The Australian dollar has lost ground against the US dollar after the RBA announced its intention to lower its interest rate. What is more, the greenback was supported by optimistic NFP expectations.

The RBA Official Cash Rate report has been published today. It indicated a decrease to 1.00% as expected from the previous value of 1.50%. RBA governor Philip Lowe made hints about a possible key rate cut in the future. He said that the RBA would be poised to act appropriately if the risks of the global economic slowdown and trade uncertainty remained. The head of the RBA noted low borrowing costs, high commodity prices, a weaker currency, and rising household incomes were cause for optimism. According to certain observation and analysis, the Australian economy is still open for reasonable growth, low unemployment, and inflation. As the global risks are quite high, the RBA is expected to be flexible with the inflation and rate decisions in the coming months.

The US dollar lost its gains despite a trade truce between the US and China. US President Donald Trump and his Chinese counterpart Xi Jinping have agreed during a bilateral meeting at the summit in Osaka, Japan, to hold off on imposing new tariffs on imports of each other's goods and to move forward with trade negotiations. The news sent stocks higher, but investor sentiment was later hit by disappointing manufacturing data from the U.S., as it showed growth of the country's manufacturing activities slowed last month and fell to its lowest level since September 2016.

Market participants are awaiting the NFP report which is going to be published on Friday. What is more, the Average Hourly Earnings report is going to be released. The reading is expected to show an increase to 0.3% from the previous value of 0.2%, Non-Farm Employment Change is likely to grow to 164k from the previous figure of 75k and Unemployment Rate is expected to be unchanged at 3.6%. Today, FOMC member Williams is going to speak about the upcoming interest key rate cut decision. Investors hope that he'll give some hints about the future of the monetary policy.

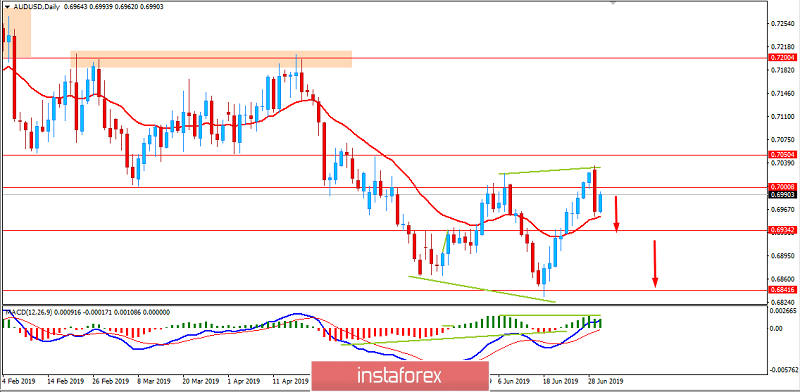

Now let us look at the technical view. The price is currently residing below 0.70 area with a daily close after significant bearish pressure. The price recently formed Bearish Divergence pushing the price lower towards 0.6850 support area in the coming days. Though the price managed to soar up today, it still remains below 0.7000-50 area with a daily close indicating a further decrease.