FX.co ★ Hyperinflation records in history

Hyperinflation records in history

Hyperinflation is the case when inflation jumps 50% and over on month. So, on a daily basis inflation in Venezuela was slightly above 1% in 2018. In fact, prices grew much faster as in the early 2018, inflation was estimated at a few hundred percent on a yearly basis. Amid hyperinflation, shop assistants did not attach price tags at grocery stores because prices could rise significantly within the day. Thus, people and firms found a solution to use eggs as a means of payment. As eggs contain a lot of protein, they are considered a valuable product.

Read about six cases of appalling hyperinflation in our photo gallery. Unlike Venezuela where hyperinflation is assessed in annual terms, inflation rates in other countries are estimated on a monthly basis.

China, 1949, daily inflation of 14%

Hyperinflation struck China in 1947. It reached its peak in 1949 when consumer prices were soaring 5,070% per pay. Hyperinflation flared up during the civil war. China’s national party, Guomindang, decided to print more banknotes to ensure government spending during the military conflict with the Communist Party.

As a result, consumer prices doubled every 3-5 days. Prices of basic consumer goods and food skyrocketed by a hundred thousand times. Printed notes had no more value than waste paper. People were forced to use rice as a means of payment. After China had introduced the yuan, inflation rates were gradually stalling ahead of 1955.

Greece, 1944, daily inflation of 18%

Greece’s economy was devastated by the Nazi’s occupation during World War II.As a result, the collapse in the agriculture entailed serious food shortages. Besides, a relief of tax burden was also to blame for high inflation. Even though it was not as galloping as inflation in post-war Hungary or Germany, Greece needed a longer time to tame it and achieve some stability in the ailing economy.

The Greeks found a solution to spend drahmas within 4 hours. Before, the natives used to keep a drahma banknote for up to 40 days. According to the hyperinflation chart composed by Steve Hanke and Nicholas Krus, consumer prices doubled every 4.3 days. The highest rate on month, recorded in October 1944, was estimated at 13,800%.

Germany, 1923, daily inflation of 21%

This is the most odious case in history. Following World War I, Germany’s economy was crippled by an enormous public debt and reparations. The government decided to print Deutsche Mark notes aiming to buy the reserved currency and to repay its debts. The national currency was losing in value at the same pace as the central bank printed more and more Deutsche Mark bills. Consumer prices doubled every 3.7 days. Inflation reached its peak in October 1923 that was 29,500% month-on-month.

A loaf of bread had a price tag of 250 Deutsche Marks in January 1923, but the price skyrocketed to 200 billion Deutsche Marks in November. Banknotes were burnt instead of fuel or logs to heat furnaces and were used instead of wallpaper. People were paid so huge packs of notes which did not fit into a suitcase. The Germans rushed to spend their wages on the day of their receipt as this money would lose virtually all of its value next day.

The BBC cited someone’s memoirs that once this person left his suitcase stuffed with wages unattended. Later, the man found out that the suitcase had been stolen, but the money had been left. Another man went to Berlin to buy a pair of new shoes. However, on his arrival that money was enough to buy a cup of coffee and a return ticket by bus. In late 1923, the government introduced annuity bonds which were backed by agricultural resources. This move propped up consumer prices. Besides, Germany’s lenders agreed to restructure wartime payments.

Yugoslavia, 1994, daily inflation of 65%

By 1992, Yugoslavia consisted only of Serbia and Montenegro remained in after other countries had withdrawn from it. The state treasury was depleted by armed conflicts and the collapse in the domestic market. So, the government set about printing banknotes. Erratic public spending, corruption, and the UN sanctions slapped in 1992/93 triggered hyperinflation. Its peak was recorded in January 1994 – 313,000,000%.

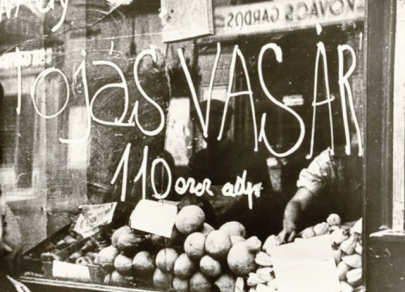

Prices were swelling every 34 hours. The nationals of the Balkan country had to spend money as soon as they were paid wages. Some people went to Hungary to buy basic goods. The inflation problem was worsened by maladministration which disabled the work of all public institutions. As a result, people failed to pay utility bills in a due time as the amount stated there lost its value in a flash.

Pushing ahead with the idea of terminating sanctions, Serbia’s leader Slobodan Milosevic adopted a new currency, the new dinar, secured by the gold and forex reserves.

Zimbabwe, 2008, daily inflation of 98%

After Zimbabwe had gained independence in 1980, the new national currency valued at nearly $1.25 was introduced. In early 2000-ies, President Robert Mugabe launched the land reform which in fact was the redistribution of land by compulsory seizure of the farmland belonging to ethnic Europeans in favor of the Zimbabwean folks. Actually, the authorities wrecked prosperous farms. Besides, the domestic economy suffered the US and EU sanctions imposed in 2002.

In 2007, landlords had to charge the rent by groceries. A room rent was paid as follows: 10 kilos of corn flour, 2 kilos of baking flour, 4 liters of oil, 10 packs of toilet paper, and 2 kilos of sugar. In 2008, a bunch of 10 bananas cost 10 billion Zimbabwean dollars. Banknotes were virtually worthless, so they were used as bookmarks or stickers.

In November 2008, inflation came in at 79 billion percent. Prices grew twice every 25 hours. A loaf of bread in the capital city cost 200 billion Zimbabwean dollars. In the same year, the authorities shifted to US dollars to stamp out rampant inflation.

Hungary, 1946, daily inflation of 207%

The worst case of hyperinflation was recorded in Hungary. In 1927, the government launched a new currency unit, the pengő, to revive the national economy after World War I and tame inflation. The Great Depression devastated Hungary’s economy. The swelling public debt forced the central bank to devalue the national currency in an effort to cover public spending.

By the start of World War II, the domestic economy was in dire straits. The central bank gave in to the government which ordered to print bank bills without any limits.

Hyperinflation reached appalling rates as prices spiked twice every 15 hours. In July 1946, the inflation was 41.9 quadrillion percent! The authorities came up with the only solution. They introduced a new currency – the forint.

When this happened in August 1946, the total amount of all Hungarian banknotes in circulation equaled 0.001 of the US dollar.