Gold opened the week with a gap of 150 pips and pushed towards $1380. It managed to push higher again with the target towards $1500. Though the price started with a Bearish gap, it is currently trying to fill it up and continue with the bullish trend.

Oil impacted the overall momentum of gold. However, the oil may lose ground as the US dollar lifts up ahead of optimistic NFP report. The precious metal is looking at markedly different fundamentals from those that propelled it to 6-year highs recently. Gold tamped down expectations for the Federal Reserve rate cut, and Wall Street to the oil market likely in risk-on mode. Meanwhile, demand for risky assets is increasing while for safe-haven currencies is lowering.

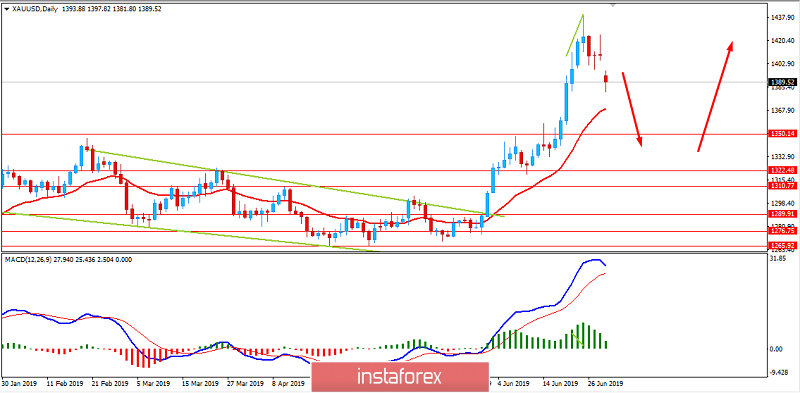

As of the current scenario, gold is expected to go down towards $1320-50 support area before continuing the bullish trend. The price has formed Bearish Divergence in the intraday timeframes along with certain Bearish crossover in the MACD at the edge. Though the certain possibility of gap fill up is expected, the bearish pressure may endure before the bulls take control again pushing the price higher towards $1500 target area.

SUPPORT: 1289, 1300, 1320, 1350

RESISTANCE: 1400, 1440-50, 1500

BIAS: BULLISH

MOMENTUM: VOLATILE