FX.co ★ Top 10 venture bets on startups

Top 10 venture bets on startups

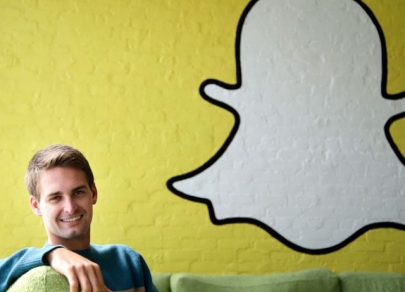

In spring 2017, Snap went public. A year ago, Google wanted to acquire the tech and social media company for $30 billion, Business Insider cited sources close and inside Snap. But the deal was not reached as Snap founder and CEO Evan Spiegel showed no interest in the proposal. The company's mobile messaging app Snapchat became popular in 2016, surpassing microblog giant Twitter in terms of daily users.

First investors involved in the now-ubiquitous search engine Google agreed to pour money in it only if the company's co-founders Larry Page and Sergey Brin give control to external CEO. It was Eric Schmidt. Thanks to him the company raised $1.42 billion in an initial public offering. By the time Schmidt stepped down in 2011, Google had grown into a company that was worth $30 billion. Later Page and Brin were unhappy with being replaced to managers' positions. But according to research firm CB Insights, external CEO was a lucky find for Google.

Chinese e-commerce giant Alibaba offered 13% of its stock. Its staggering initial public offering shattered all records and became the largest IPO ever. Heavy demand from investors prompted underwriters to sell more shares. The sale of additional shares boosted the total amount raised by Alibaba from $21.8 billion to $25 billion.

Facebook wrapped up its landmark purchase of WhatsApp in 2014, its largest acquisition ever. Venture capital firm Sequoia Capital was the only institutional backer in the messaging service, having invested $60 million since 2011 for an 18% stake that was worth $3 billion. The fact that it was Facebook that bought WhatsApp was crucial for Sequoia Capital. A decade ago, Mark Zuckerberg took the meeting with Sequoia, but purposely blew it. He showed up late and presented a PowerPoint deck titled "The Top Ten Reasons You Should Not Invest." Later he apologized for the incident.

Investor Peter Thiel called distrust of Facebook the biggest mistake in life. He invested $500,000 in the social network in 2004, believing that this is enough and the project is overestimated. He did not change his mind when venture capitalists Accel Partners and Breyer Capital invested $12.7 billion in exchange for a 15% stake in Facebook. DST Global, the investment firm led by Yuri Milner an Alisher Usmanov bought about 10% of the social networking platform and then in 2013 sold the stake. Interestingly, Russia-based Gazprom investholding LLC, Gazprom's subsidiary, was one of the investors in Facebook.

Stemcentrx, a company developing disease-specific cancer treatments, is an example of another successful startup. However, investors are concerned over risks, despite cutting-edge technology. “Our feeling with many biotechs is that people understate these probabilities. They say it is half, but maybe it is just one in 10. And even if just one of these steps is one in 10, you are really screwed,” Peter Thiel said.

At Twitter's IPO, Union Square Ventures' share of the microblogging social networking service was valued at $863 billion. USV led a $5 million funding round back in 2007. After that, sums only increased. To the extent that venture capitalists can make their investing thesis clear, they can encourage deal flow from a stronger, more self-selecting group of founders who are confident they are teaming up with the right investor.

Social gaming giant Zynga gained its popularity thanks to Farmville game on Facebook. “Building a game network on top of the social web is a big idea,” wrote Fred Wilson of USV. “But the most important thing is to plug into the APIs of the various social networks so that you can easily find out which of your friends are online and ready to play with you.”

Lending Club, the US largest peer-to-peer lending network, received investment from Yuri Milner's DST Global and Coatue Management LLC in November 2013. A year later, when Lending Club went public, its IPO was 20x oversubscribed and its stock soared by 56% during its first day of trading.

Mobileye, a Jerusalem-based developer of advanced vision and driver assistance systems, was founded in 1999. It was the main supplier for Tesla's Autopilot autonomous driving feature on a Model S. In 2017, Intel bought Mobileye for a $15.3 billion, the biggest ever exit in Israeli history.