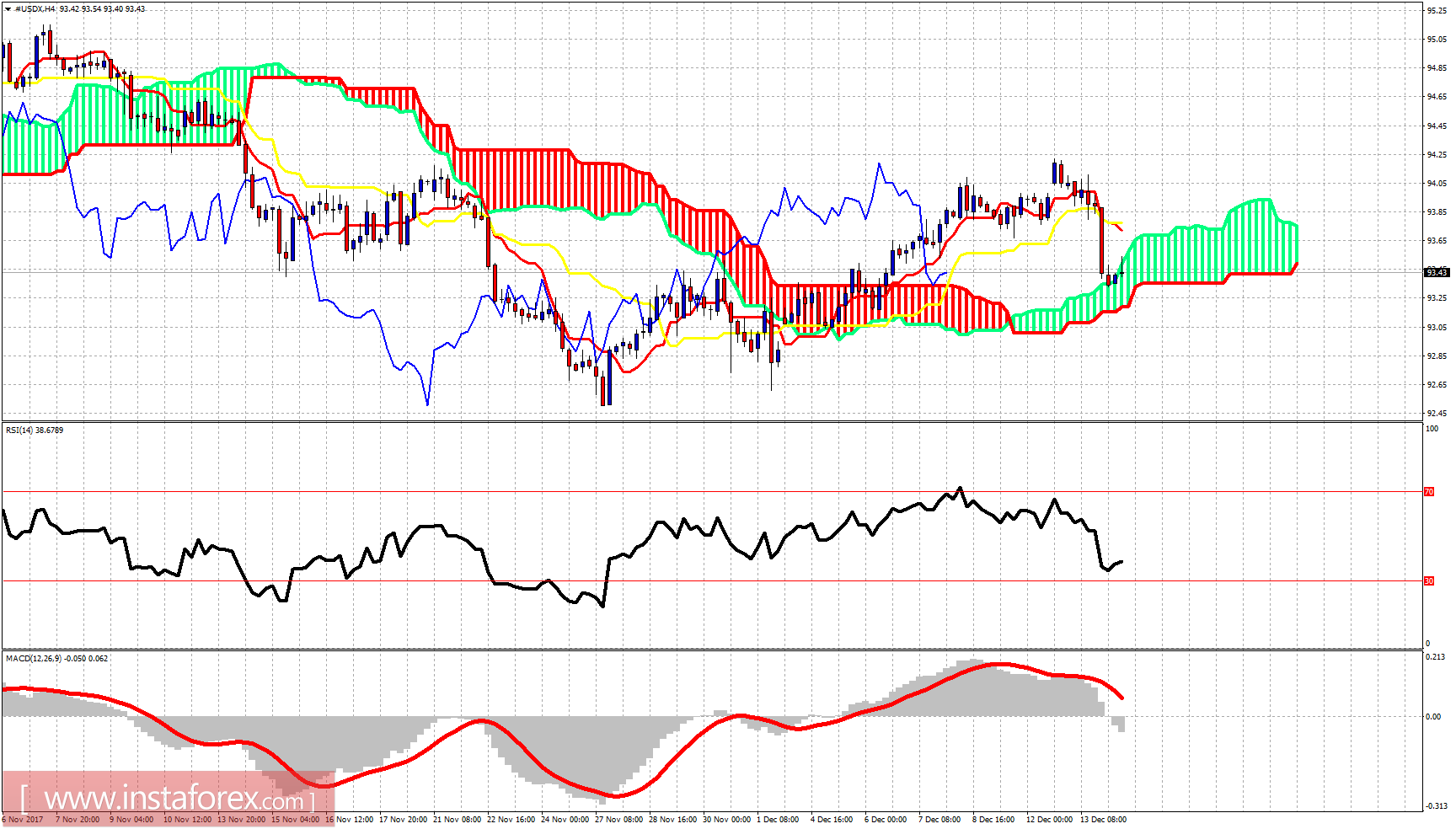

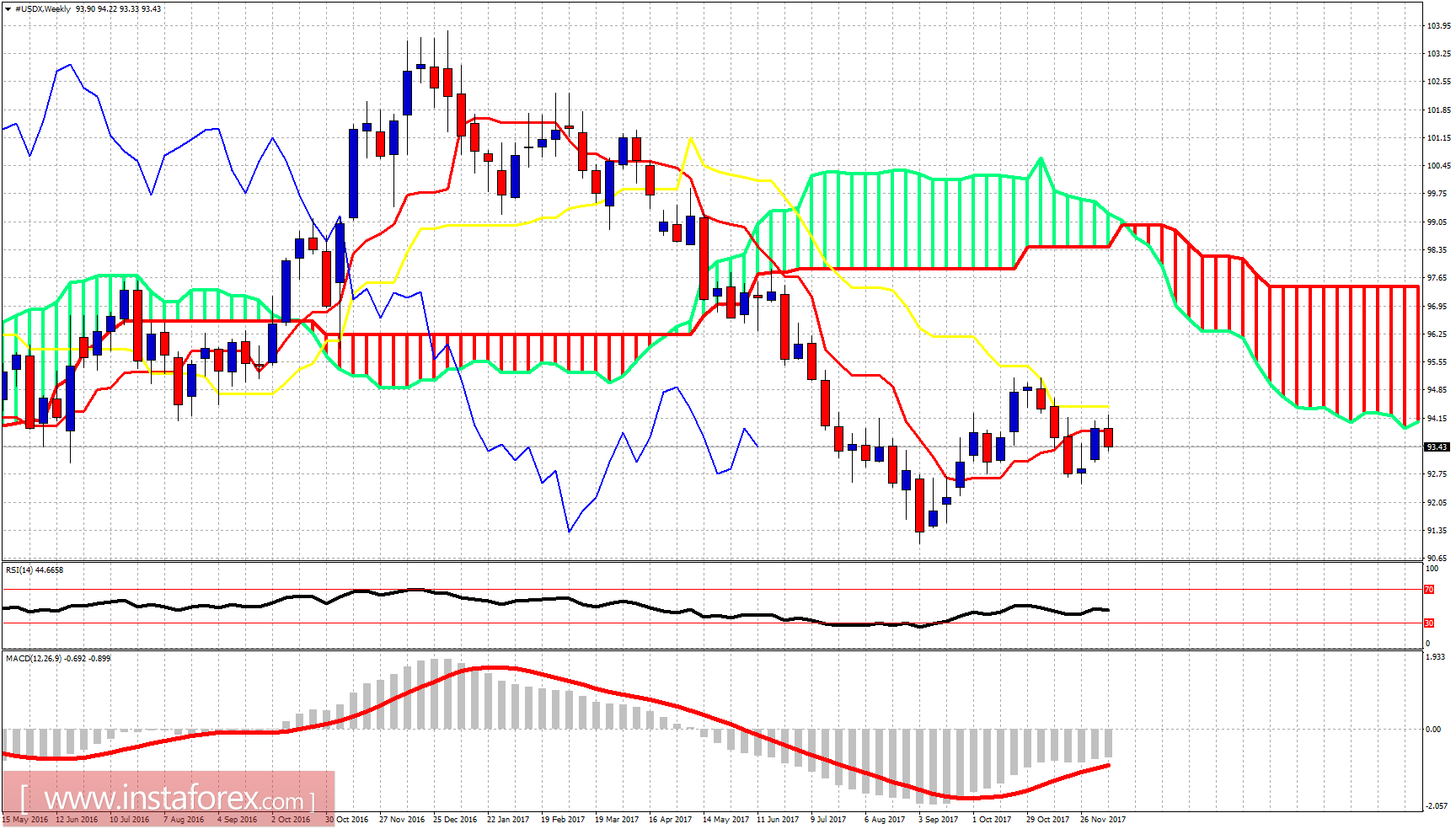

The Dollar index has pulled back as expected by our latest analysis back towards 93.30 and cloud support. This is a very important short-term support area. Bears must be careful of a possible bounce higher.

I have warned Dollar bulls several times in previous posts that the area of 93.90-94.40 is important resistance area and a rejection there is very possible, before the resumption of the upward move that started at the 92.50 low. A break above yesterday's highs will increase dramatically the chances of the index going towards 96-97. A break below 92.50 will increase the chances of a move towards 88-87.