FX.co ★ One Day Devaluation: 5 Currencies That Depreciated Sharply

One Day Devaluation: 5 Currencies That Depreciated Sharply

Venezuelan bolivar (devaluation - 100.3%)

The Venezuelan bolivar leads the top 5 sharply depreciated currencies. The key event for the national currency took place on January 11, 2010. Two days before, on January 9, 2010, Venezuelan President Hugo Chavez set a course for a controlled devaluation of the bolivar (by 17%, to 2.6 bolivars per $1). The goals of this financial operation were to increase oil export revenues and stimulate exports. However, the national currency fell much more than the government expected. After the decision of the authorities, for $1 on the black market of the country it cost 6 bolivars. As a result, the Venezuelan bolivar sank by an impressive 100.3%

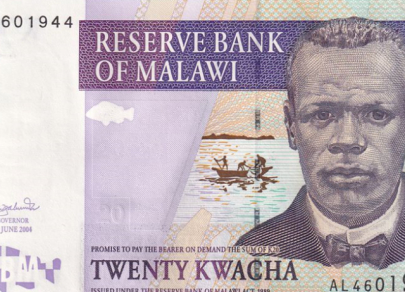

Malawian kwacha (devaluation - 49.9%)

The Malawian kwacha was another record holder for depreciation in one day. This happened on May 7, 2012, when the Central Bank of Malawi untied the exchange rate of the national currency from the US dollar. This measure was carried out at the request of the International Monetary Fund (IMF). As a result, the rate of the Malawian kwacha fell by almost 50% on the country's black market. Malawians spent several days queuing to buy fuel and basic necessities.

Ukrainian hryvnia (devaluation - 49%)

The Ukrainian hryvnia also failed to avoid a one-day devaluation and fell by 49%. This happened on February 5, 2015, when the National Bank of Ukraine scrapped hold daily currency auctions in the foreign exchange market. For reference, they were necessary to determine the equilibrium exchange rate of the hryvnia. This financial operation was recommended by the International Monetary Fund (IMF). As a result, the market reacted with a collapse of the hryvnia exchange rate, which at its peak exceeded 30 hryvnia per 1 USD.

Kazakhstani tenge (devaluation - 27.9%)

Another record one-day devaluation is the Kazakh tenge, which depreciated by 27.9%. This event took place on August 20, 2015 at the auction on the Kazakhstan Stock Exchange. This precedent occurred on August 20, 2015 during trading on the Kazakhstan Stock Exchange. On this day, the weighted average rate of the national currency against the US dollar increased by 66.88 tenge, up to 255.26 tenge per 1 USD. This is how the market reacted to the transition to a freely floating exchange rate of the national currency. This decision was made by the Prime Minister of Kazakhstan Karim Massimov. During the period of devaluation, banks and currency exchange offices were temporarily closed, and imported goods rose in price sharply.

Russian ruble (devaluation - 15.3%)

The Russian ruble closes the top 5 currencies that sank sharply in 1 day. On the night of December 15–16, 2014, the Bank of Russia raised the key rate immediately by 6.5% to 17% per annum. This led to the devaluation of the national currency, which fell by 15.3%. Experts believe that the reasons for this were the collapse of oil prices and the transition to a free float of the ruble. Currently, many analysts fear a repeat of this scenario.