FX.co ★ Famous insider trading cases

Famous insider trading cases

The Wall Street Journal/R. Foster Winans

R. Foster Winans had been a columnist for The Wall Street Journal for three years. He was convicted of insider trading and mail fraud.

In 1985, he was accused of giving information to two stockbrokers about stocks he was planning to write about in his column. Traders used this information and earned about $690 thousand. Winans’ cut was $31 thousand.

As a result, Winans was sentenced to 18 months in prison. Other conspirators were also convicted.

Enron/Jeffrey Skilling

Jeffrey Skilling, the former Enron president, became the most famous business criminal who managed to serve his sentence and get out of jail.

Skilling was indicted on 35 cases of fraud, insider trading, and other crimes related to the Enron scandal.

Skilling pleaded not guilty of all charges. However, prosecution managed to bring Skilling to justice when he sold almost $60 million of Enron's shares after quitting the company.

Prosecutors said that Jeffrey knew about the company's imminent insolvency and used this against all laws on foreign exchange operations.

As a result, Skilling was sentenced to 292 months in prison.

Ivan Boesky

Ivan Boesky, a son of a Russian immigrant, became one of the wealthiest people in the US thanks to insider information. However, shocking trading scandal that occurred in 1986 completely ruined his reputation.

Boesky’s company was engaged in insider trading. Using both public and insider information, Boesky found corporate takeovers and bought their shares shortly before the release of public information. Then, he sold the shares a few days before corporations announced a takeover.

Boesky’s success attracted attention of the US Securities and Exchange Commission. In 1986, the prosecution revealed that Boesky was passing insider information to Dennis B. Levine, a managing director of Drexel Burnham Lambert, who was taken into custody in May. Boesky had been under surveillance since that day.

In 1986, federal investigators offered Boesky a secret agreement instead of a longtime prison term. According to the agreement, Boesky was forbidden from security trading for life. Moreover, he had to uncover other traders who used takeover information for illegal purposes.

As a result, Boesky met dozens of his former partners in crime with a listening device attached to him. In the aftermath, 14 traders were arrested.

Business Week

In 1990, printing company worker William Jackson and stockbroker Brian Callahan were convicted of using stock information in Business Week magazine before it was distributed to the public.

According to the Court, Jackson and Callahan made over $19 thousand each. As a result, they had to pay $37,445.

Galleon Group/Raj Rajaratnam

The District Court of New York convicted former billionaire and the head of the hedge fund firm Galleon Group of insider trading.

Once a successful billionaire and the hedge fund manager of the Galleon Group, Raj Rajaratnam, was found guilty of conspiracy and securities fraud by the District Court of New York.

According to the Court, the billionaire had been using insider information he received from executives, bankers, traders, and directors of such companies as Goldman Sachs, Intel, and Hilton Hotels for seven years.

As a result, Rajaratnam made some $45 million. On May 11, 2011, he was sentenced to 11 years in prison.

Keefe, Bruyette & Woods/McDermott Jr.

James McDermott Jr., CEO of investment bank Keefe, Bruyette & Woods, was convinced of insider trading in 2000.

He gave the information about pending bank merger to his mistress Marilyn Star, an adult-movie actress.

McDermott Jr. was sentenced to 8 months in prison. His mistress received a 3-months term. Moreover, McDermott Jr. was ordered to pay a fine of $25 thousand.

ImClone

Former ImClone CEO Samuel Waksal was sentenced to 87 months in prison and paid $3 million after he was found guilty of insider trading and fraud.

ImClone developed a new type of cancer drug, Erbitux. However, regulators rejected the application. Despite this fact, Samuel Waksal sold the company’s stock. Later, the drug was approved.

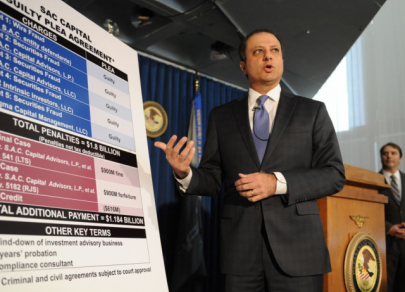

SAC Group/Steven A. Cohen

Steven Cohen is the founder of SAC Capital Partners. He became known for his phenomenal ability to make money regardless of market conditions. BusinessWeek called Cohen the most influential trader on Wall Street.

Cohen had been closely watched by the US Attorney Office and regulatory authorities for a couple of years. The investigation of the SAC Capital case became one of the major and long-term processes in the history of Wall Street. The first suspicions among regulators and prosecutors arose more than ten years ago.

However, the SEC was the only government department that dared to publicly accuse Steven Cohen. The company was accused of encouraging its employees to insider trading since 1999 and ignoring signs of illegitimacy of such practice. Several cases of fraud and insider trading were uncovered.

According to the SEC, SAC Capital illegally earned more than $275 million on insider trading.

In November 2013, the hedge fund SAC Capital pleaded guilty to securities fraud as part of the insider trading case and agreed to pay a record $1.8 billion. At the same time, New York District Attorney announced that SAC Capital would stop its investment consulting activity.