FX.co ★ 10 Saxo Bank forecasts for 2021 which are hard to believe

10 Saxo Bank forecasts for 2021 which are hard to believe

Amazon to relocate to Cyprus

Analysts predict that Amazon could relocate its European headquarters to Cyprus. This country has been always benevolent to the e-commerce giant as its huge taxes help Cyprus’ authorities to reduce a ratio of its GDP to the public debt. At present, this ratio has almost reached 100%. In 2020, Trump’s administration cracked down on Amazon for a variety of controversies. Besides, the hi-tech giant has been under investigation for tax evasion. So, scrutiny from the US law enforcement authorities could prompt Amazon executives to shift focus towards Cyprus as the country offers lucrative opportunities because of lower tax rates.

Germany to come up with aid for France

France might join the countries with a heavy debt burden. Such prospects are worsened by the pandemic-driven crisis. By late 2020, France’s public debt could approach 100% of its GDP and the private debt could come as high as 140% of GDP. Saxo Bank experts reckon that the state debt could balloon to 120% of GDP in 2021. Under such conditions, Germany will lend a helping hand. The largest EU economy will provide a relief package to France which has been going through a tough challenge. The economic downturn in France is accompanied by lower public spending and the alarming public debt.

Blockchain technology to eliminate fake news

In 2021, the Internet will be flooded with fake news, so the level of people’s trust in reputable news agencies will fall to zero. Mass media and social platforms around the world will have to struggle against misleading news. This problem will be solved thanks to blockchain technology which ensures a validity check of both the content and the source and information protection. The technology of a shared ledger will make any change in the content transparent, experts believe. As a result, any news could be tracked down from a source to publication eliminating false information.

Digital CNY to propel robust capital shift

DCEP abbreviated as Digital Currency Electronic Payment is a new payment means that is being developed in China. It will be based on blockchain and cryptographic technology. In 2021, the People’s Bank of China is planning to enhance the efficiency of monetary and fiscal stimulus measures by minimizing the use of cash. China’s authorities intend to launch DCEP next year. The new digital currency will be supervised by the central bank. Experts at Saxo Bank think that the revolutionary cryptocurrency could challenge the US dollar’s status of the world’s reserve currency. Adoption of the digital currency that is capable of competing with the greenback will create buoyant domestic consumption and reinforce China’s financial market.

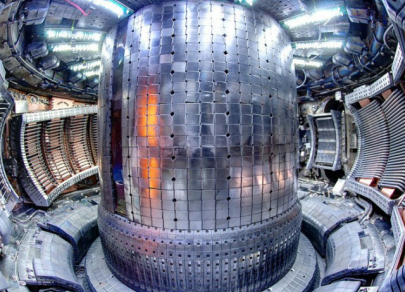

Groundbreaking thermonuclear technology to create ample energy

According to Saxo Bank, available technologies are not enough to boost momentum in the global economy. The world needs a breakthrough in the energy sector that will be ensured by cutting-edge thermonuclear technology. This year, the SPARC project was launched within a framework of nuclear synthesis. The nuclear fusion reactor is a source of abundant and clean energy for mankind that will make thermonuclear energy much cheaper. Experts point out that taming thermonuclear energy people will solve the problem of water and food shortages worldwide. If implemented, this scenario will reduce notably logistic expenses and promote a widespread application of robots.

UBI to devastate metropolises

The universal basic income will become an innovative economic concept next year. Economists acknowledge that the income of one person is not enough to support a family. At the same time, the development of innovative technologies makes human jobs redundant in a number of industries. The introduction of the UBI concept will fundamentally change the attitude towards work and leisure, according to Saxo Bank. Metropolitan areas can become empty, as citizens will either move to the countryside and find a job to their liking, or become teleworkers outside the urban environment.

Citizens Technology Fund to appear as a result of technological breakthrough

The roaring success of high technologies against the backdrop of a free market will set the tone for the whole 2021. Experts at Saxo Bank predict the creation of the Citizens Technology Fund that transfers a portion of asset ownership of capital assets to everyone. The idea of this fund is to allocate dividends gained from buoyant productivity growth of hi-tech companies to every person. The policy of dividends on technical progress aims to relieve economic and social anxieties.

Successful COVID-19 vaccination to ruin corporations

The COVID-19 pandemic greatly worsened the debt burden in the global economy. As a result, most investors are poised to revise their portfolios in favor of risky assets. The risk-on mood is fed by expectations of an efficient vaccine against COVID-19 that will enable the global economy to regain momentum. In 2020, credit conditions tightened due to long bond maturity. Besides, lots of corporations defaulted on their debt at record levels over many years. Nevertheless, experts at Saxo Bank believe that success in mass vaccination against COVID-19 will solve such problems, though large corporations are at stake.

Silver to rally amid high demand for solar panels

Next year, analysts foresee a rally of silver prices amid growing demand for “clean energy” products. The metal is used in solar panels, so their popularity will be a catalyst for a rise in silver prices. Other factors are the weak US dollar and negative bond yields. Analysts at Saxo Bank reckon that a large-scale application of silver in industries lies behind its appreciation. Moreover, they do not rule out a shortage of the precious metal in the global market in 2021. Thus, demand for silver could exceed its supply, Saxo Bank warns.

Emerging markets to boom thanks to innovative technologies

In 2021, lots of emerging markets will have a good excuse to celebrate the triumph. Many of them have been seriously underestimated. Next year, they will be able to grab a chance to upgrade their economies thanks to innovative technologies. The key to success will be the widespread introduction of satellite internet systems across developing countries. This move will knock down GSM tariffs and greatly increase a traffic speed. As a result, this will notably improve the quality of education and business. Saxo Bank points out other drivers of economic growth in emerging markets such as pilotless vehicles and total automation of industrial production.