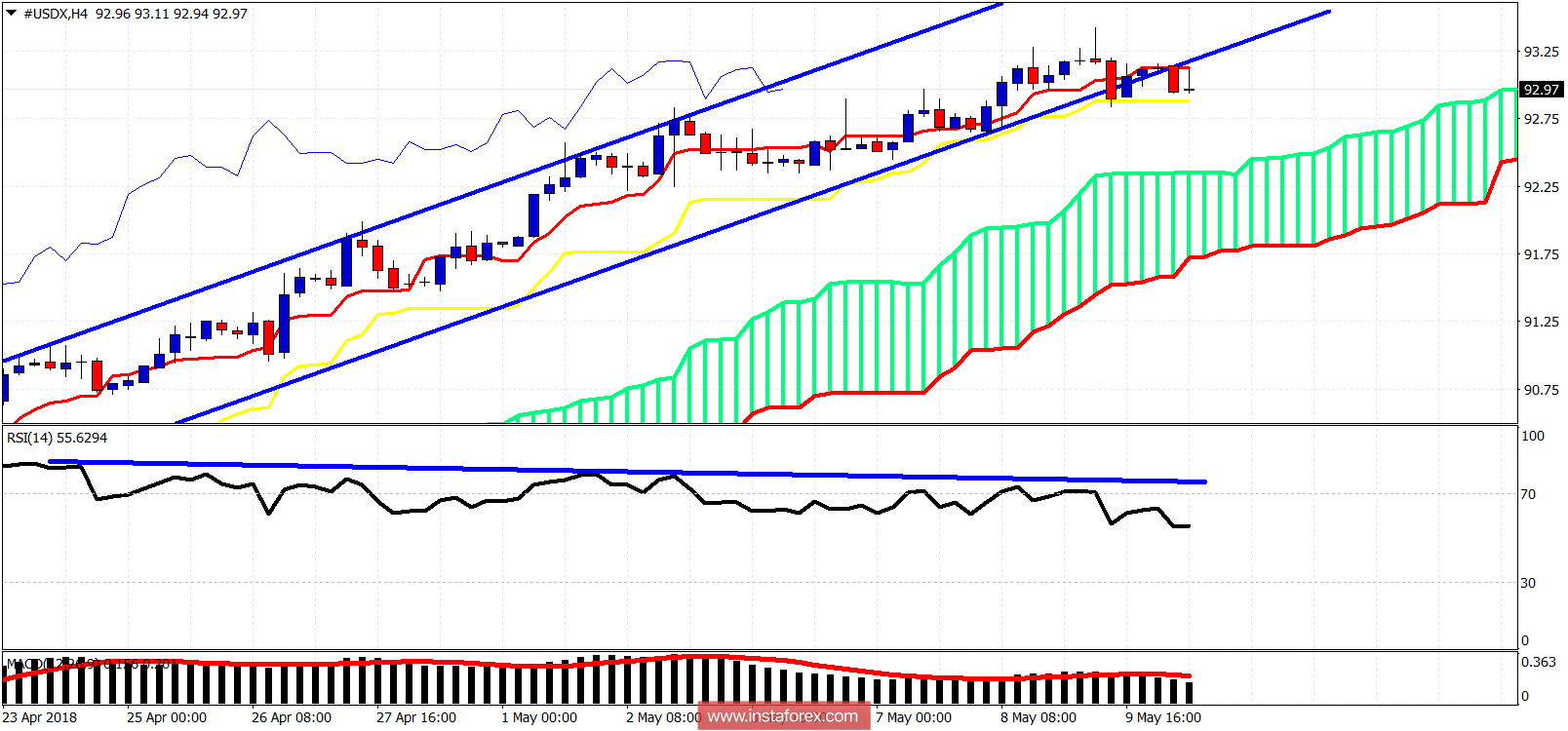

The Dollar index is showing reversal signs. After the bearish divergence warnings by the RSI, the price broke out and below the bullish channel. Two attempts to break above the important 93 level resistance have so far failed. The price pops up above resistance, but sellers push it back below it.

Blue lines - bullish channel

Downward sloping blue line - bearish divergence

The Dollar index has most probably made a short-term top at least. Support is at 92.90. A four close below it will open the way for a push lower towards cloud support at 92.35. Important support area is found at 92.35-91.80. A break below this zone will open the way for a bigger correction lower. So far, the trend remains bullish, but a pullback is imminent.