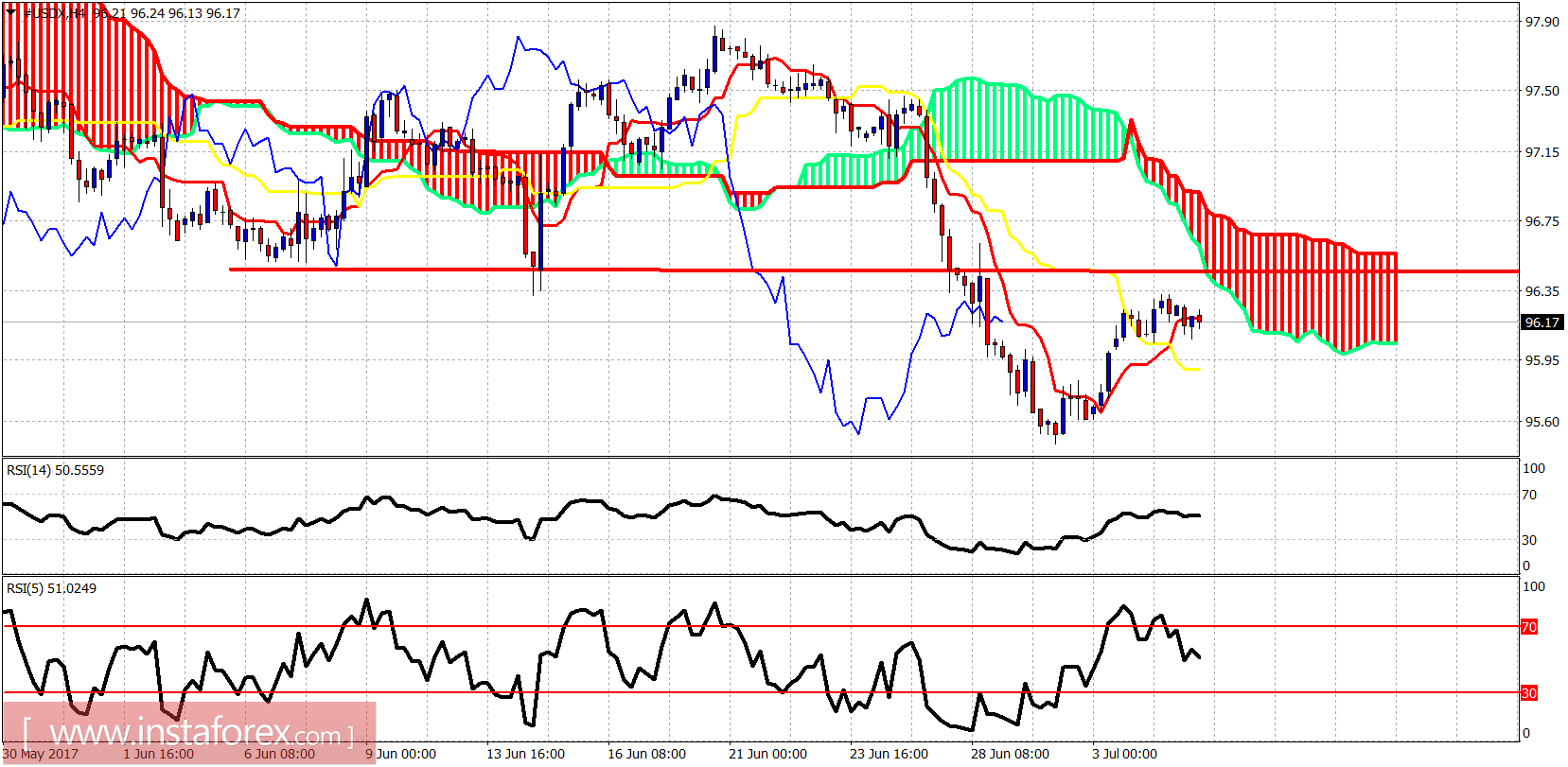

The Dollar index bounced as expected but found resistance at 96.50 and did not manage to break it. A rejection at current levels will imply a move lower below 95.

Price is below the 4-hour Kumo and trying to hold above the tenkan- and kijun-sen indicators. Support is at 96 and resistance at 96.50. A break above 96.50 could push the index towards 98. A break below 96 will open the way for new lows towards 94.50.