The night on the currency market was quite calm as none of the major currencies changes the value to USD by more than 0.2. EUR/USD challenges the support zone around the October minimum, USD/JPY fights to preserve the growth structure by defending support 108.50-70. In the stock markets very negative moods. Yesterday on Wall Street, which is still stronger than Europe, there were declines of 0.5-1.5%. Futures on SP500 is at 2692 points. The Asian stock exchanges: Hang Seng, Nikkei 225 and Shanghai Composite are roughly 1.5% down. 10Y US debt yield increases by several bp, but is at 2.82%, 30 bps at the local highs. Despite the increased risk aversion and the unexpected return of fear of a new version of the debt crisis, the gold rate is not able to return over USD 1,300. The WTI barrel is valued at USD 66.7.

On Wednesday 30th of May, the event calendar is busy in important news releases. The event of the day is the Bank of Canada interest rate decision (no change expected), but there are important data releases from the US (ADP Non-Farm Employment Change, Goods Trade Balance and GDP), Germany (CPI, Unemployment Rate, Unemployment Change), Eurozone (Consumer Confidence data), Switzerland (KOF Economic Barometer data) and France (Consumer Spending and GDP).

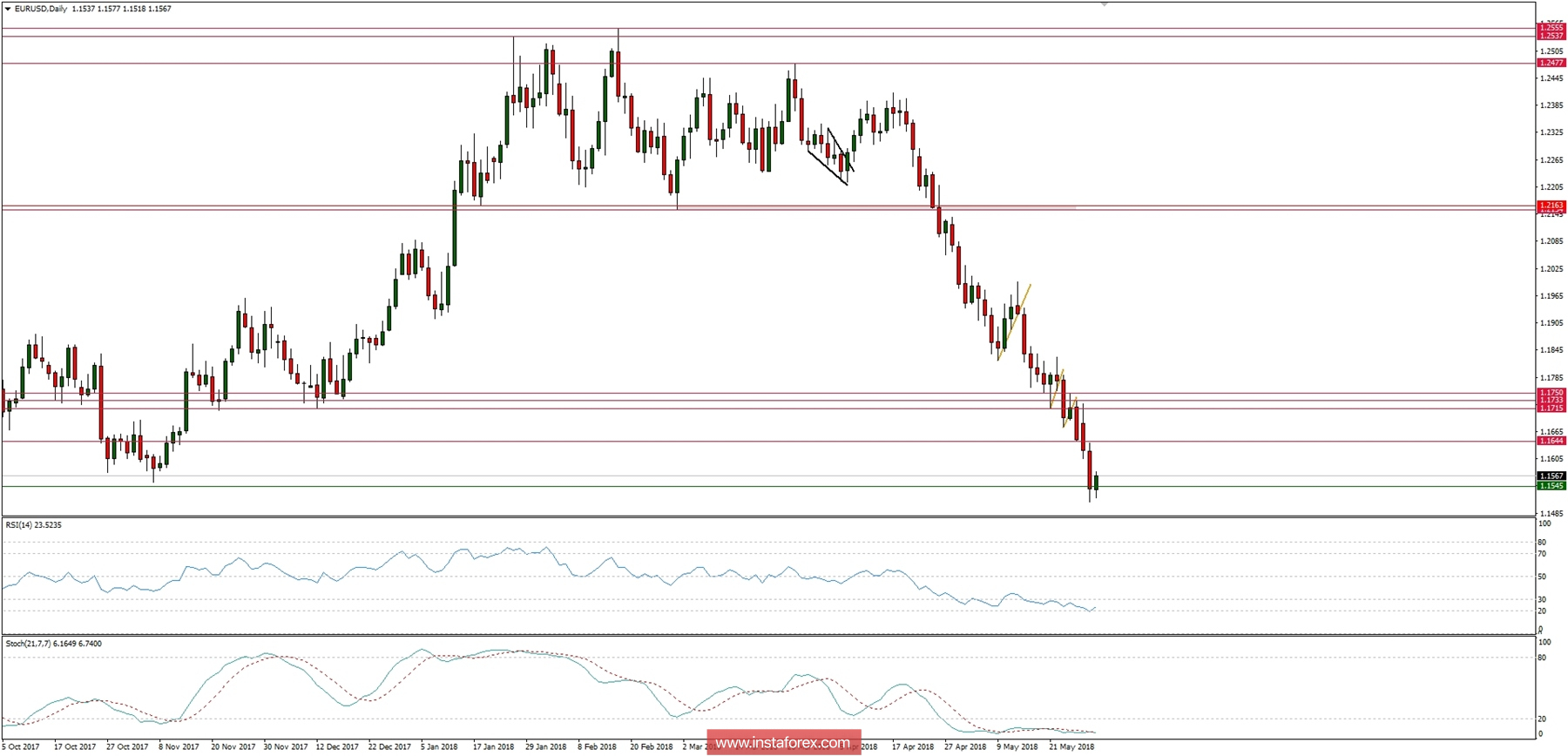

EUR/USD analysis for 30/05/2018:

The first portion of the data was released this morning: the German Retail Sales data beat the estimates of 0.5% with the figure of 2.3% (-0.4% prior). nevertheless, the Import Price Index data were worse than expected as they were released at the level of 0.6% while the market participants expected 0.7% increase after 0.0% figure a month ago.

There are more important data coming from the various economies today, so it might be a violate day on the marekts.

Let's now take a look at the EUR/USD technical picture at the daily time frame. The exchange rate reached October bottom at 1.1550 which, given the strongly sold out market, may induce some investors to take profits. It is not possible to talk about a greater rebound as long as the downward trend line at 1.1710 is not broken and the whole zone of local highs 1.1725-50 strengthened by the level of 23.6% Fibo retracement started a month ago. Earlier, they would operate as 1.16 and 1.1620 as resistance. Breaking through yesterday's low would allow extending end the drops to the 200-week average and half of the upward trend from 2017 to 2018.