FX.co ★ Decabillionaire dynasties in US

Decabillionaire dynasties in US

Walton family

At the top of the rating is the Walton family with a fortune of $267 billion. The main source of their wealth is the retail giant Walmart. Although Sam and Bud Walton's heirs have sold nearly $22 billion worth of stock in the company in recent years, they still retain control of 45% of Walmart's shares. Besides, significant investments in sports contribute to the growth of their capital. Today, the Waltons own famous teams such as Arsenal and the Los Angeles Rams.

Mars family

The second place in the ranking is occupied by the Mars family who has amassed a capital of $117 billion. Their income mainly comes from Mars Inc., one of the world's largest confectionary and pet food manufacturers. Today the company is owned by brother and sister John and Jacqueline Mars. Other heirs to the dynasty, including Stephen Badger and Victoria Mars, also play active roles in running the multibillion-dollar business. Mars' annual revenue is estimated at $47 billion.

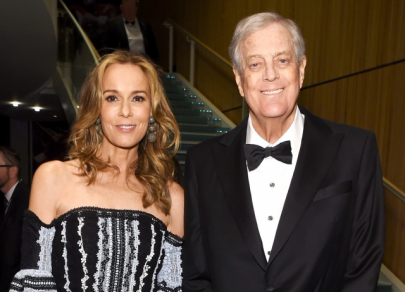

Koch family

The diversified conglomerate Koch Industries, whose interests range from oil production to the production of paper towels, has been controlled by Charles Koch since the late 1960s. He and Julia Koch, the widow of his late brother David, are the majority owners of the company today. Each of them has 42% of shares in their portfolio. The overall capital of all members of the Koch family, at last count, exceeds $116 billion.

Cargill-MacMillan family

The Cargill-McMillan family, whose combined net worth is estimated at more than $60 billion, now owns an 88% stake in the largest American private company by revenue, agribusiness giant Cargill. Founded in the mid-19th century, the grain storage company now occupies a leading share in the global market of agricultural products. Cargill produces a variety of meats, butter, cocoa, sugar, starch, corn syrup, and many other products.

Johnson family

The top 5 richest dynasties in the US are completed by the Johnson family who owns a fortune of almost $45 billion. The main source of its wealth is the financial services giant Fidelity Investments. Abigail Johnson, granddaughter of company founder Edward C. Johnson II, took over the company 10 years ago. Since then, Fidelity's assets have doubled to more than $4 trillion. This success was achieved largely due to the integration of Bitcoin into the company’s portfolio of investment assets.