Last week did not abound in important macroeconomic publications. The exception is Wednesday, which, however, brought disappointments. The values of PMI indices for European economies have failed, which contributed (to the company with the noise from the Italian political scene) to deepening the EUR / USD sell-off to 1.1675. The inflation from Great Britain also failed. Although the reading was only slightly lower than the consensus, the GBP / USD fell to 1.33. The August hike in the Bank of England is becoming increasingly questionable. All those who counted on finding hawkish goodies in the minutes of the FOMC meeting in May disappointed. The June hike is decided, but the market has not received any further guidance. It took the arguments of a tired monthly rally dollar, but on the pound side, the euro is too vain to look for positives that would lead to a stronger correction. The yen is slightly different as the USD / JPY pair fell almost from 111.50 to 109.00 after the sentiment deteriorated. The reason was Donald Trump and his canceling the meeting with the leader of North Korea and reminding him painfully that he did not lose any protectionist in trade policy. Although the yield on US 10y debt clearly turned back and fell back under 3%, the pressure on emerging markets currencies did not weaken.

The start of this week is calm, among other things due to the holiday in the USA (Memorial Day). Then the events will start to gain momentum quickly. In the Eurozone, Tuesday is the publication of monetary aggregates - data interesting and important from the point of view of the ECB policy, but not having the potential to shake up the market. It will be different on Wednesday and Thursday, when information about the initial price dynamics in May (from Germany and the entire Eurozone) will arrive. It can be assumed that the dynamics of consumer prices will approach the goal of monetary policy. If this happens, not only due to higher fuel prices, but also to a rebound in core inflation, this may be an important contribution to investors again thinking about the overpriced euro. The more so that the issue of Italian politics will quickly go to the background. However, a deeper improvement in data is needed for a lasting rebound of the euro. The Friday reading of the PMI index will be less interesting than the first values of indicators for peripheral economies, namely Spain of Italy.

The second part of the week is also a spill of data from the USA. On Wednesday, we will see the second estimate of GDP for the first quarter and part of the market expects a downward revision. In addition, consumer sentiment and the change of employment in the private sector will be published according to ADP. In addition, the light will be read by the beige Fed Book, ie a descriptive diagnosis of the state of the economy, taking into account the economic situation in individual regions. Of course, the document should, above all, look for signs of intensification of price and wage pressure. On Thursday, apart from the traditional publication of the number of applications for benefits, we will learn, among other things, further information from the braking real estate market, expenses and revenues of Americans and the basic PCE deflator. The most important, however, may be the Chicago PMI index, which, like the regional barometers, should increase. The moods of American industry again clearly diverge from the sentiment of the industry on the other side of the Atlantic. The first Friday of the month are publications on the condition of the labor market in May. Strong growth in employment and record low unemployment no longer surprise anyone. USD needs to accelerate wage pressure. In addition, we will get to know the ISM index, which should confirm the good condition of the industrial sector following other barometers.

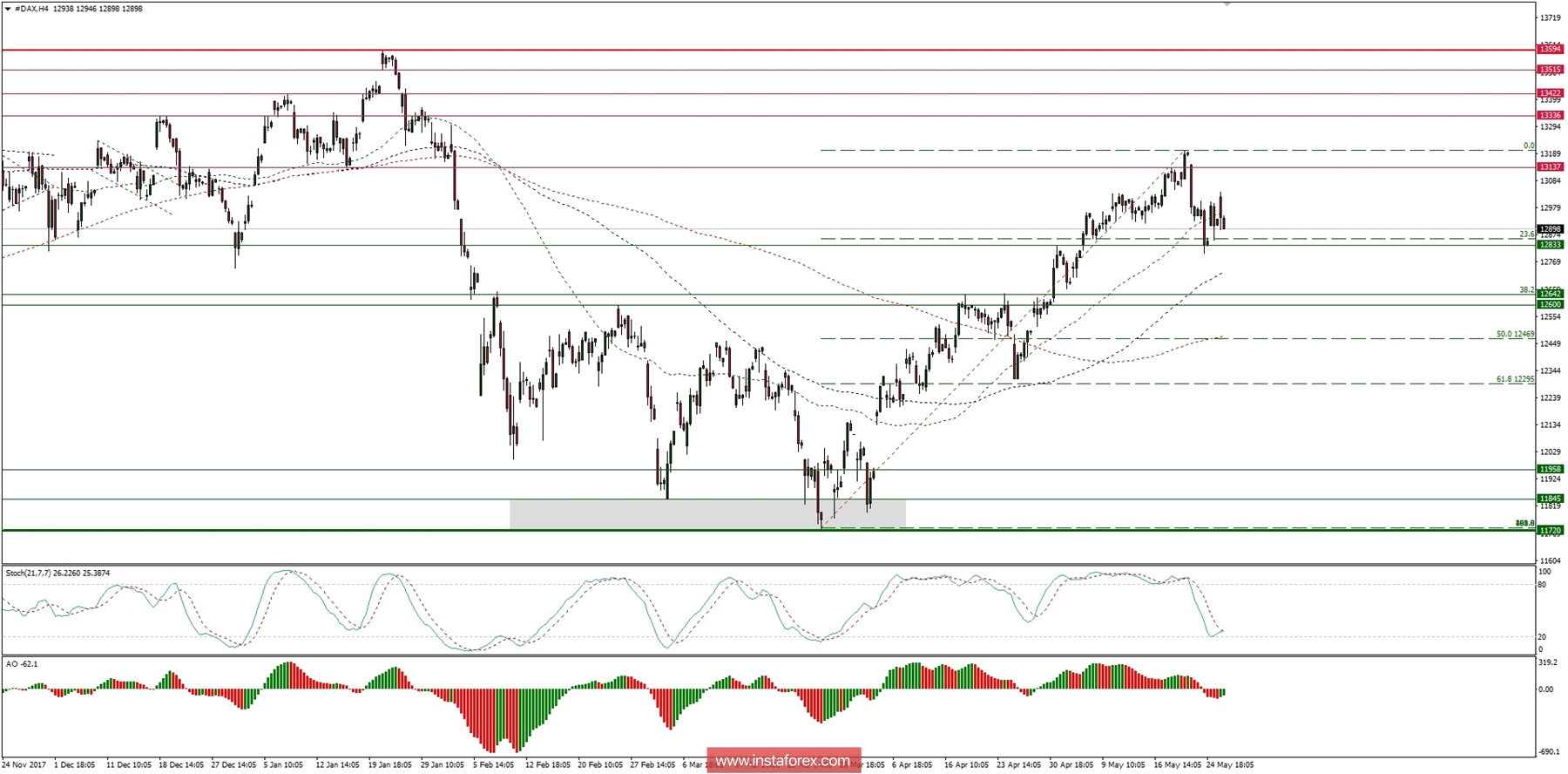

Let's now take a look at the DAX technical picture at the H4 time frame before the Eurozone data are published. The market has retraced 23% of the previous swing up so far and reached the level of 12,796. The bounce from this level was short-lived and shallow, so now the bears might challenge again the level of support at 12,796. In a case of a breakout lower, the next technical support is seen at the level of 12,642 (38% Fibo) and 12,600. Please notice the oversold market conditions.