USD/CAD has been bearish recently after breaking above the 1.2660 resistance area which is currently expected to be retested as support. CAD has been quite mixed in light of recent economic reports. Canada's Employment Change showed positive change to 35.3k from the previous figure of 10.0k which was expected to be at 15.3k, Trade Balance report was published unchanged at -3.2B which was expected to decrease the deficit to -3.0B, and Unemployment Rate report showed an increase to 6.3% which was expected to be unchanged at 6.2%. This mixed reports helped the currency to sustain gains, but USD is expected to make a comeback soon as the Rate Hike is highly probable in December. Today, Canada's NHPI report is going to be published which is expected to increase to 0.2% from the previous value of 0.1%. Positive outcome of the report is likely to encourage further gains of CAD against USD in the short term. On the USD side, today Unemployment Claims report is going to be published which is expected to show an increase to 232k from the previous figure of 229k, Final Wholesale Inventories report is expected to be unchanged at 0.3%, and Natural Gas Storage is expected to decrease to 15B from the previous figure of 65B. As for the current scenario, if Canada's economic reports reveal better than expected readings, then we might see further bearish pressure in the pair whereas negatively forecasted US reports will also be a strong factor for a further directional move in this pair. To sum up, CAD is expected to have an upper hand over USD in the coming days.

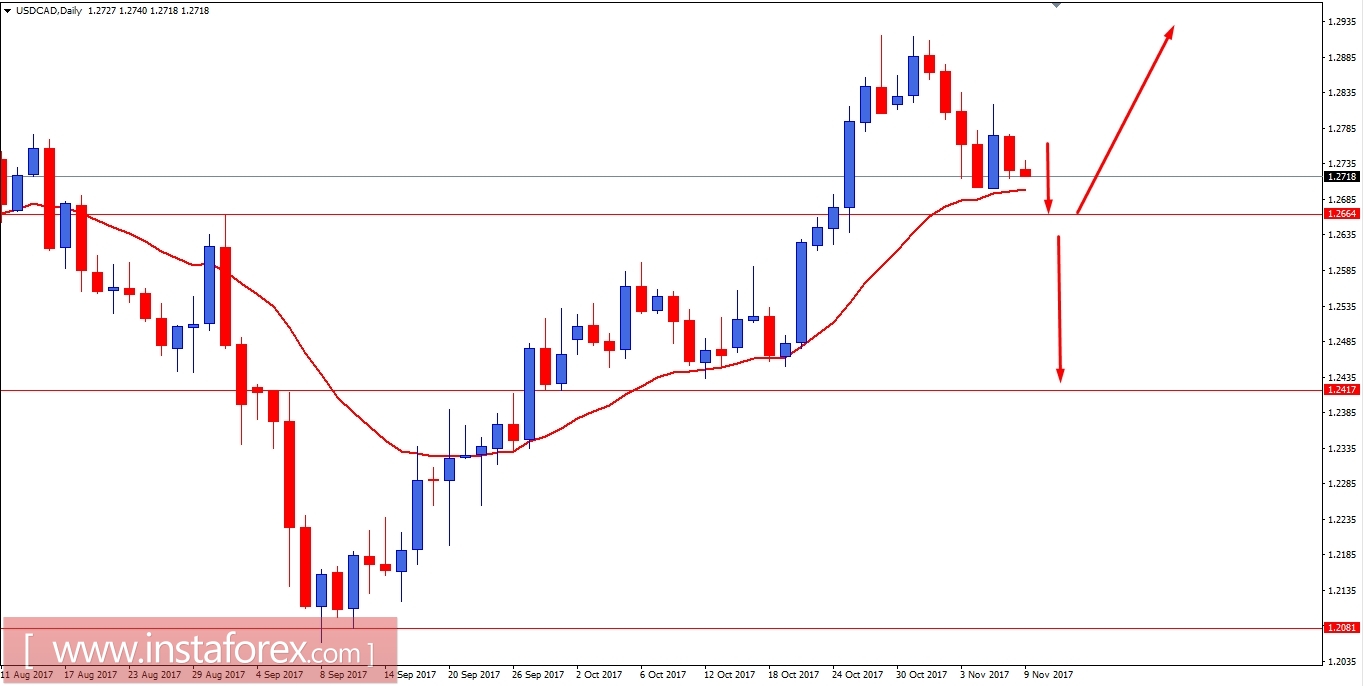

Now let us look at the technical chart. The price is currently showing some bearish pressure after bouncing off the dynamic support level of 20 EMA. As the price proceeds towards the support level of 1.2660, we will be looking forward for a break below or bounce off the level. If the price breaks below the 1.2660 level with a daily close then, we will consider sell positions with a target towards 1.2410 support area. On the other hand, if the price bounces off the 1.2660 with a daily bearish rejection or bullish engulf, then we will be looking forward to buy with target towards 1.30 resistance area. The bearish bias is expected to continue until price remains below 1.2850 resistance area.