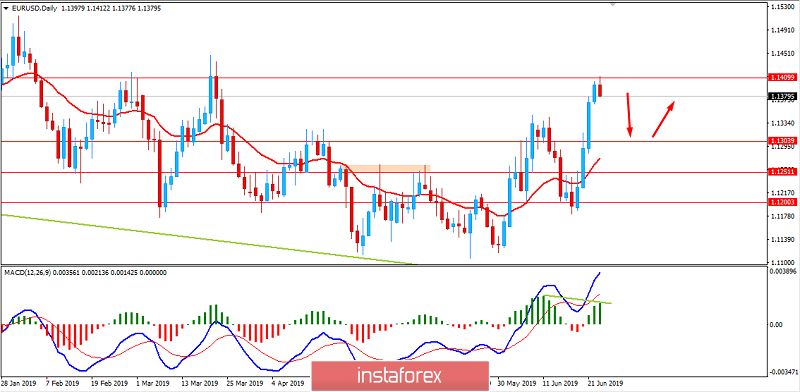

The euro has been the dominant currency in the pair. The quotes of the pair are residing at the edge of 1.1400 area with a daily close. The US dollar is pressurized by the Fed's possible decision to cut its key rate and weak economic reports.

According to ECB reports, profitability across the eurozone bank sector is low and weakening growth could further dampen the sector's prospects. Negative ECB rates are not the cause of the weakness as super-easy monetary policy has so far had a neutral effect on bank profits. The overall effects of negative rates on the banking sector need to be carefully monitored, particularly because the balance of their effects will depend on how long rates remain in negative territory.

Remarkably, the European Union will allow Italy to increase its deficit if it helped the country's economy.

Moreover, US Final GDP report is going to be published. The reading is expected to be unchanged at 3.1%. The greenback is likely to gain momentum over the euro. Additionally, Fed policymakers are discovering they likely need to shift into an even lower gear than in recent history if they are to speed up the US economy. The main reasons listed for the lower neutral rate includes ongoing fallout from the financial crisis, weaker productivity, continued slackness in the labor market, and an aging population.

Today, US CB consumer confidence report is going to be published. The figure is expected to decrease to 132.0 from 134.1, Richmond Manufacturing Index to increase to 7 from 5, and New Home Sale to rise to 686k from 673k. Fed Chairman Jerome Powell is going to speak today about the economic outlook and monetary policy at the Foreign Relations Council.

To sum up, ahead of the G20 meeting, the US dollar is expected to regain momentum over the euro. The greenback may catch bullish momentum if economic data is upbeat.

Now let us look at the technical view. The price is currently pushing lower quite impulsively after rejecting off the 1.1400 area with strong bearish pressure. The price is residing quite away from the Mean, which is expected to revert lower before showing any further bullish momentum. As the price remains below 1.1400 area with a daily close, the probability of certain bearish throwback is quite high.