FX.co ★ Biggest market crashes in US history

Biggest market crashes in US history

Panic of 1792

The financial credit crisis occurred during the months of March and April 1792. As a result, securities lost about a quarter of their value. The Panic of 1792 is considered to be the first serious financial crisis in the US. Extended lending by the First Bank of the US and massive speculations were one of the primary causes of the panic.

Alexander Macomb, an American merchant, took a loan from a bank. He used it to purchase land from the state. Macomb wanted to make money on speculations from the retail sales of land plots. However, sales were low and Macomb did not have enough money for the next payment to the bank. William Duer and a number of bankers bought up American debt securities and bank stocks and tried to raise their prices. However, at some point they were unable to pay their debts and began massive sell-offs. Therefore, asset prices fell sharply. People around the country rushed to withdraw their deposits.

Secretary of the Treasury Alexander Hamilton was able to manage the crisis. Eventually, his actions were considered as the theoretical and practical measures the central bank should take when faced with financial crises.

Black Friday 1869

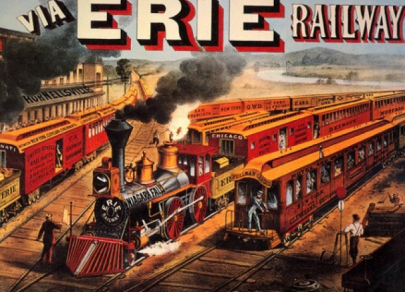

On September 24, 1869, Erie Railroad railway executive Jason Gould and his partner James Fisk decided to encourage a rally in the markets. They were buying up gold hoping that it would increase grain prices and the demand for grain transportation contributing to a rise of the railway tariffs.

Gould counted, among other things, on the close circle of President Grant. He spent $7 million on buyup which boosted gold prices by 40 percent on the first day. The bank under the control of Boss Tweed gave assurance to Gould. However, some cautious speculators left Gould behind and came directly to the president.

In order to stabilize the market, the US Department of Treasury threw a ton of gold into the market without a warning. By that time, the gold price soared by 65 percent since July 1869. Black Friday took place on September 24, 1869. That day, the gold value crashed by 30 percent. Gould did not suffer financial losses. However, he was faced with countless lawsuits and almost lynched on the street. In 1872, Gould had to leave the exchange and the railway. James Fisk was killed in the same year.

Panic of 1893

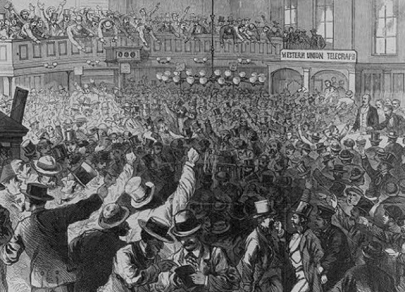

The economic depression began in 1893 when excessive production negatively affected shares of railway companies followed by the collapse of banks around the country.

It was one of the worst depressions in US history at that time. More than 500 banks and 15 thousand companies went bankrupt. Unemployment during the depression was 17–19 percent.

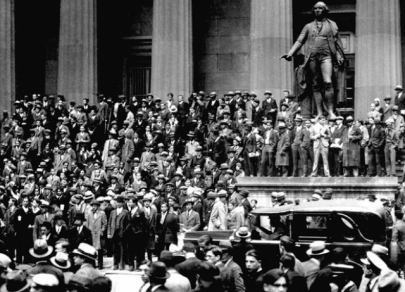

Wall Street Crash of 1929

The Wall Street Crash, which broke out on October 24, 1926, signaled the beginning of the Great Depression.

On that day, the Dow Jones Industrial Average being at around 381.17 lost 11 percent. The bubble popped and a stock investors burst into panic selling. Investors sold 12.9 million securities that day, trying to get rid of the shares before they completely went down in value.

Over the next few days, about 30 million more shares were sold. Overall, US stocks plummeted by 40 percent for a week losing about $30 billion in value. It is more than the US government spent for the entire period of the First World War.

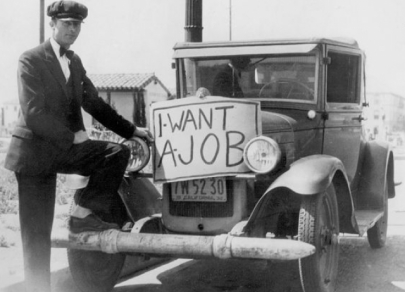

The banks that had provided stock investors with loans failed to reclaim their debts. As a result, they had to declare bankruptcy. Then, enterprises closed due to the lack of loans. These factors were to blame for large-scale unemployment.

Thereafter, the Securities and Exchange Commission was founded. It developed rules and regulations aimed to prevent similar stock market crashes.

Recession of 1937–1938

The economic downturn took place in 1937–1938. The unemployment jumped from 4.5 million to 11 million for almost a year. Inventories were piled up denting demand and inflating prices.

In 1963, the US authorities tightened monetary and fiscal policies causing an economic collapse. The recession led to the termination of the gold inflow policy in 1938. The Fed reduced the required provision for financial institutions in April of the same year. In 1939, the budget deficit grew to 3 percent of GDP.

Friday the 13th mini-crash

The Friday the 13th mini-crash occurred on October 13, 1989 when UAL Corporation announced that the $6.8 billion employee-led buyout of the company collapsed. UAL Corporation said it was not able to raise the necessary funds.

Arbitrageurs sold their shares at the price of common ULA stocks. As a result, Dow Jones Industrial Average slumped 190 points overnight.

Economic aftermath of 9/11 attacks

The tragedy made a devastating impact on the US economy. Wall Street was destroyed and large firms suffered losses. It took a lot of time to restore infrastructure and urban facilities.

The owners of the destroyed Twin Towers received insurance payments worth several billion dollars. Back then, the stock index tumbled by 14 percent. It was the biggest downfall in history which exceeded even the scores of the Great Depression.

The tragedy dampened demand for flights because people were afraid that the attacks could happen again and chose safer means of transport.

Stock market downturn of 2002

By the first half of October 2002, the Dow Jones Industrial Average fell by 37,5 percent, S&Р-500 sank by 50 percent and the NASDAQ Composite - by 78 percent compared to the absolute highs reached at the beginning of 2000.

Financial companies and funds decided to revise their investment portfolios. Risk-free assets won favor with investors, especially government bonds. However, buoyant demand caused a sharp decline in bond yields.

In early 2000, yields of the ten-year Treasuries were above 6.75 percent. In the mid-2003, yields fell to 3.14 percent. Besides, yields of two-year bonds slumped to a nearly record low of 1%.

Financial crisis of 2007–2008

It was triggered by a US mortgage crisis, banks downfall, and falling stock prices. So, the local crisis spilled over to global financial markets.

The first signs of a mortgage crisis showed up in 2006. It resulted in sluggish home sales which grew into a crisis of high-risk mortgage loans by the spring of 2007. In the summer of 2007, it turned into a financial crisis and caused damage to many countries along with the US.

Shares of the largest US insurance company AIG fell by 60 percent. The company was the main issuer of the credit default swaps. This was followed by the collapse of the entire market of credit default swaps. Therefore, five leading US banks had to change the direction of their activity.

2010 Flash Crash

The US stock market crashed when the Dow Jones index lost 1 thousand points (9 percent) during one trading session. The prime cause for a severe downturn was concerns over the crisis in Greece. At 02:42, when the Dow index dropped by 3 percent, the stock market went into a nosedive. It lost 600 points within 5 minutes, and by 02:47 the downfall reached almost 1 thousand points. By 03:07, the market recovered most of the 600-point decrease.