EUR/USD has been quite corrective and indecisive recently trading at near 1.1400. The price gained impulsive bearish momentum today which is expected to last in the coming days.

At present, the ECB is taking measures to spur consumer inflation. So, low inflation is not seen as a new challenge faced by the European economy as there are other challenges. Amid a slowdown in the ecnoomy and persistent low inflation, the monetary authorities in the eurozone are likely to announce a rate cut and restart an asset purchase cycle. Though the ECB's target may be achieved in the near future, headline inflation will hardly develop steadily. In light of the recent reports, the eurozone's lending growth held steady in May. A broader money supply indicator which often foreshadows future activity grew faster than expected. Household lending increased by 3.3%, holding steady at a post-crisis high while corporate lending rose by 3.9%, below its post-crisis peak but defying expectations for a slowdown.

The eurozone is facing a sharp economic slowdown amid weak export demand for manufactured goods. The ECB set out plans to normalize policy and even flagged more stimulus, thus signaling a possible rate cut or a restart of bond purchases. The annual growth rate of the M3 measure of money supply, which is often viewed as a precursor of future activity, edged up to 4.8% from 4.7% a month earlier, beating forecasts for 4.6% which is also bullish for EUR.

On the USD side, ahead of NFP reports to be published on Friday this week, USD opened the week with strong gains which could sustain further in the coming days. Recently FED's Vice Chairman Clarida stated that the US economy is in a good shape. Nevertheless, uncertainties from trade disputes and a slowdown in global growth are affecting it significantly. The market welcomed the news that trade negotiations between the US and China have entered a new stage. However, some Fed policymakers advocate for easier monetary policy in the face of uncertainties.

Recently, record-setting run of US economic growth was sustained for a decade by low interest rates and massive Federal Reserve intervention. That helped 22 million people to return back to work, thus contributing to a positive employment report this week. If the forecast comes true, NFPs could help USD to regain losses against EUR in the coming days.

To sum it up, EUR is being neutral with the recent fundamentals. USD will be able to assert strength if the official data on the US labor market comes up to expectations by the end of this week and other economic reports from the US perform better than expected. There are higher chances for USD to hold the upper hand over EUR, but upcoming reports should support it.

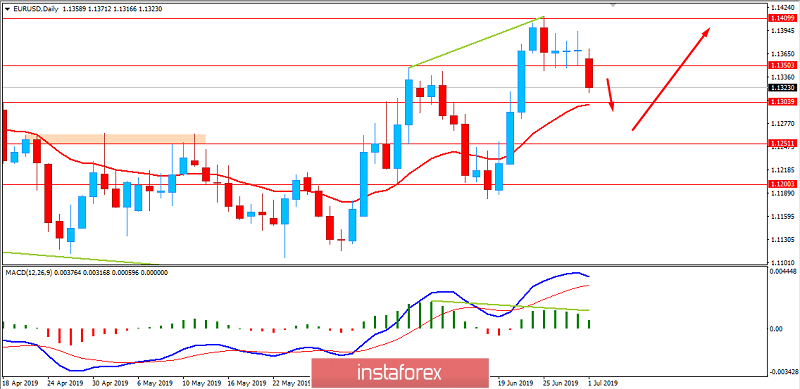

Now let us look at the technical view. The price recently formed Bearish Regular Divergence which also completed recently after the price reached 1.1400 area. The price is currently going lower quite impulsively. The pair is expected to decline to 1.1250-1.1300 before showing any bullish sign.