Daily Outlook

The short-term outlook turns to become bearish as long as the EUR/USD pair keeps trading below the broken uptrend as well as the lower limit of the depicted consolidation range remains broken.

Bearish persistence below the price level of 1.2200 allowed further bearish decline towards the price levels of 1.1990 and 1.1880.

As mentioned, the price zone (1.1850-1.1750) offered temporary bullish rejection towards 1.1990 where a descending high was established.

The EUR/USD bulls failed to pursue towards higher bullish targets. This enhances the bearish scenario of the market.

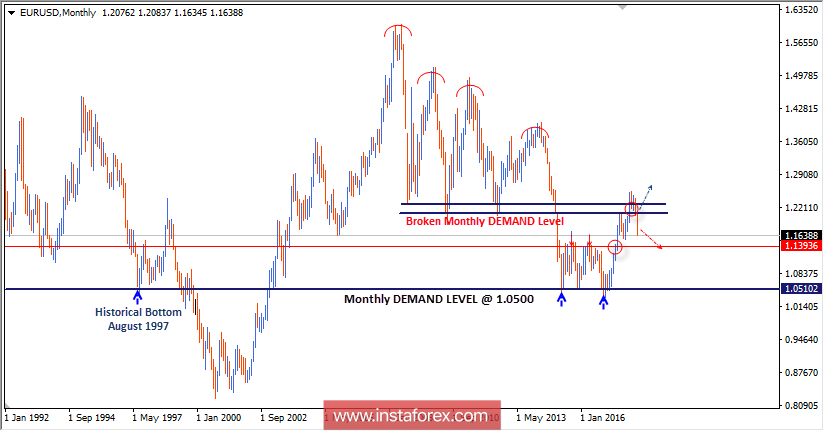

If bearish momentum dominates, bearish persistence below 1.1700-1.1750 (zone of previous daily lows) will be maintained to enhance further bearish decline towards 1.1400 (the previously mentioned monthly key-level).

On the other hand, the price zone (1.1850-1.1750) is now considered a prominent Supply zone to be watched for bearish rejection and possible SELL entries if any bullish pullback occurs.