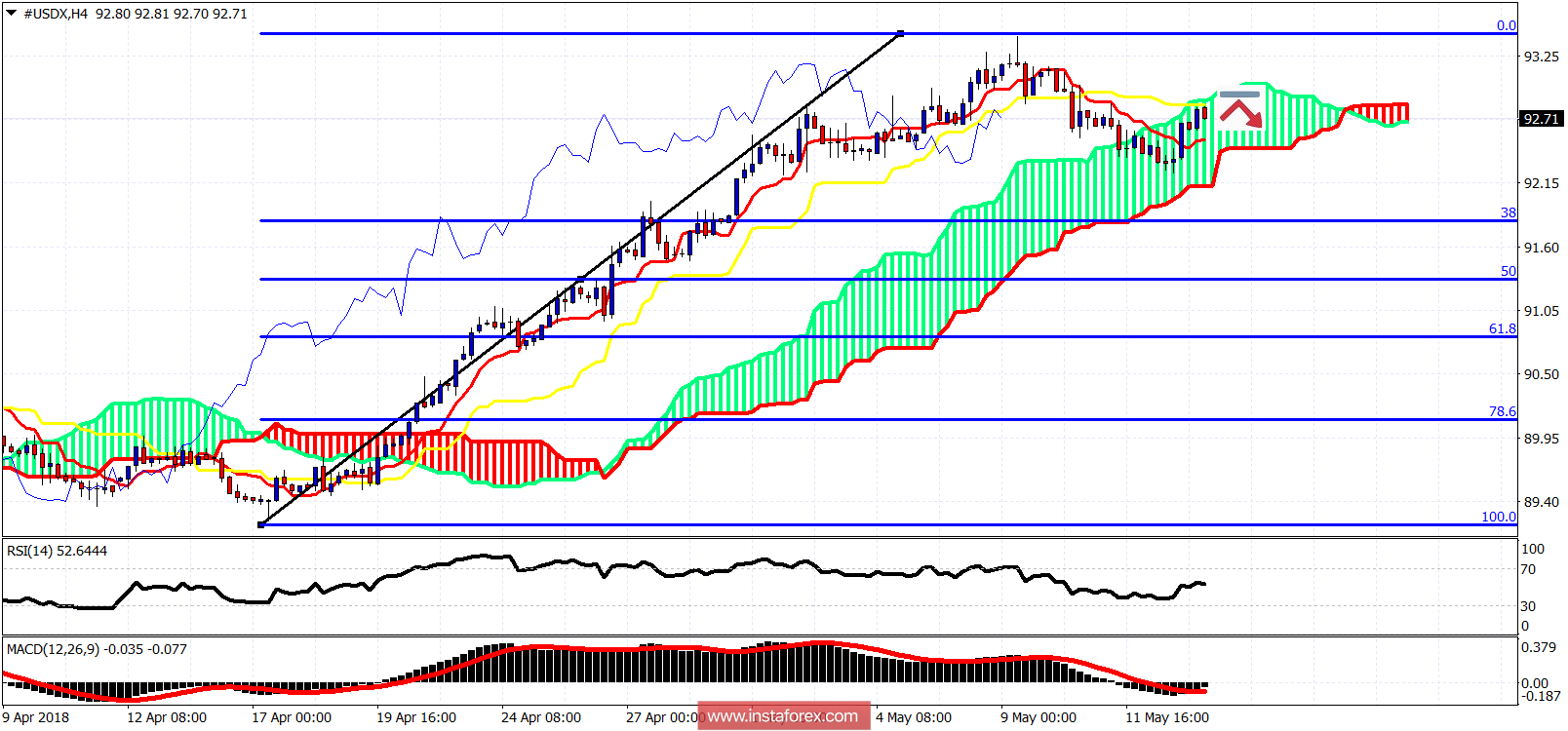

The Dollar index is bouncing after a couple days of a bearish reversal towards 92. I do not expect the index to make new highs. Resistance by the Ichimoku cloud is at 92.90 and I expect the price to get rejected there today and turn lower. Support is at 92.25-92.15.

My first target for this pullback is at 91.80 and next at 90.80 where the 61.8% Fibonacci retracement is found. Short-term support is at 92.50. Breaking below it will increase chances of moving to new weekly lows towards 91.80. If resistance at 92.90 is broken, we could see a test of the highs at 93.40. I'm bearish the Dollar.