As expected, JPY has been gaining ground over USD which is expected to strengthen further after a series of pullbacks and corrections along the way.

The US is due to release revised GDP report for Q1 which is likely to remain flat at 3.1%. The report can help USD to regain grounds against JPY but how long it is going to help the currency to climb higher is still an open question. The Federal Reserve policy makers made a conclusion that they need to soften rhetoric on monetary policy if they are to speed up the US economy. The main reasons listed for the lower neutral rate includes ongoing fallout from the financial crisis, weaker productivity, low employment in the labor market, and an aging population, which when combined leave the economy structurally weaker. Today, FED Chairman Jerome Powell is going to speak about the economic outlook and monetary policy at the Foreign Relations Council, New York.

Today US CB Consumer Confidence report is going to be published which is expected to decrease to 132.0 from the previous figure of 134.1, Richmond Manufacturing Index is likely to grow to 7 from from the previous figure of 5, and New Home Sales is also expected to increase to 686k from the previous figure of 673k.

On the JPY side, Japan's big manufacturers' business confidence is expected to worsen to nearly three-year lows in the June quarter as the US-China trade war and sluggish global demand hurt the export-reliant economy. A deterioration in corporate sentiment will add to the Bank of Japan's concerns about slowing economic growth after its governor signalled readiness to ramp up stimulus as global risks cloud the outlook. Additionally, an escalation in the US-China trade conflict dents exports, so the yen's appreciation damaged the corporate earnings environment.

Japan's government recently signaled its readiness to pursue flexible fiscal spending to offset risks to economic growth. Tokyo's plan to raise the sales tax to 10% from 8% in October could darken the outlook for consumer spending which makes up roughly 60% of Japan's gross domestic product (GDP), at a time of slower demand from overseas. Moreover, Japan and the United States confirmed their understanding of each other's viewpoints on trade during talks held over the past week. Today Japanese SPPI report was published with a decrease to 0.8% from the previous value of 1.0% which was expected to rise to 1.1% and BOJ Core CPI was published unchanged at 0.7% which was expected to decrease to 0.6%.

To sum it up, amid mixed economic reports JPY is struggling to sustain the impulsive bearish momentum over USD. Despite broad-based weakness, USD is expected to rebound in the coming days if the upcoming GDP report comes positive and better than expected without any further dovish tone from the Fed.

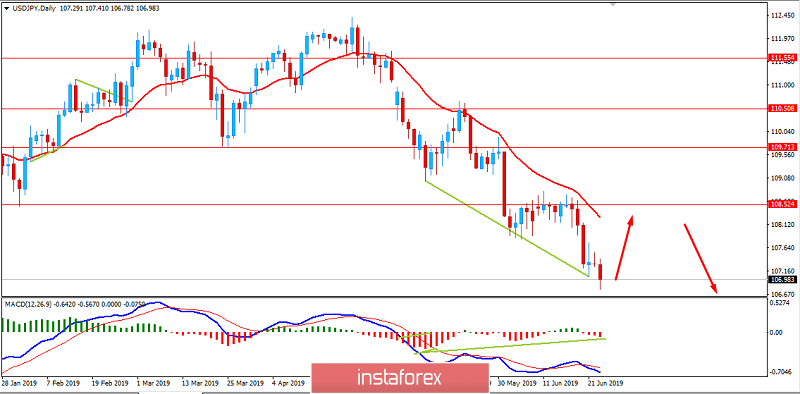

Now let us look at the technical view. The price is currently trading below 107.00 under strong bearish momentum. The price is expected to pullback towards 108.50. The price formed Bullish Divergence along the way which also indicates further upward pressure. As the price is trading far away from the Mean i.e. dynamic level of 20 EMA, there is a higher probability of price pushing higher towards 108.50 before continuing with the bearish trend in the future.