FX.co ★ Greatest hedge fund disasters of 2016

Greatest hedge fund disasters of 2016

Platinum Partners

At the start of the year many investors wondered whether there are any pitfalls in such strong earnings reports of Platinum Partners. Claiming 17% annual returns in its flagship fund despite multiple blowups of its high-risk portfolio companies, some of the fund's companies faced various issues and went bankrupt.

Later the hedge fund's co-founder Mark Nordlicht was arrested and charged with creating a Ponzi scheme. The government alleged that the hedge fund was faking its reports. In June, Platinum Partners begun liquidation of the fund, having failed to meet investors' requests to withdraw their money, and filed for bankruptcy in October.

Visium

The problems of this fund resulted in a tragedy. Less than a week after being charged with insider trading, Visium hedge fund manager Sanjay Valvani committed suicide. He was accused of making $32 million by trading pharmaceutical stocks using confidential information.

Valvani's informant, a former FDA official, pleaded guilty with a penalty of five years in prison. Due to the tarnished reputation, CIO Jacob Gottlieb chose to close the $8 billion hedge fund.

Bill Ackman and Valeant

Bill Ackman's hedge fund delivered its worst performance in history in 2015, losing 20.5%. In the first 10 months of 2016, the fund lost 22.5% after Ackman doubled down on his investment in Valeant. The investment in the troubled drug maker cost him more than $3 billion in losses as Valeant stock plummeted by 95%.

The US presidential election helped to improve some of Ackman's other holdings. Investors hope the fund's performance will improve further in 2017.

Leon Cooperman, Omega Advisors

In September, CEO of Omega Advisors Leon Cooperman was charged with insider trading. The Securities and Exchange Commission (SEC) accused Cooperman of making $4 million on illegal trades of an energy company's stock. The investor pleaded not guilty. A Supreme Court ruling earlier in December enlarged the powers of regulators prosecuting insider trading.

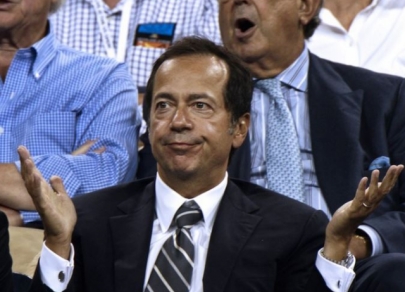

John Paulson

John Paulson's hedge fund is famous for making billions betting against the subprime mortgages that led to the 2008 financial crisis. Paulson had $21.7 billion worth of investments in his fund. However, today his stock portfolio is only worth $9.2 billion.

The hedge fund manager made mistake when he invested $2 billion in Valeant. In addition, he made billion-dollar bets on other pharmaceutical companies, whose stock prices fell significantly.