Jeden krok vpred, dva kroky vzad: index S&P 500 po počiatočnom raste opäť klesol. Investori sa zameriavajú na pozitívne faktory, ako sú silné zisky spoločností, zámer Fedu znížiť úrokové sadzby a rast technológií umelej inteligencie. Údaje o inflácii v USA však môžu všetko obrátiť naruby. Rýchlejší rast spotrebiteľských cien môže na trh opäť priniesť obavy zo stagflácie a recesie. V takomto scenári hrozí širokému akciovému indexu pokles.

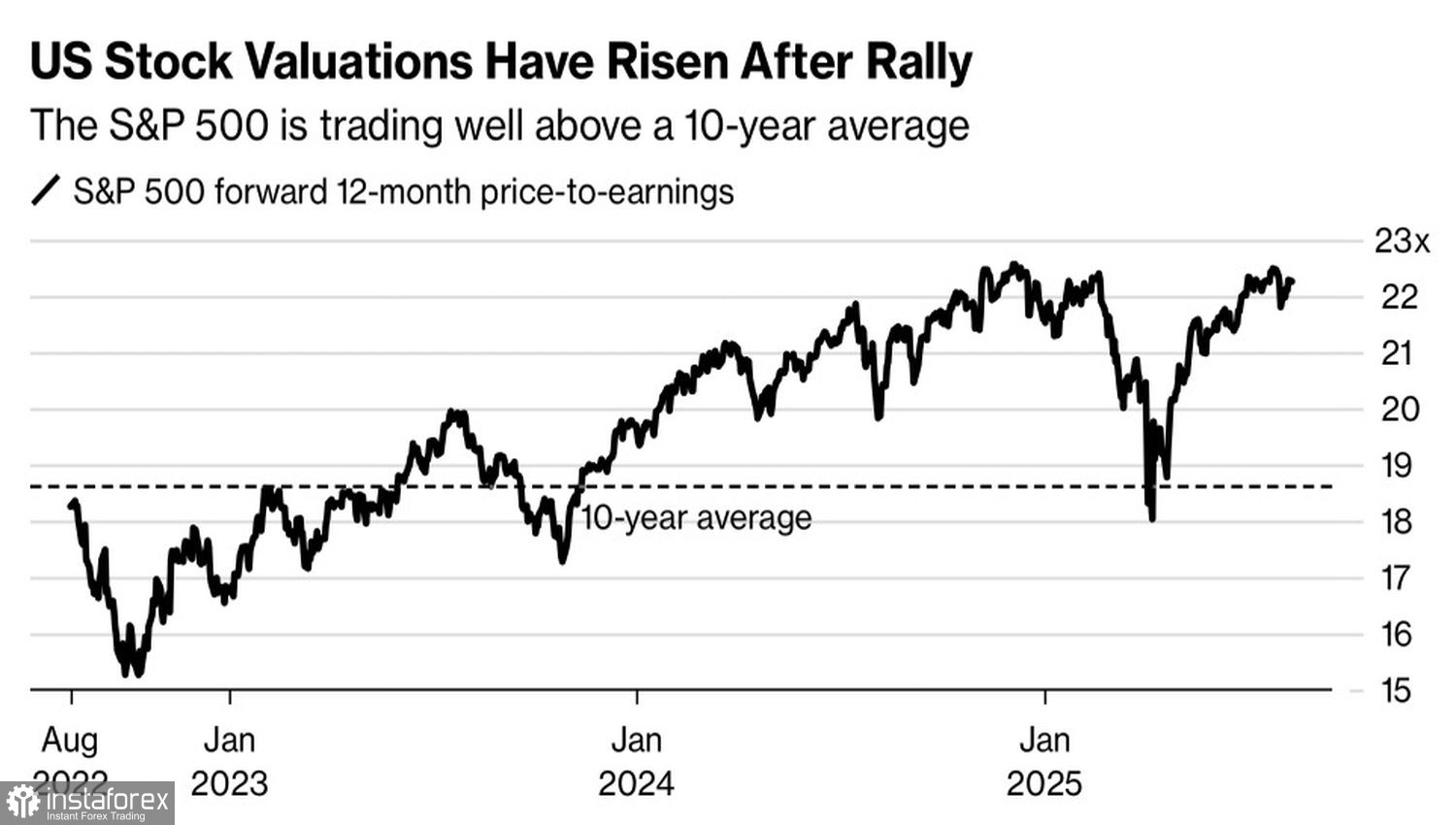

Podľa 91 % respondentov prieskumu Bank of America je americký trh nadhodnotený. 30 % rast indexu S&P 500 od aprílových miním skutočne posunul pomer ceny k očakávaným ziskom na najbližších 12 mesiacov na najvyššiu úroveň od začiatku roka.

Trendy pomeru ceny a čistého zisku pre spoločnosti indexu S&P 500

Napriek tomu len 5 % respondentov očakáva výrazné spomalenie americkej ekonomiky. Ako hlavné riziká uvádzajú obnovenie obchodných vojen, vyššiu infláciu a turbulencie na trhu s dlhopismi.

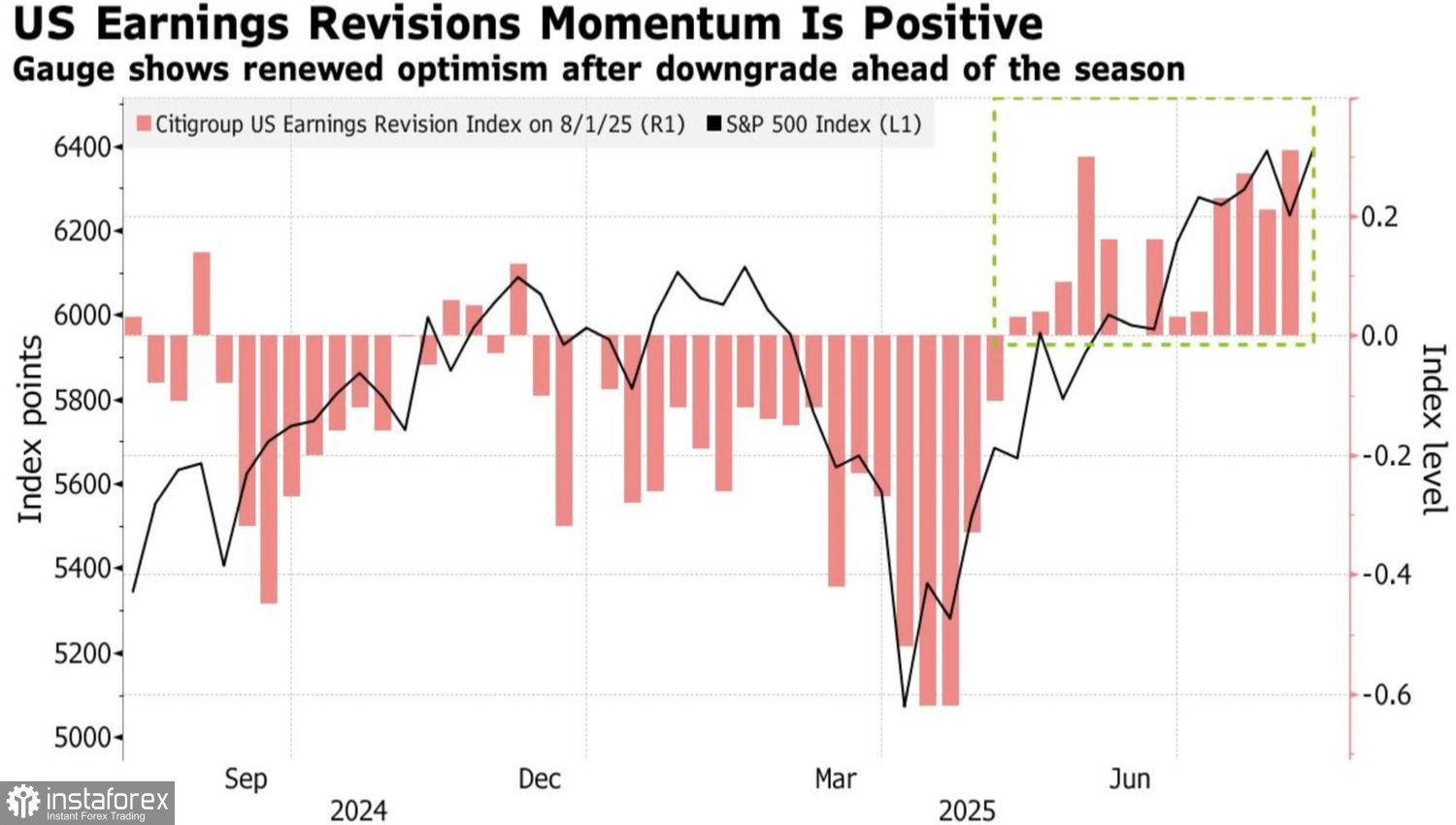

Citigroup však zvýšila svoju prognózu indexu S&P 500 na koniec roka 2025 z 6 300 na 6 600, čo je približne o 3 % viac ako súčasná úroveň. Hlavným dôvodom je mimoriadna odolnosť amerických spoločností voči clám Donalda Trumpa. 81 % spoločností, ktoré zverejnili svoje výsledky, dosiahlo lepšie výsledky, ako očakávali analytici z Wall Street – čo je najvyššie číslo za posledných sedem kvartálov. Tento pozitívny trend umožnil Citigroup revidovať svoje odhady ziskov smerom nahor.

Výkonnosť indexu S&P 500 a prognózy ziskov amerických spoločností

Široký akciový index má teraz silu, ktorú predtým nemal. Objavila sa nová generácia investorov, ktorých obľúbeným ťahom je "nakupovať pri poklese". Nikdy nezažili krach dot-comov ani globálnu finančnú krízu – jednoducho skupujú akcie, ktorých cena klesla počas pullbackov. Táto stratégia stáda bráni tomu, aby index S&P 500 klesol príliš hlboko. Na druhej strane, ak dôjde k skutočnej korekcii, panika medzi touto novou vlnou investorov by ju mohla premeniť na lavíny.

Odborníci na trh si dobre uvedomujú, že existujú dôvody na obavy. Nový šéf BLS by mohol začať manipulovať so štatistikami v prospech Donalda Trumpa. Prezidentove zámery zabaviť časť príjmov spoločnosti NVIDIA z predaja čipov do Číny, prepustiť generálneho riaditeľa spoločnosti Intel a osobne prideliť viac ako 1 bilión dolárov na investície z EÚ a Číny vyvolávajú porovnania so štátnym kapitalizmom.

Zároveň pevná vôľa Bieleho domu dostať Federálny rezervný systém pod svoju kontrolu vyvoláva porovnania medzi americkým trhom cenných papierov a trhmi rozvíjajúcich sa ekonomík. V dôsledku toho niektorí investori uprednostňujú istotu a presúvajú svoje peniaze mimo Spojených štátov.

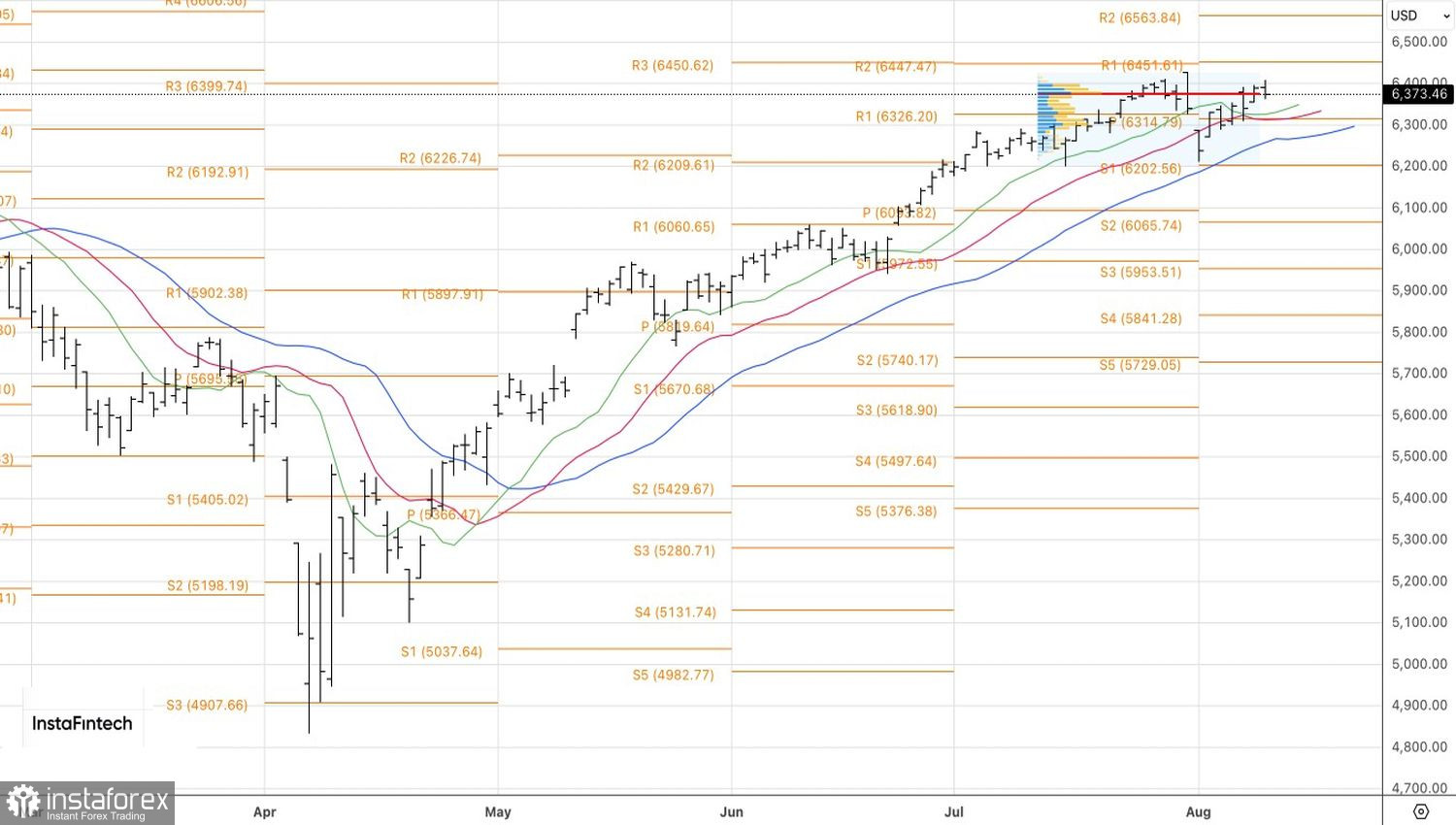

Z technického hľadiska sa na dennom grafe indexu S&P 500 zvyšuje pravdepodobnosť, že sa čoskoro vytvorí obratová formácia 1-2-3. Obchodníci, ktorí agresívne predávajú široký akciový index pri raste, môžu skončiť v ideálnej pozícii. Ostatní by mohli zvážiť otvorenie krátkych pozícií z úrovní 6 350 a 6 325.