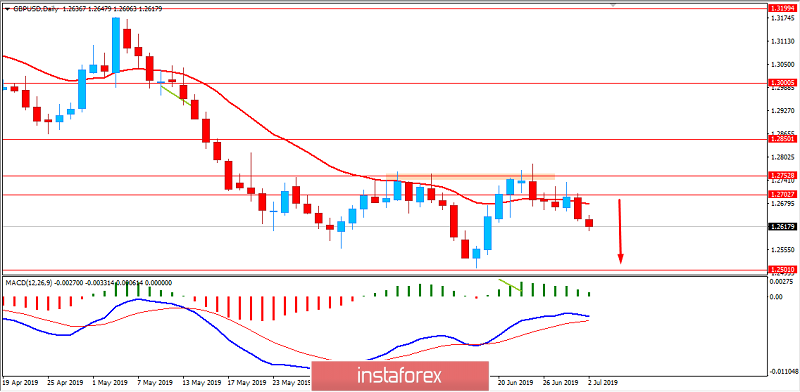

The GBP/USD pair was attempting to break above 1.2700 area but failed. Overall, the pair is trading in a bullish channel.

According to the latest reports, the British manufacturers reported that the domestic orders have fallen to its lowest in seven years as Brexit uncertainty and the global slowdown take their toll. The British Chamber of Commerce recently stated that Manufacturing factories showed the weakest picture for export orders in four years in the April-June period while a slight pick-up for services firms was not strong enough to make up for a weak start to the year. Britain's economy began 2019 strongly, but the growth came largely from a surge in stockpiling by manufacturers seeking to protect themselves against the risk of border delays after the original March 29 Brexit deadline.

Today UK Construction PMI report has been published. The reading decreased to 43.1 from the previous figure of 48.6. economists predicted an increase to 49.4. Moreover, tomorrow the UK Services PMI report is going to be published. The figure is expected to be unchanged at 51.0. Additionally, MPC Member Broadbent is going to give a speech about the monetary policy.

The US dollar lost its gains despite a trade truce between the US and China. US President Donald Trump and his Chinese counterpart Xi Jinping have agreed during a bilateral meeting at the summit in Osaka, Japan, to hold off on imposing new tariffs on imports of each other's goods and to move forward with trade negotiations. The news sent stocks higher, but investor sentiment was later hit by disappointing manufacturing data from the U.S., as it showed growth of the country's manufacturing activities slowed last month and fell to its lowest level since September 2016.

Market participants are awaiting the NFP report which is going to be published on Friday. What is more, the Average Hourly Earnings report is going to be released. The reading is expected to show an increase to 0.3% from the previous value of 0.2%, Non-Farm Employment Change is likely to grow to 164k from the previous figure of 75k and Unemployment Rate is expected to be unchanged at 3.6%. Today, FOMC member Williams is going to speak about the upcoming interest key rate cut decision. Investors hope that he'll give some hints about the future of the monetary policy.

Now let us look at the technical view. The price is currently residing below 1.2700 area after surging up to 1.2700 area with a daily close. The price is heading towards 1.2500 area and expected to reach the area sooner than expected. As the preceding trend is bearish, further gains on the downside will not come as a surprise for market participants.