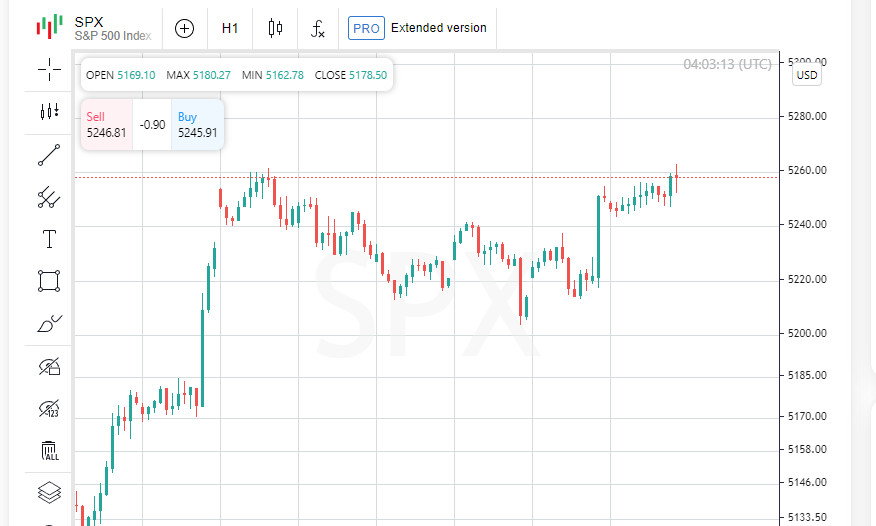

Amid the latest economic data, the S&P 500 ended the week with positive dynamics, marking its best quarterly result in the last five years. Investors are optimistic about the future, awaiting new information on inflation.

Breakout of leading indices

In addition to the S&P 500, two other key US indices also posted significant gains this quarter. The 10.16% rise for the S&P 500 was driven by growing interest in artificial intelligence stocks and speculation that the Federal Reserve will cut interest rates this year.

Dow Jones on the verge of historic achievement

The Dow Jones index is approaching a significant milestone of 40,000 points, less than 1% away from this goal.

Economic progress and labor market sustainability

The latest data shows the US economy grew faster than expected in the fourth quarter, helped by strong consumer spending. Additionally, the decline in initial unemployment claims underscores the stability in the labor market.

Optimism among experts

"The economy and consumers are doing well as they continue to spend. Unemployment remains low and there are regions where the economy is thriving... There are funds that want to be spent in a variety of ways," shares George Young, portfolio manager at Villere & Company.

Nasdaq reaches new heights

The tech-heavy Nasdaq Composite Index also posted its first record peak since November 2021, opening up new opportunities for investors.

Belief in a "soft landing" of the economy

A key factor in this year's success has been investor confidence in the possibility of a "soft landing" for the economy, which involves lowering inflation without leading to a major recession.

Looking to the future: soft landing is a priority

A BofA Global Research survey conducted in March shows more than two-thirds of asset managers view a soft landing as the most likely scenario for the economy over the next 12 months, while just 11% expect a hard landing.

Fed maintains optimism

The March Federal Reserve meeting, which confirmed expectations of three interest rate cuts during the year while improving the economic outlook, added confidence to investors.

Overcoming rising bond yields

The stock has successfully weathered the rise in Treasury yields that previously weighed on stock prices heading into 2023. The yield on the 10-year Treasury note reached 4.2%, up from 3.86% at the end of last year.

Expanding the Boundaries of Optimism

BlackRock Investment Institute strategists say risk optimism could expand beyond the tech sector thanks to the integration of AI across industries, as well as support from the Federal Reserve and slowing inflation. This is pushing for more investment in US stocks.

Rising share prices reflect confidence

The forward price-to-earnings ratio for the S&P 500 reached 21, a two-year high and reflecting increased investor optimism in the stock market, according to LSEG Datastream.

Wind of change in the stock market

The stock market remains under the influence of large companies that dictated trends in 2023. However, the current year has brought diversity to growth dynamics, especially among the tech giants known as the "Magnificent Seven."

Artificial Intelligence Stars

Nvidia stands out, posting impressive growth of over 80% thanks to its role as a leader in AI chips. Meta Platforms is also showing notable success, increasing its value by 37% and paying dividends for the first time in February.

Tests for titans of technology

At the same time, not all major players are lucky. Apple faces an 11% loss as the company comes under pressure in China and from regulators. Tesla is also experiencing a 29% decline, driven by concerns about demand for electric vehicles.

Redistribution of influence

According to S&P Dow Jones Indices, the Magnificent Seven are responsible for 40% of the S&P 500's year-to-date gain, down significantly from last year, when they contributed more than 60%. This suggests the rally is expanding to other stocks, offsetting the current decline.

A look at inflation ahead of the holiday

Against the backdrop of the upcoming Good Friday celebration and the closure of US stock markets, analysts are eagerly awaiting the publication of the PCE index. The index, the Federal Reserve's preferred measure of inflation, will provide insight into the possible timing and extent of upcoming interest rate cuts.

Minor changes compared to expectations

The Dow Jones Industrial Average gained some ground, gaining 0.12%, while the S&P 500 also rose a modest 0.11%. In contrast, the Nasdaq Composite fell slightly by 0.12%, reflecting the market's mixed reaction to the current economic outlook.

Weekly and monthly achievements

Over the past week, the Dow Jones rose 0.84%, the S&P 500 rose 0.39%, and the Nasdaq rose 0.3%. March gains were notable, with the Dow Jones up 2.08%, the S&P 500 up 3.1% and the Nasdaq up 1.79%. This quarter was marked by significant gains for all three indexes: the Dow by 5.62%, the S&P 500 by 10.16%, and the Nasdaq by 9.11%.

Comment from the Fed confirms caution

Federal Reserve Chairman Christopher Waller noted that despite the disappointing inflation data, the Fed should show restraint in cutting short-term interest rates. However, he did not rule out the possibility of a rate cut later this year, emphasizing the readiness for further regulatory action in response to the economic situation.

Fed Interest Rate Forecasts

Market analysts assign a 64% chance that the Federal Reserve will cut interest rates by 25 basis points by June, based on an analysis of data from CME's FedWatch Tool.

Sectoral achievements and failures

Among key sectors, communications, energy and technology stood out as the best performers in the quarter, while the real estate sector faced losses. This distribution of indicators reflects the changing priorities and interests of investors in the market.

Expanding investment horizons

According to Anthony Saglimbene, chief market strategist at Ameriprise, the observed trends suggest that investors are starting to explore opportunities outside the dominance of big tech companies, anticipating lower interest rates later in the year.

Focus on the winners of the AI era

Investors are also cautiously optimistic about which companies stand to benefit most from the increased use of artificial intelligence, tailoring their investment strategies to upcoming technology trends.

AI boom attracts attention

Nvidia continues to lead the AI push, but excitement around the technology has also spread to other chipmakers such as Super Micro Computer and Arm Holdings. Astera Labs, another player in this arena, impressed the market by doubling its stock price from its initial public offering price in just a week.

Healthcare in Focus

Walgreens Boots shares rose sharply following its quarterly earnings report, where the company noted a 3.19% decline in the value of its investment in medical clinic operator VillageMD.

Strategic moves in retail

Home Depot shares fell slightly after announcing the largest acquisition in the company's history, the purchase of building materials supplier SRS Distribution for $18.25 billion. The move highlights the retailer's strategic efforts to expand its presence in the market.